Cash Transfers Across the Ukrainian Border: Common Issues and How to Avoid Them

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

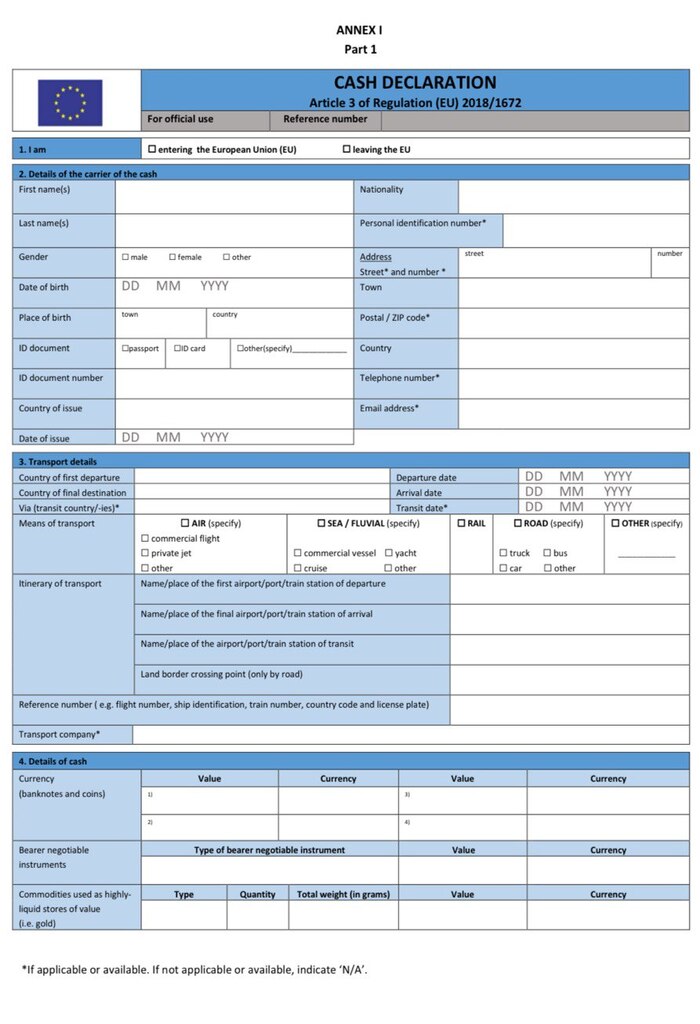

The transfer of cash across Ukraine’s border is strictly regulated by Ukrainian law. In Ukraine, the rule is: each person may take out up to €10,000 (or the equivalent in another currency) without a written declaration. If the amount exceeds this limit, the traveler must submit a customs declaration and provide documents confirming the legal origin of the funds.

The main difficulty is that many underestimate the importance of properly preparing the documents. In practice, this often leads to customs authorities refusing permission to take the money out, forcing the traveler to return to finalize or obtain supporting documents. In most cases, such a situation does not result in fines, but it does cause travel delays and extra expenses for time and transportation.

In this context, proper planning and legal support become key elements of safely transferring funds. In our practice, we have repeatedly encountered situations where a well-prepared set of documents and professional guidance helped clients avoid negative consequences and pass customs control quickly. In this article, we will share our experience and explain the typical problems that arise at the border when taking money out, so you know how to minimize risks.

You might also like: Confirming the Source of Funds: When It Is Required and How to Do It

Typical Problems at the Border When Exporting Money

The cash declaration procedure may seem straightforward, but in practice, it involves many nuances. Travelers often face difficulties that delay border crossing or even make it impossible to take the funds out. Here are the most common problems we have encountered in our practice:

1. Request for additional documents. Ukrainian law and customs regulations provide a clear list of documents that confirm the legal origin of funds.

However, in practice, customs officers sometimes demand extra documents that are not formally included in this list. Such requests are not always lawful, but they create difficulties for travelers and can delay the border-crossing process.

2. Missing stamps or signatures on bank receipts. Bank documents must be properly executed.

Even if the funds were legally withdrawn from an account, an incorrectly issued receipt can halt the process of exporting the money.

