Taxation of a commercial representative office in Ukraine

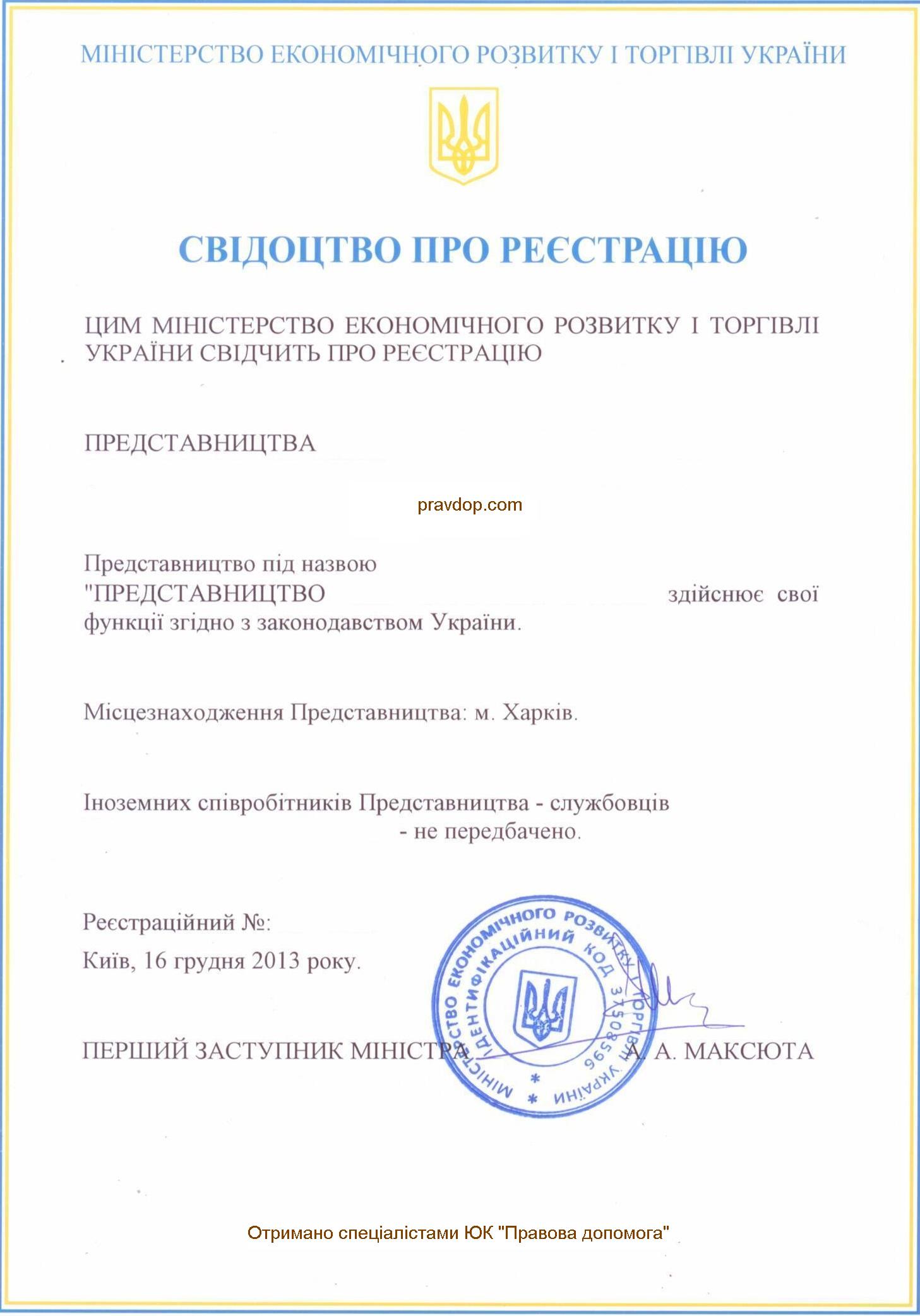

Permanent or commercial representative office in Ukraine is a place of the foreign company’s business activity in Ukraine, through which it conducts all or part of its business activity in Ukraine. This may be an office, a branch, a workshop and even a construction site - it depends on the type of activity of the main company and what the company is going to do in Ukraine.

Commercial representative office, although it is a special type of business activity in which a foreign founding company is registered as a taxpayer in Ukraine, still must have both a tax and accounting system.

Today, the taxation system of representative offices is changing - the foreign company must be registered with the tax office, and it must pay taxes such as income tax, etc. However, a representative office still must keep its accounting, especially if it has employees, both foreigners and Ukrainian citizens.

We will talk about taxation of a commercial representative office in Ukraine. If you would like to understand what awaits you when registering your representative office, please contact our experts for personal consultations.

You may also like: The Period and the Cost of Registering a Representative Office in Ukraine

What taxes does a commercial foreign representative office pay in Ukraine?

A commercial embassy in Ukraine is not a legal entity, but since it may conduct profitable activities, it is not exempt from paying taxes.

Accounting in the permanent representative office is organized and conducted according to the general procedure, but with its own peculiarities. For example, if the representative office employs foreign employees, when calculating their salary and paying taxes, you must take personal income tax into account and calculate everything so as not to be subject to double taxation.

Standard tax rates for commercial representative offices are as follows:

- VAT 20% if the amount of income exceeds 1 million per year;

- payroll taxes.

The group and the scheme of taxation will depend on the type of your business activity conducted in Ukraine, your main contractors and the operating scheme of the company.

You may also like: Director of a Foreign Representative Office in Ukraine

Also, depending on various situations and decisions made by management, a representative office may be required to pay other taxes and fees. For example, when purchasing a land plot, it will be necessary to pay land tax (if the plot is purchased) or rent fee for state or municipally owned land (the plot is under lease). If it is not land but other real estate, it may be necessary to pay real estate tax in Ukraine.

One of the key issues when a foreign company enters the Ukrainian market will be the repatriation of income to the parent company. And vice versa - the accrual of funds from the parent company to the representative office. For example, an important aspect is that financing of your representative office by your company is not subject to VAT.

You can learn the taxation of the representative office on your own. But firstly, it will take you a lot of time, and secondly, even if you got the main rules you may miss some important nuances that could make your business in Ukraine more profitable. Even leaving accounting issues in the hands of a Ukrainian accountant, you need to be sure that his/her actions will be closely monitored, and the whole scheme of taxation and accounting will be calculated beforehand.

We offer you tax consulting during the registration procedure of a representative office in Ukraine. This is only part of our services, which usually include:

- advising on registration of a representative office in Ukraine;

- registration of a representative office of a foreign company in Ukraine;

- assistance with organization of bookkeeping and personnel accounting in a foreign representative office;

- full legal and accounting support of a representative office in Ukraine, including Payroll and other personnel issues.

Do you want to know all the ins and outs of taxation of a foreign representative office in Ukraine for you? Don’t hesitate to contact us! We will help you not only to understand the taxation issues in Ukraine, but also offer you the best taxation scheme.

Didn’t find an answer to your question?

Everything about the establishment and operation of the representative office in Ukraine here.