Legal services in Kiev

forlegal entities and Non-residents

Our law firm in Ukraine has been servicing business since 2006.

Providing legal support in Ukraine, we are aware of the level of competition. Therefore, all the work of the company is aimed at long-term efficiency. We understand that this can only be achieved if our Clients return to us for services themselves and recommend us, if necessary, to their colleagues.

We offer you the Quality Standard of the "Pravova Dopomoga" company. This is what distinguishes us from any other legal company on the Ukrainian market.

- The main thing for us is your goal, not the task you came with. This means we can discover and understand your ultimate goal. And the main thing is to find a legal way to achieve it. Even if it's different from what you came up with, you'll get exactly the result you're after.

- We will offer an option that will suit you, your organization, your business, and your life situation. Because each client is unique to us.

- Even at the start of working with us, before the first payment, you will know how much and what you are paying for.

- We are not afraid of challenges. No matter how difficult your task is, we will find the optimal solution. If not us, then no one.

- We are always in touch - each client has a personal manager who keeps you informed and provides complete information. He is just one of the team of specialists who will be responsible for the outcome of your case.

- Spending your time is minimal. You tell us your goals, we organize and ensure their achievement.

- We are a reliable partner for any legal issues. This means that you do not need to look for contractors to solve various problems - everything can be obtained in one place. Legal consulting, accounting support, migration support, tax issues, even verified notaries and realtors - we will provide you with comprehensive assistance.

We offer:

-

legal consulting;

-

assistance in obtaining medical and other licenses;

-

registration of charitable foundations, public organizations in Kyiv, LLC, etc.

The most popular legal services of our company are:

-

bringing foreign companies to the Ukrainian market (registration of an LLC, registration of a representative office of a foreign company in Ukraine, a permit for employment of a foreigner, registration of a temporary residence permit);

-

servicing non-profit organizations (registration of a charitable foundation, registration of a public organization, registration of a print publication, registration of an information agency, amendments to the charter of a charitable foundation and a public organization).

Legal services in the field of licensing:

If it is too long for you to wait for a license, you can purchase from us a ready-made company with a license, a charitable foundation or a public organization.for each project

Key practices of the legal company "Pravova Dopomoga":

-

Court practice. We represent the interests of our Clients all over Ukraine.

-

Corporate law. Our lawyers usually take care of registration of various forms of business organizations, as well as state registration of various changes - governing bodies of the company, its founders, etc.

-

Tax law. Professional tax planning, optimization of taxation and tax disputes resolution has a critical role for successful business.

-

Real estate, construction and land law. We defend the interests of our Clients, both legal entities and individuals, local and foreign companies.

-

Medical and pharmaceutical law. Legal support of medical practice, cosmetic services, activities related to medical devices and medical equipment, other related activities, consumer protection.

-

Service for unprofitable organizations. Registration of any forms of unprofitable organizations, assistance in obtaining the status of unprofitable organization and protection of interests of unprofitable organizations.

Recognition of the high qualifications of the specialists of the Law Firm "Pravova Dopomoga" is the demand for their experience and knowledge not only by the Clients, but also by leading non-governmental organizations, central TV channels, legal and specialized business publications, as well as the involvement of our specialists in public councils and working groups under state authorities Ukraine.

For example, we are a partner of the All-Ukrainian Council for the Protection of Patients' Rights and Safety. Also, on the basis of "Pravova Dopomoga", we have created a specialized department to combat violations in the field of advertising of medicines, as well as on access to treatment.

We are a partner of the Ukrainian Wrestling Association, and we provide legal advice on all issues of the Association's activities.

The specialists of our company are involved in providing comments to such respected specialized publications as: "Yurist & Zakon", "Yuridicheskaya Gazeta", Yurliga; national publications - Forbes, UA contracts, UBR, "Law and Business", "Today", Pravotoday, "Status. Economic news" and others; publications of the central authorities - "Uryadovij kurjer"; as well as central TV channels - "1 + 1", "Inter", "ICTV" and others.

Our services

We are ready to help you!

Contact us by mail [email protected] or by filling out the form:Reviews of our Clients

News of jurisprudence

Our team

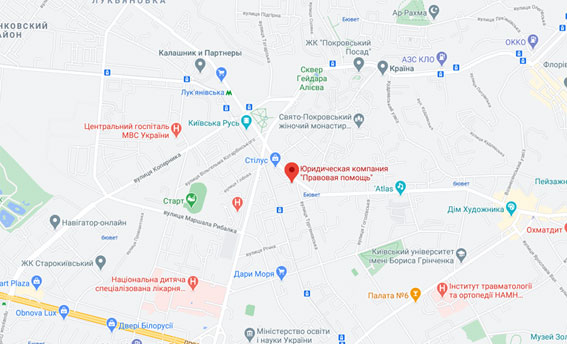

Contacts

Our deeds - speak for themselves

Comments on legislation