Practical examples:

- A client withdrew foreign currency at a bank counter but received a receipt without the cashier’s signature and stamp.

- A bank issued an ATM slip, which customs officers refused to accept as valid proof.

In such cases, the transfer of funds is delayed until properly executed documents are provided.

3. Funds carried by someone other than the account holder. Problems often arise when money is withdrawn from one person’s account but transported by another.

Please note: while it is possible to withdraw cash from an account under a power of attorney, exporting those funds is not allowed. Carrying cash across the border is permitted only by the person who legally owns it. This common misconception often results in the money having to remain in Ukraine.

4. Language of the declaration. Many travelers are unaware that the declaration sometimes must be completed not in English but in the language of the country through which they are exiting or transiting.

For example, if Poland is not just a transit country but the actual point of entry, customs officers may require the declaration to be filled out in Polish.

For example, if Poland is not a transit country but the actual point of entry, customs officers may insist that the declaration be completed in Polish.

5. Discrepancies in amounts or currencies. Misunderstandings may arise from incorrect currency conversion or inconsistent equivalents.

For instance, if the declaration lists an amount in U.S. dollars that does not match the official euro exchange rate, customs officers may require the documents to be redone or additional explanations to be provided. This slows down the clearance process.

6. Formal grounds for refusal. Customs authorities pay attention even to minor details, such as incorrect currency notation, missing dates, or errors in names.

Such formal inaccuracies often become grounds for refusing the transfer of funds. For the traveler, this means wasted time and the need to redo the paperwork.

You might also like: Transferring Funds from Ukraine to the U.S. and Their Legalization

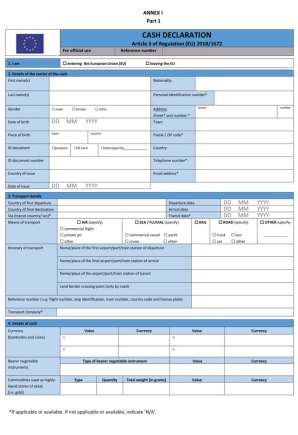

Do Customs Officers Have the Right to Request Additional Documents When Exporting Funds Abroad?

Ukrainian customs regulations clearly define which documents may be required from individuals when taking cash abroad. In particular, if the amount exceeds the equivalent of €10,000, the traveler must provide documents confirming the withdrawal of funds from their own bank account. These documents are valid for 90 calendar days from the date of withdrawal.

Which Documents Are Required to Take Cash Abroad

According to the clarifications of the National Bank of Ukraine, the supporting documents include:

- A payment instruction for the issuance of cash (if funds are withdrawn at a bank’s cash desk).

- An ATM receipt and/or payment terminal slip, or a cardholder’s withdrawal slip/receipt — when withdrawing funds through ATMs or other payment devices.

- An account statement showing the movement of funds.

- A receipt for a currency exchange transaction or for operations with banking metals (form provided in NBU Regulation No. 2 of 02.01.2019).

Thus, the list of documents is exhaustive and strictly defined by NBU regulations.

Please note! Only the account holder from whose account the funds were withdrawn is allowed to take the cash abroad.

In practice, however, there are cases when customs authorities request additional documents not provided for by law (for example, certificates of the source of funds, internal bank confirmations, documents on opening a bank account, etc.). Such requirements are not always legally justified.

At the same time, to avoid unpleasant situations, lawyers recommend preparing the most complete set of documents in advance and carrying proof of the legal origin of the cash.

