Procedure for Closing an LLC in Ukraine and Key Features of the Updated 2025 Legislation

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

The issue of closing an LLC in Ukraine remains highly relevant for many entrepreneurs. Changes in tax and corporate legislation, along with increased oversight of reporting and inspections by state authorities, are motivating business owners to act in a timely and legally competent manner.

Voluntary liquidation is a way to formally end a company’s operations without the risk of fines or accumulating debts.

The most common reasons for closing an LLC include:

- lack of business activity or financial justification to maintain the company;

- change of business direction or transition to another legal structure;

- completion of the project for which the company was created;

- inability to meet tax or financial obligations;

- a decision by the owners to optimize or restructure the business.

For LLC owners and directors, including foreign founders who want to close a business in Ukraine legally, it is essential to understand each stage of the process, the typical mistakes, and the modern legal tools that allow the liquidation to be completed quickly and safely.

In this article, we will explain the LLC liquidation procedure, timelines, required documents, and the key features of the updated legislation. You will also learn how to properly complete the company’s closure through classical liquidation, as well as an alternative method that helps simplify and significantly speed up the process.

You might also like: “Dormant” LLCs in Ukraine: Risks and Solutions

General Procedure for Liquidating an LLC: Bureaucratic Challenges

Voluntary liquidation of an LLC follows a clearly defined sequence of steps established by Ukrainian law. In practice, each stage is accompanied by certain bureaucratic obstacles that can significantly delay the process.

Adoption of the Decision by the General Meeting of Participants

The procedure begins with convening a general meeting of participants, where the decision to liquidate the company is made. The same decision must also determine the composition of the liquidation commission or appoint a liquidator. From that moment, all management powers are transferred to this body.

Once the liquidation commission or liquidator is appointed, the executive body of the LLC ceases to perform its functions. In practice, forming the commission often causes delays. Participants may struggle to agree on candidates or may need to involve external specialists such as lawyers or auditors.

Notifying the State Registrar or a Notary

Within three working days after the decision to liquidate is made, the company must notify the state registrar or a notary so that a record can be entered into the Unified State Register (USR) indicating that the LLC is in the process of termination.

At this stage, technical difficulties often arise due to incorrectly completed applications, mistakes in company details, or overload of the electronic systems. Once the record is entered, the supervisory authorities, such as the State Tax Service and the Pension Fund, automatically receive a notification that the liquidation process has begun.

Notifying Creditors About the Liquidation of an LLC

Next, the liquidation commission must notify creditors about the LLC’s liquidation. Formally, this is done through a publication in the Unified State Register. However, in practice, it is often necessary to send additional letters or notices directly to creditors, which creates administrative costs and increases the risk of missing deadlines.

At the same time, the commission must contact the LLC’s debtors and demand repayment of outstanding obligations. This requires proper documentation and careful handling to ensure all claims are processed correctly.

Tax Audit Required to Remove the LLC From the Tax Register

One of the most bureaucratically complex stages of liquidation is the tax audit, without which the company cannot be dissolved. To initiate this audit, the liquidation commission must submit an application to the tax authorities requesting removal of the LLC from the tax register.

Delays frequently occur at this stage. The audit may not begin immediately due to inspectors’ workload, and once it starts, it can last up to three weeks or even longer. Any inconsistencies in financial reporting or missing primary documents can lead to repeat audits or additional requests from the tax authority.

Inventory of LLC Assets

After this, a full inventory of all LLC assets must be carried out. This includes not only fixed assets but also leased property, items held in storage, and off-balance-sheet assets. A thorough review of the company’s assets is required by law, but due to bureaucratic procedures, this stage often takes longer than expected.

Preparation of the Intermediate Liquidation Balance Sheet

Preparing the intermediate liquidation balance sheet is another critical stage. This document must reflect the complete composition of the company’s assets, the list of creditors’ claims, and the results of their review.

The tax authority and other supervisory bodies often return the balance sheet for revisions because of minor technical inaccuracies, which can delay the liquidation process.

Dismissal of Employees and Closure of Bank Accounts

Next, the liquidation commission proceeds with dismissing employees and closing all bank accounts except one settlement account, which is used to make payments to creditors. Every creditor’s claim must be reviewed within the timeframe established by law, and any refusal must be provided in writing with proper justification.

At this stage, the level of formal requirements is extremely high. Even a minor mistake in the written response to a creditor can become grounds for a legal challenge.

Settlements With Creditors in the Order Defined by Law

Settlements with creditors are carried out in the sequence established by Ukrainian law. If the company’s assets are insufficient to satisfy all claims, the liquidation process is converted into bankruptcy proceedings, which are regulated by the Bankruptcy Procedures Code of Ukraine.

This is a separate and even more complex procedure that requires the involvement of an insolvency practitioner and is conducted under court supervision.

