Liquidation of a Company with Foreign Founders and a Director in Ukraine

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

In recent years, many companies in Ukraine with foreign founders and a foreign director have effectively ceased operations due to changes in market conditions, the war, business relocation, or the loss of economic viability. However, even an inactive company remains a business entity obliged to report to the tax authorities, pay taxes, and maintain up-to-date information in official registries.

Such companies often remain registered without reporting, turnover, or oversight, which quickly turns the entity into a source of debts, fines, and legal complications. This is why the timely liquidation of inactive legal entities with foreign capital is a necessary step.

In this article, we explain how to properly close a business in Ukraine without leaving behind “debt traces” or administrative issues, and why professional legal support is critically important in this process.

You might also like: Dormant LLCs in Ukraine: Risks and Solutions

Why Timely Company Liquidation Is Important for Foreign Owners

Timely termination of a company’s activities is an important step to prevent financial, legal, and even immigration-related issues in the future. Owners often leave a company “on pause,” assuming that without active operations, it poses no risks.

However, Ukrainian law imposes a number of obligations that apply regardless of whether the company is actively conducting business.

Financial and Legal Risks of an Inactive Company

Tax Debts and Penalties

Even if a company does not generate profit, it is still required to submit tax reports, financial statements, and other mandatory documentation. Failure to comply automatically leads to penalties, interest charges, and the accumulation of tax debt.

With each passing month, these amounts grow, and the company may be added to the list of debtors or “risky” taxpayers, making any future actions with the entity significantly more complicated.

Risk of Inspections and Account Freezes

An inactive or problematic company attracts the attention of tax and financial authorities. If debts accumulate or registry data does not match, the tax service may initiate an unscheduled audit, freeze bank accounts, or forward information to law enforcement agencies.

Even if the company is not operating, this creates additional administrative and financial risks for the owners.

Liability of a Foreign Director

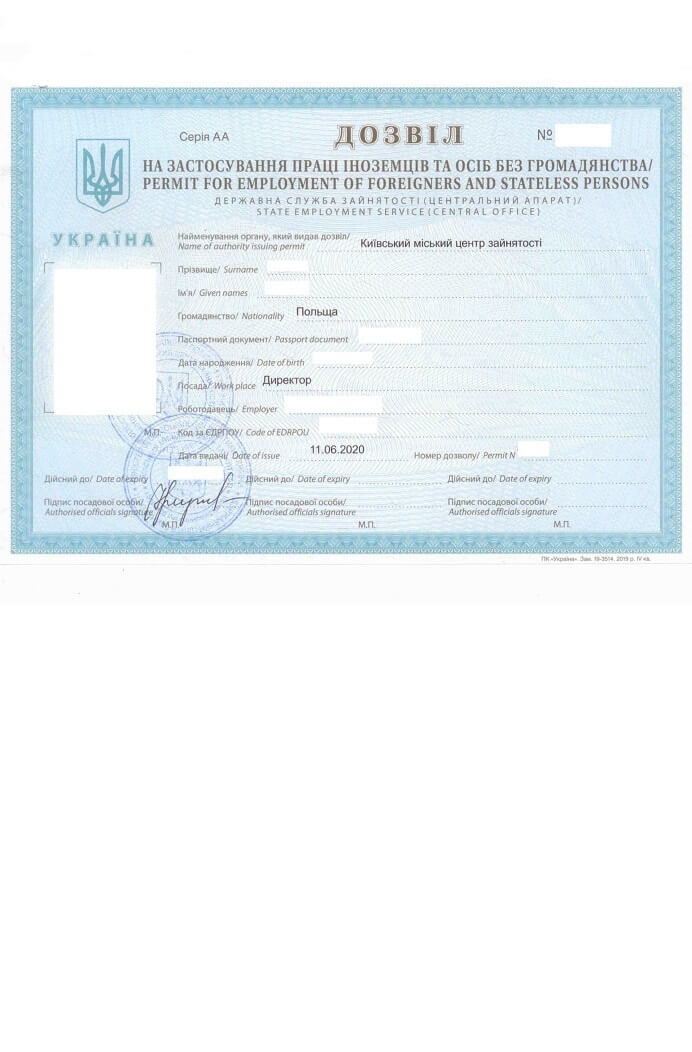

If the company’s director is a foreign national who has effectively stopped managing the business but remains the official head in the registry, they may be violating Ukraine’s migration and labor laws. Under Ukrainian legislation, a foreigner may work as a director only if they hold a valid work permit or residence permit.

If the company is inactive but the director is still listed in the registry, this may be considered an illegal stay or performing work duties without proper authorization. The consequences can be serious:

- refusal to extend a residence permit;

- cancellation of the work permit;

- administrative liability;

- a ban on entering Ukraine for a certain period.

