Liquidation (winding up) of representative office in Kiev (Ukraine)

Cost of services

Reviews of our Clients

What we offer

- Provide verbal consultations on all issues related to the preparation of documents for closure (liquidation) of the representative office;

- Prepare a full package of documents required for closure (liquidation) of the representative office;

- Submit documents to the relevant state authorities and provide legal support until the de-registration completion;

- Obtain a notice of closure (liquidation) of the representative office.

Documents and information required for buying a business

Client shall also provide us with:

- Certificate of registration in the Unified State Register of Legal Entities, Individual Entrepreneurs and Public Organizations of Ukraine (Certificate of the State Statistics Service of Ukraine)

- Certificate of registration as a tax payer (application form 34-OPP or 4-OPP);

- Notification of registration as a single tax payer;

- Accounting documents of the representative office.

Service packages offers

- Advice on the liquidation procedure and the documents and information required to start the procedure

- Preparation of a package of documents for the liquidation of the representative office

- Submission of documents to relevant state bodies

- Reconciliation in tax aothorities for the presence of debt or overpayments

- The fastest way to pass an inspection in the tax authorities

- Obtaining a certificate on the absence of debt and deregistration from the tax authorities

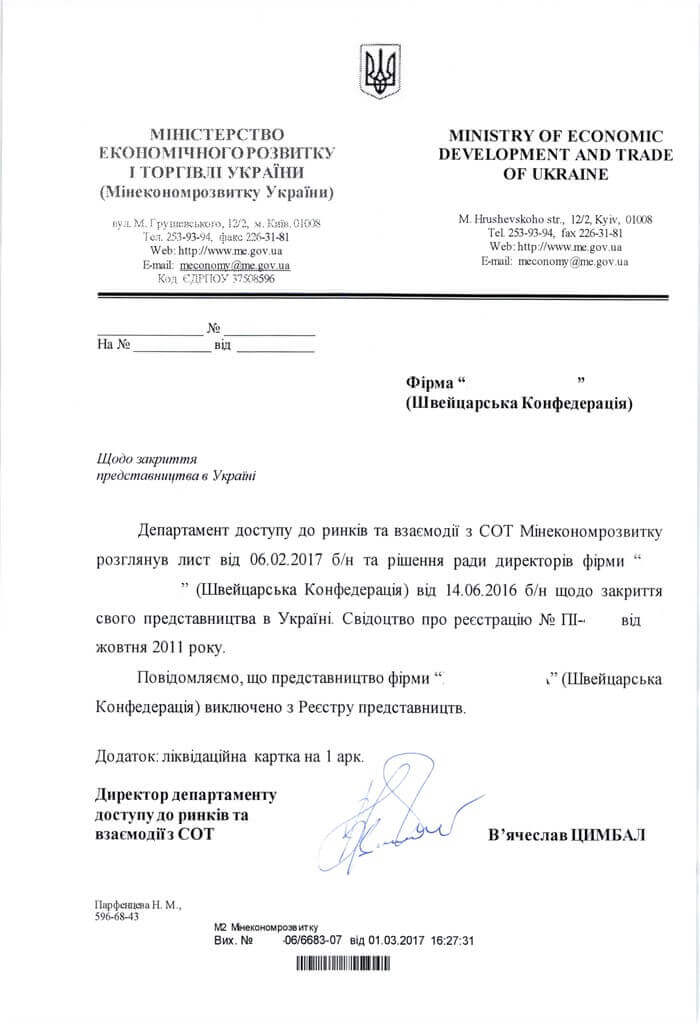

- Deregistration in the Ministry of Economic Development and other state bodies

- Final liquidation (removal of information about the representative office from the register in the statistical office)

- Appointment of the nominal head of the representative office for the liquidation process

- Organization of storage of primary accounting documents of the representative office with our lawyers

- Advice on the liquidation procedure and the documents and information required to start the procedure

- Preparation of a package of documents for the liquidation of the representative office

- Submission of documents to relevant state bodies

- Reconciliation in tax authorities for the presence of debt or overpayments

- The fastest way to pass an inspection in the tax authorities

- Obtaining a certificate on the absence of debt and deregistration from the tax authorities

- Deregistration in the Ministry of Economic Development and other state bodies

- Final liquidation (removal of information about the representative office from the register in the statistical office)

Legal advice on liquidation of a representative office of a foreign company in Ukraine

Liquidation of a representative office of a foreign company in Ukraine is not an easy procedure that includes several stages. If you want to understand it, ask our lawyers for introductory consultation!