Completion of LLC Liquidation and Distribution of Assets

Once all settlements have been finalized, the remaining assets are distributed among the participants, tax and Pension Fund audits are completed, and the company’s documents are transferred to the state archive.

Only after the liquidation commission receives the archival certificate can it submit an application to the state registrar to enter the final record in the Unified State Register. This entry officially completes the liquidation process.

Successful case: Alternative Liquidation of a Troubled Company

Timeframes (Duration) and Documents Required for Closing an LLC

The duration of an LLC liquidation depends on the scale of its activities, its financial condition, and the timely preparation of all necessary documents.

- The minimum liquidation period is around three months, but it cannot be shorter than the legally established period for creditor claims which is two months.

Such a fast process is possible only in exceptional cases when the LLC has not conducted business, has no tax or financial debts, and all reporting and documents have already been properly prepared. - The average liquidation period for a company ranges from six months to one year in most situations. The longest and most complex stage is the tax audit because it determines whether the company can be removed from the register without additional clarifications or penalties.

It is almost impossible to predict the exact duration of the procedure. It depends on many factors, including:

- the completeness and correctness of document preparation;

- the speed of document submission;

- the workload of state registrars and tax inspectors;

- the presence of any discrepancies in reporting.

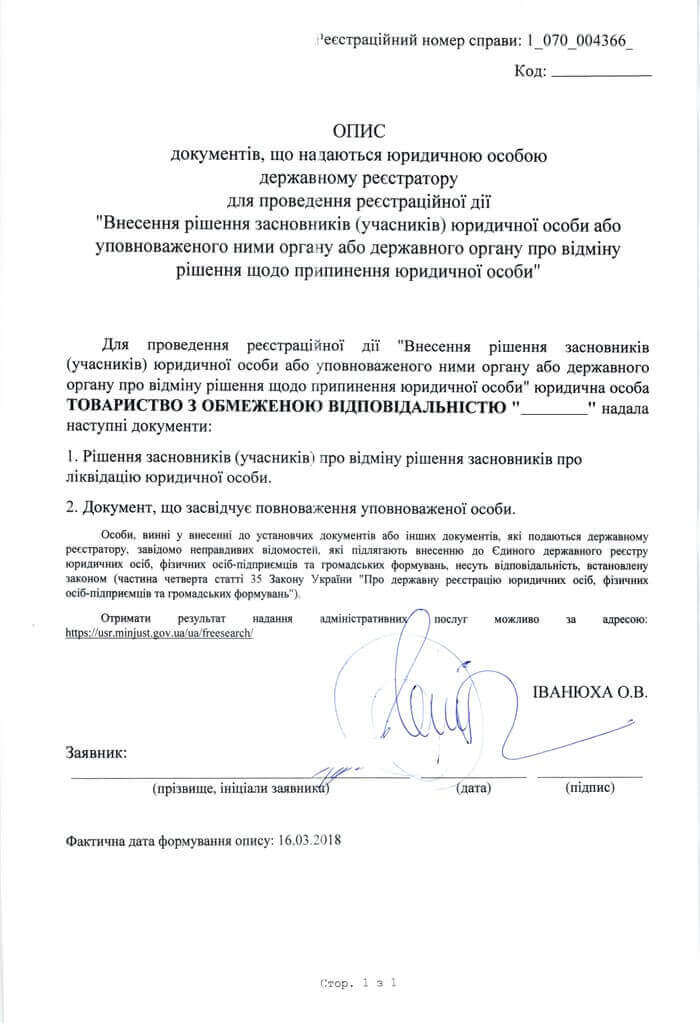

Main Documents Required for Closing an LLC

To close an LLC, the following key documents must be prepared:

- a decision of the founders on the liquidation of the company;

- an order establishing a liquidation commission or appointing a liquidator;

- a notification to the state registrar about the termination of the legal entity;

- reporting submitted to the tax authorities, including liquidation reports, reconciliation statements, and confirmation of the absence of debts;

- a liquidation balance sheet prepared after all settlements are completed;

- an application for state registration of the termination of the LLC after all procedures are finalized.

Specific Features of Closing an LLC Under the Updated Legislation of 2025

In 2025, the procedure for liquidating an LLC in Ukraine underwent several important changes related to the updated legal framework and the digitalization of state services.

The main regulatory act governing the termination of activities is the Law of Ukraine On Limited and Additional Liability Companies No. 2275 VIII, along with the provisions of the Civil Code of Ukraine.

One of the key features is the gradual amendment of the Commercial Code of Ukraine in accordance with Law No. 4196 IX, which enters into force in August 2025. This means that all liquidation processes are now based solely on civil law norms. At the same time, a transition period continues during which mixed norms remain in effect, and this may create some confusion in the interpretation of procedures.