Reputational and Legal Risks

Companies with foreign capital are often part of international business groups or used for investment projects. Having an “abandoned” legal entity with debts or open enforcement actions in Ukrainian registries can negatively affect the business reputation of foreign owners or holding structures.

In some cases, Ukrainian tax authorities may also send inquiries to foreign jurisdictions regarding the activities of such a company.

You might also like: Successful Case — Can You Sell a Company With Debts and What Is Alternative Liquidation?

Specifics of Liquidating a Company With Foreign Founders

Liquidating a company with foreign founders involves several procedural and legal nuances that set it apart from the standard process of closing Ukrainian businesses. The main challenge lies in correctly preparing the documents, confirming the authority of the founders, and interacting with state authorities without the owners’ physical presence.

Verification of Identity and Authority of a Foreign Founder

Foreign individuals or legal entities that own Ukrainian companies must provide documents confirming their authority to participate in the liquidation process. These may include:

- notarized copies of passports or corporate founding documents;

- documents confirming signing authority (for legal entities, extracts from the commercial registers of the country of incorporation);

- a power of attorney for a representative in Ukraine.

All documents must be translated into Ukrainian and notarized. If issued abroad, they require an apostille or consular legalization depending on the country of origin.

Possibility of Liquidation Without Personal Presence

Most procedures can be completed without the founder personally traveling to Ukraine. This is done by issuing a power of attorney to a Ukrainian lawyer or another authorized representative who acts on behalf of the foreign owner at all stages of liquidation, from submitting the application to the state registrar to communicating with tax authorities.

This significantly simplifies the process for foreigners who are outside Ukraine or do not have a valid residence permit.

