How do I pay the salaries of the employees of a charitable foundation? And other administrative costs of foundations

Cost of services:

Reviews of our Clients

Having established a charitable organization, its founders are faced with the payroll issue, as well as with other general business expenses that arise in the process of the activity. The Law of Ukraine “On Charity and Charitable Organizations” (hereinafter - the Law) identifies all these expenses as administrative. Since the Law allows to spend on them no more than 20% of the income, it is important to understand the concept of “income” and what expenses can be classified as administrative.

- Definition and structure of administrative expenses

This publication will help you to gain insight into the following issues:

- To determine the categories of income of charitable organizations, and to understand whether a loan falls under this category;

- To learn what refers to administrative expenses;

- To learn more about the liability for violating the requirements of the Law.

As far as charitable organizations are nonprofit organizations, their sources of income are quite specific and have the following structure:

- Special-purpose receipts - charitable contributions, donations, contributions from members of a charitable organization, grants, etc.

Peculiarities of reflecting such income in the accounting records - until the charitable organization does not meet the conditions of these special-purpose receipts, they will not be recognized as income (for example, if the money was collected for the treatment of sick children, they are not recognized as income, until the money is transferred to the account of such a child or a healthcare facility).

- No-purpose receipts - funds that do not have a clear target. For example, irrevocable financial assistance received from a natural or legal person.

Peculiarities of reflecting such income in the accounting records - they are reflected as an asset on the balance sheet, because they are recognised as receivables and as income, at the same time.

- Funds received from the sale of products of a charitable organization, which in the future will be used to achieve the goals for which the charitable organization was established, as well as funds from the lease of property and the sale of residue stock.

Peculiarities of reflecting such income in the accounting records - such income should be reasonably estimated, therefore, it is necessary to indicate the documents on the basis of which such funds were received.

- Passive income - dividends, reimbursements, insurance payments, and royalties.

Peculiarities of reflecting such income in the accounting records - such income shall be reflected in the period when the decision to pay them is made (e.g. payment of dividends on deposit).

According to the Financial Reporting Standard 15, reimbursable financial assistance (loan) shall not be recognized as income (paragraph 6.5). In other words, replenishment of the foundation’s budget with the loan and use of these funds to pay salaries to employees of the foundation will be interpreted as a violation of the requirements of the Law. However, if there the charitable organization receives no other funds, the financial sanctions for such violation will be minimal.

Definition and structure of administrative expenses

Administrative expenses related to the operation and management of the organization (paragraph 18 of the Financial Reporting Standard 16).

They include the following categories:

- Payroll expenses for administrative staff and other staff;

- Business travel expenses;

- Premises maintenance expenses (repairs, heating, lighting, water supply, water disposal, security);

- Rental expenses (including the rental of operating vehicles);

- Expenses related to vehicle maintenance (purchase of fuel and lubricants, parking and parking fees, repairs and amortization);

- Organization and holding of charitable events (concerts, fundraising, etc.);

- Communications expenses;

- Bank charges

- Expenses for settling disputes in courts.

The total amount of such expenses shall not exceed 20% of the foundation’s receipts recognized as income. For example, if the annual salary of the head of a charitable organization is UAH 5,000, then by the end of the year such charitable organization shall receive income of at least UAH 300,000.

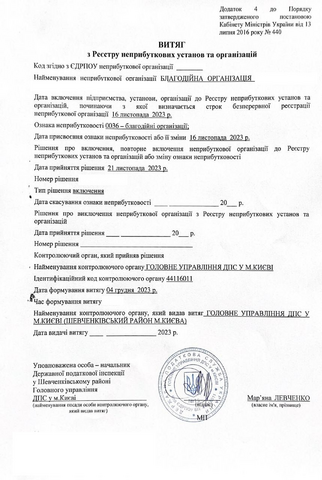

In case of violating the requirements of the Law and exceeding the 20% limit set for administrative expenses, the State Fiscal Service of Ukraine may revoke the non-profit status of such charitable organization, i.e. it will have to pay corporate income tax on a general basis, as well as to pay tax on the misused funds for the period from the beginning of the year to the last day of the month in which such a violation is detected or from the moment of recognition of such an organization as nonprofit (as defined in paragraph 133.4.3 of the Tax Code of Ukraine). First of all, the organization will be faced with financial losses, as it is impossible to restore the non-profit status until the new reporting year starts, even if the factor that led to the loss of this status is eliminated.

Thus, summing up the above information, it can be concluded that charitable organizations shall follow specific requirements for maintenance of accounting records due to the fact that charitable organizations do not aim to make a profit, and therefore are registered as nonprofit organizations. The budget of charitable organizations shall be replenished with due consideration of the definition of their income, as defined by the Tax Code of Ukraine, and to spend funds in accordance with the restrictions established by it.

In order to avoid difficulties related to maintenance of accounting records, we advise you to seek professional services, if you do not have an accountant or you don’t properly understand the peculiarities of financial reporting.

Our clients