You might also like: Declaring Funds at the Border: How to Properly Prepare and File Documents

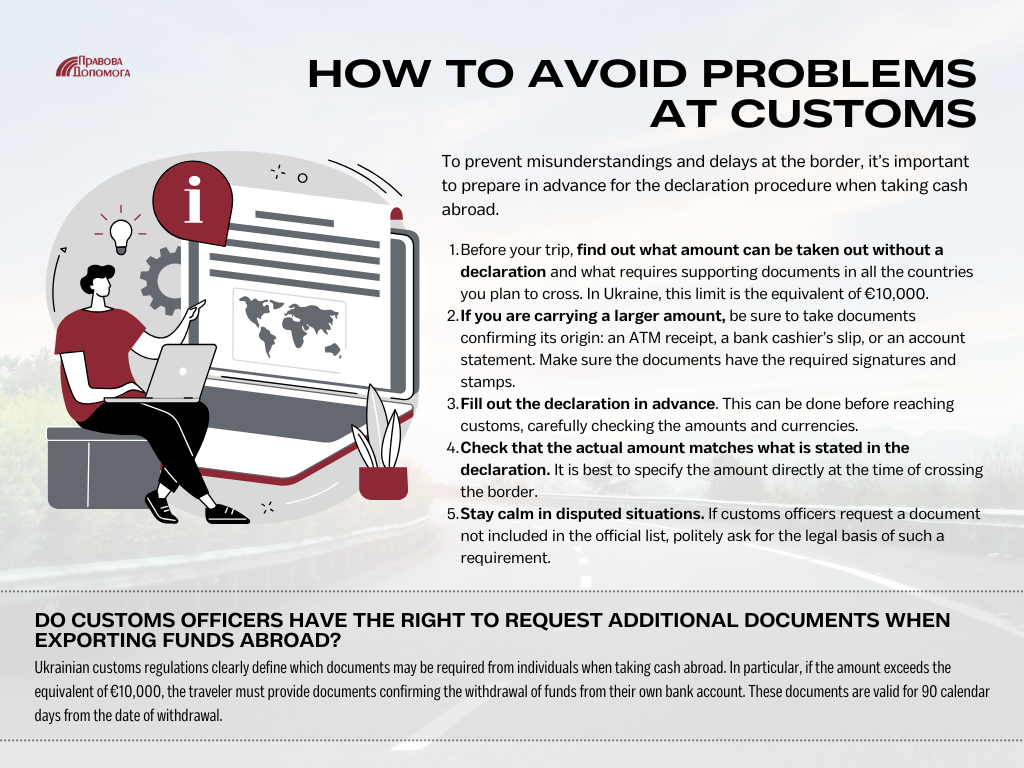

How to Avoid Problems at Customs: Step-by-Step Tips

To prevent misunderstandings and delays at the border, it’s important to prepare in advance for the declaration procedure when taking cash abroad. Below are the key steps and practical recommendations:

- Before your trip, find out what amount can be taken out without a declaration and what requires supporting documents in all the countries you plan to cross. In Ukraine, this limit is the equivalent of €10,000.

- If you are carrying a larger amount, be sure to take documents confirming its origin: an ATM receipt, a bank cashier’s slip, or an account statement. Make sure the documents have the required signatures and stamps.

- Fill out the declaration in advance. This can be done before reaching customs, carefully checking the amounts and currencies.

- Check that the actual amount matches what is stated in the declaration. It is best to specify the amount directly at the time of crossing the border.

- Stay calm in disputed situations. If customs officers request a document not included in the official list, politely ask for the legal basis of such a requirement.

How Lawyers Help with Cross-Border Fund Transfers

Moving funds across the border is not just about paperwork. It’s about your time, your plans, and your peace of mind. When what’s at stake includes not only money but also your reputation and the continuity of your trip, it’s essential to act proactively.

Our team of lawyers specializes in customs and currency regulation, so we understand that the top priority for our clients is to avoid unforeseen situations and maintain control over the process. That’s why we take care of all the legal details:

- We explain the rules for taking funds abroad and specify which documents you need to prepare in your particular case to avoid misunderstandings at the border.

- We review documents, including receipts, account statements, and bank certificates, to ensure they meet the requirements of the NBU and customs authorities, paying close attention to signatures, stamps, and validity periods.

- We explain how to correctly complete the declaration so that it complies with regulations.

- We outline an action plan for situations where disputes arise at the border or customs officers request documents not required by law.

Leave a request and we will ensure that moving funds across the border is transparent, safe, and hassle-free for you.

Our clients