Specifics of Preparing the Resolution on Liquidation

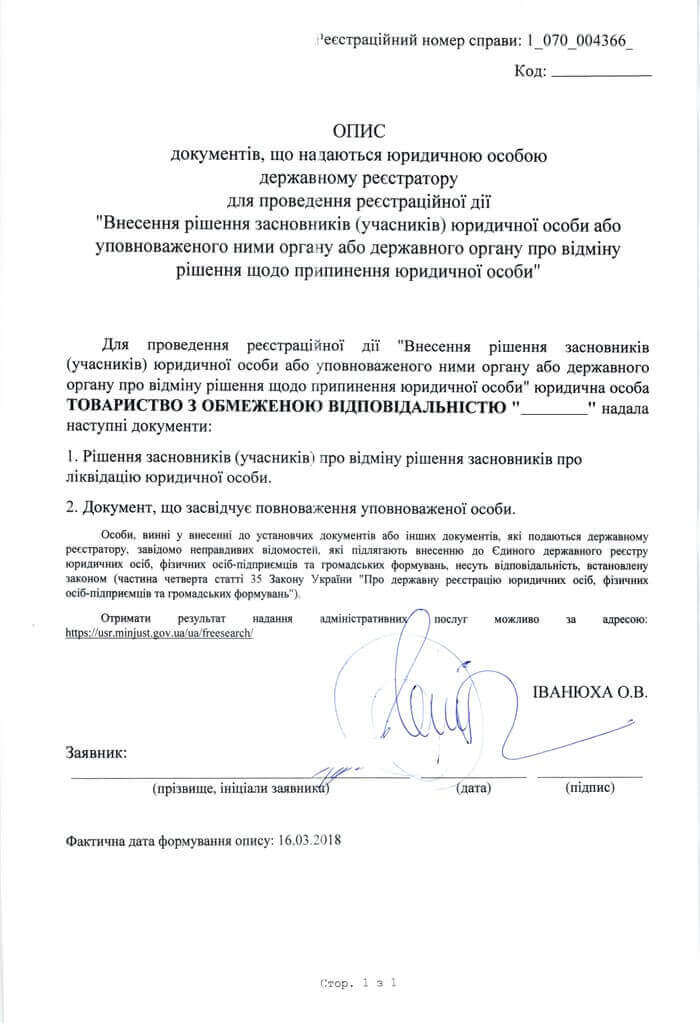

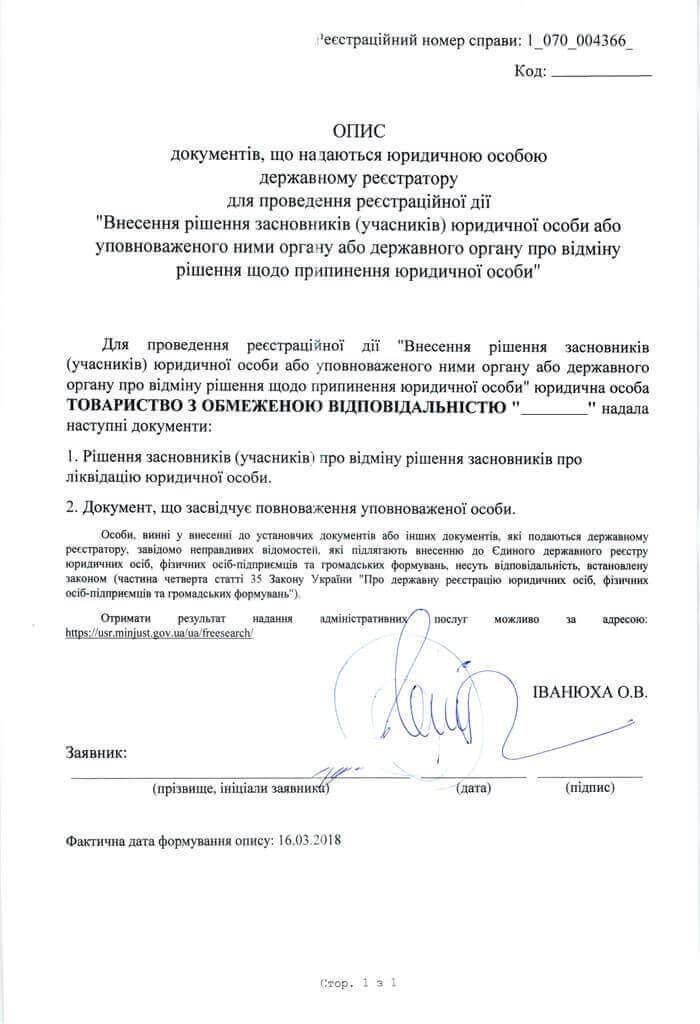

The decision to liquidate is made by the general meeting of founders (or by the sole owner). If the founder is a foreign individual or legal entity, the document must be prepared in accordance with Ukrainian legal requirements, including the appointment of a liquidator, the timeline of the procedure, and the method of distributing assets.

This resolution is submitted to the state registrar together with the required set of documents, after which the company officially receives the status of being in the process of termination.

Interaction With Tax Authorities and Banks

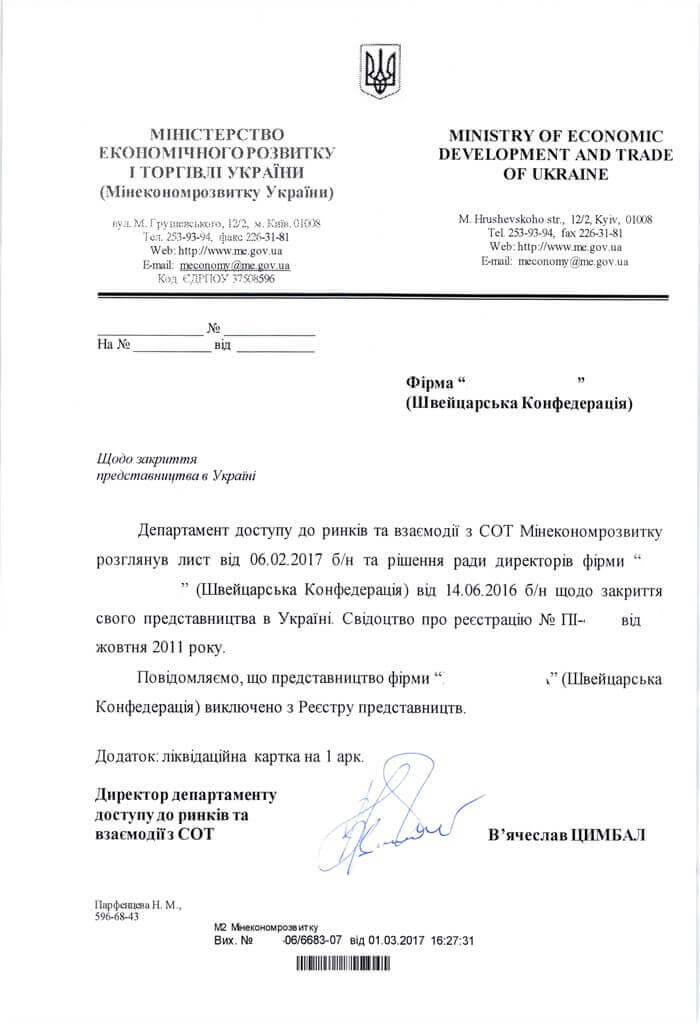

After the liquidation entry is added to the Unified State Register, the tax service conducts an audit to confirm that the company has no outstanding tax liabilities. For foreign owners, it is important to have accurate and up-to-date accounting records and reporting, even if no activity took place.