At the introductory consultation the client gets acquainted with the specialist who will solve his problem. You will be able to ask the lawyer all your questions, and he will answer them clearly, thoroughly and in simple language.

What you will get when you ask for an introductory consultation:

-

An understanding of how liquidation of the representative office of a foreign company in Ukraine works.

-

Checking the list of documents you need to begin the procedure.

-

Understanding of the basic algorithm of the work we offer.

The base cost of the liquidation of a foreign company’s representative office covers the preparation of the relevant documents and their submission to the state authorities.

The cost of the liquidation of a foreign company’s representative office on a turnkey basis covers additionally: legal support of the documents processing procedure, de-registration of the representative office at the state authorities, carrying out other legal actions required for complete liquidation of the representative office.

The procedure for complete liquidation of the foreign company’s representative office takes 60 business days and more upon the receipt of the full package of documents.

The cost of services does not include fines, charges, penalties, etc., due to accounting violations, failure to provide reporting and the like. The cost of the liquidation of a foreign company’s representative office depends on the scope of work and the Client’s time requirements for the representative office liquidation.

Why us

We are ready to help you!

Contact us by mail [email protected] or by filling out the form:Our successful projects

- Liquidation of the parent company;

- Upon decision of a foreign company that has founded a representative office in Ukraine;

- Termination of the agreement on the opening of the representative office;

- By decision of a court.

Answers to frequently asked questions

No, it isn’t. Representative office is not a legal entity. Although it is entirely owned by the parent company, which can make any decision on it, no one can buy a representative office. Thus, the only option is to terminate its operation.

This aspect is not regulated with law. But technically, it is possible to do at the initial stage of the procedure. To be exact, this can be done before a tax audit. No changes can be made after the de-registration at the tax service. Due to the fact that all state authorities, where the representative office is registered, shall be notified of the replacement of the representative office director and some of them may process the documents within one month, we don’t recommend to do this during the liquidation procedure. After all, this can bring the procedure into a stalemate due to the information inconsistency.

Procedure for liquidation of a foreign company’s representative office in Ukraine

After the Client notifies us of his/her willingness to order services for liquidating a foreign company’s representative office, we conclude a Legal Services Agreement with the Client.After signing the Agreement, our company provides the Client with draft power of attorney and minutes to be signed. After that, our company’s lawyers carry out all the necessary actions within the terms stipulated by this Agreement.

If you want to change the director of a representative office before the beginning of the procedure, we can easily do this upon prior agreement. This will allow you to minimize communication with Ukrainian state authorities and involvement of the previous director of the representative office in the liquidation process.

If necessary, the standard procedure can be changed to better meet your needs.

If you have any questions regarding the legal assistance provided by Pravova Dopomoga Law Firm during the liquidation of a foreign company’s representative office, please don’t hesitate to contact us.

Liquidation of a representative office with our firm

Our lawyers have been working in this area of law for many years, constantly monitoring related changes in legislation.We have gone through the whole liquidation procedure together with our Clients for many times. This allowed us to thoroughly study the whole process and bring our actions to perfection. This means that we can help you go through the long procedure faster and more easily.

We constantly enhance the quality of our services and have our own standards of delivering services:

- We’re very reliable. If our lawyers take on the job, it will be done. Our commitment and high performance is a result of streamlining our processes. This means that we thoroughly work on each procedure and have a clear plan to move towards the goal. Of course, each situation is individual, because we always deal with people and quite non-standard cases. But the preliminary preparation and knowledge of the processes allow us to overcome any difficulties.

- We are the partner that can help you solve any legal issues. We have a multidisciplinary team of lawyers with deep legal expertise in various areas of law. This allows us not only to be prepared for any eventuality, but also to address any issue in a holistic manner and easily find the best solution.

If You wish to the liquidate of a foreign company’s representative office fast and easy - call us!