It is also necessary to close all bank accounts and remove the company from every type of official registration.

Considering Migration Aspects

If a foreign director resigns during the liquidation process, the State Employment Center must be notified and the work permit must be canceled. Otherwise, the system may consider that the foreigner continues to work without legal grounds, which violates migration laws.

You might also like: Liquidation of Several Companies at Once or Companies With a Complex Structure

Options for Closing a Foreign Business in Ukraine

For companies with foreign founders in Ukraine, there are two main ways to terminate business activities: classical liquidation and alternative liquidation. The choice depends on the company’s situation, the presence of debts, the desired timeline, and whether the owner wishes to participate in the procedure personally.

Classical Liquidation

This is the formal and complete method of terminating a legal entity. It requires the founders to adopt a resolution on liquidation, appoint a liquidator or a liquidation commission, submit the necessary documents to the state registrar, and notify the tax authorities.

After this, the company undergoes an audit during which the regulatory authorities confirm the absence of tax debts, reporting obligations, and property disputes. Once the audit is completed and the company is removed from all types of official registration, the final set of documents is submitted and the state registrar enters a record of the legal entity’s termination in the Unified State Register.

The main advantage of classical liquidation is that the company officially ceases to exist, and after the procedure is complete, no claims or charges can be imposed.

However, this method is relatively long, usually from three to six months. It includes a tax audit and requires thorough preparation of accounting documents. For foreign founders, it often involves additional formalities such as document translation, apostille, and confirmation of authority.

Alternative Liquidation

This is a completely different approach. Alternative liquidation, also known as transferring the company to new owners, does not involve dissolving the legal entity. Instead, the company’s structure changes. The foreign founder leaves the list of participants, and their share is acquired by a new owner who accepts all rights and obligations of the company.

At the same time, the director, legal address, and other registration details are updated. As a result, the foreign owner fully exits the company, and the new owner assumes responsibility for all future activities.

The main advantage of alternative liquidation is its speed. The procedure takes only a few days and does not require a tax audit. The foreign founder is not required to travel to Ukraine. All actions can be carried out through a notarized power of attorney. This method is convenient for those who want to exit a business quickly and without unnecessary formalities.

How to Avoid the Accumulation of Debts and Penalties

For companies with foreign founders, it is especially important not to leave the business unattended, even if operations are effectively paused. Any registered legal entity in Ukraine is required to maintain accounting records, submit reports, and keep its information up to date in state registries. Otherwise, debts, fines, and interest charges begin to accumulate automatically.

These issues can be avoided by taking care of several key points in advance:

- Submit reports to the tax authorities on time. Even if the company has no economic activity, tax declarations must be filed as zero. Failure to submit reports automatically leads to penalties that may become significant over time. Therefore, before starting liquidation, it is important to check for overdue declarations and submit them if needed.

- Monitor tax obligations and bank accounts. The company must have up to date information about any debts owed to the tax service, the Pension Fund, or other authorities. Bank accounts that are no longer used should be closed since fees may continue to accrue or transactions may be blocked.

- Remove the company from all types of registration after business activity ends, including with the tax authorities, the statistics office, and the social insurance funds. This helps avoid situations where a company remains active only on paper while debts continue to accumulate.

- Consider the migration status of the director. If a foreign citizen remains listed as the director in the registry but no longer has a valid work permit, this may create additional problems. Therefore, before liquidation or transferring the company, it is advisable to formally terminate the powers of the foreign director.

The most reliable way to avoid debts is to initiate liquidation immediately after business operations cease. The earlier the procedure begins, the fewer the risks and the easier it is to complete all formalities. With proper legal support, the entire process can be completed without penalties, without inspections, and without the personal presence of the owners.

You might also like: What to Do With the Company's Property During Its Liquidation?

Legal Support for Liquidating Companies With Foreign Founders and Directors

For more than ten years, our lawyers have specialized in liquidating companies with foreign founders and foreign directors and understand all the challenges faced by owners who are located abroad. We provide full support throughout the entire process, from assessing the situation to entering the final record of company termination in the Unified State Register.

Our services include:

- Preparation and submission of all documents to state authorities, banks, and registrars

- Remote liquidation by notarized power of attorney if you are abroad

- Preparation of documents in Ukrainian and English that meet apostille or legalization requirements

- Alternative liquidation, involving the transfer of corporate rights and a change of director, to exit the business quickly, without inspections and bureaucracy.

We make complex procedures simple and safe so that you can avoid debts, penalties, and risks to your migration status in advance.

Contact us now and we will arrange the liquidation of your company within optimal timeframes, legally and without unnecessary complications.

Our clients