Another significant aspect is the broader use of electronic services such as the Diia portal and the online system of the state register. Thanks to these tools, it is possible to submit a liquidation application or make changes remotely without visiting a public service center. However, due to the incomplete integration between the Unified State Register, the Tax Service, and the Pension Fund, technical issues and delays in document confirmation often occur.

Starting in 2025, the tax service has been more active in applying a risk-oriented approach. Companies with clean reporting can be removed from the register without an on site audit, while those with even minor discrepancies in their reports or with tax debt undergo an extended audit.

In addition, the requirements for preserving documents and transferring them to the archive have become stricter. State archives accept only complete document packages with properly prepared historical summaries, inventories of permanent storage files, and personnel documentation. The absence of even one required act for documents that must be destroyed can result in a refusal to issue an archive certificate. This certificate is mandatory, and without it the liquidation process cannot be completed.

Common Mistakes When Liquidating a Company

During the closure of an LLC, entrepreneurs and liquidation commissions often make the same mistakes, which can significantly prolong the process. The most common include:

- Incomplete or late submission of documents to the state registrar. The liquidation commission often fails to meet the three-day deadline for notifying the start of the procedure, which leads to the need to resubmit the application.

- Incorrect notification of creditors. If the decision on liquidation does not specify a clear deadline for submitting claims or if the notification is not done properly, this may later become a reason for legal disputes and delays.

- Problems during the tax audit. Discrepancies in reporting data, missing primary documents, or late submission of liquidation reporting may result in additional payments and repeated audits. In such cases, the liquidation process effectively stops until the issues are resolved.

- Mistakes in the liquidation balance sheet, such as missing signatures, incorrect reflection of assets, or failure to include accounts receivable. Tax authorities carefully examine these documents, and even minor inaccuracies can lead to the balance sheet being returned for revision.

- Incorrect settlements with employees. Failure to pay compensation or delays in terminating employment relationships often lead to complaints, which slow down the completion of the liquidation procedure.

- Loss or improper transfer of documents to the archive. Companies often lose part of their accounting or personnel documents, which results in the archive service refusing to issue a certificate. Without this certificate, the state registrar cannot record the liquidation.

You might also like: Is it possible to remotely close an LLC in Kyiv?

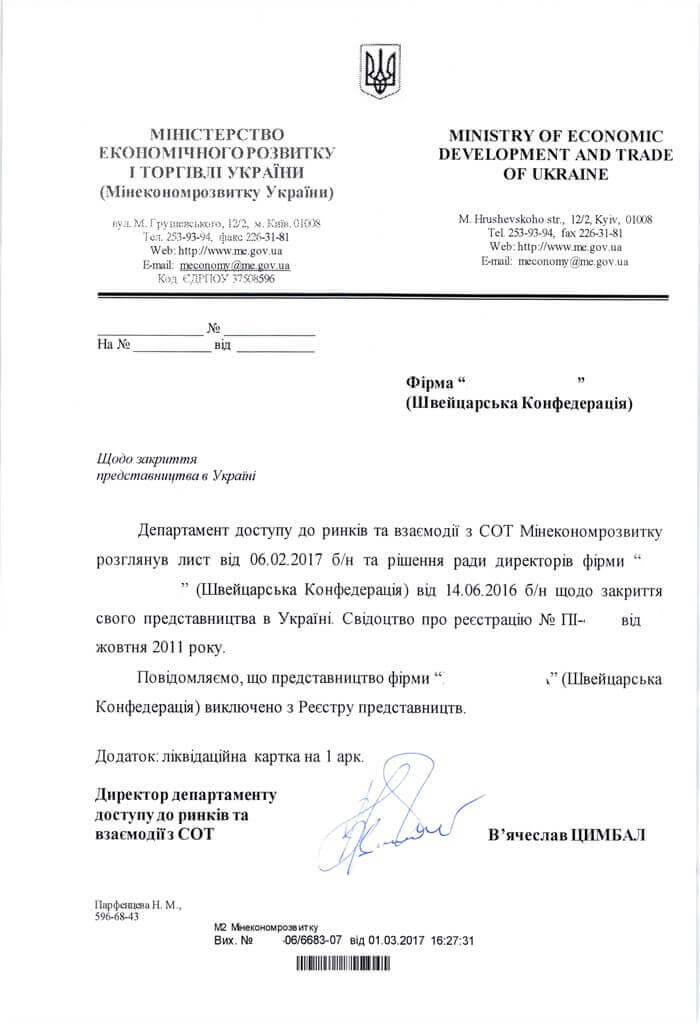

Alternative LLC Liquidation: Fast, Legal, and Stress Free

We have now reviewed in detail all stages of the standard liquidation of an LLC, from forming a liquidation commission to tax audits and transferring documents to the archive.

As shown, even with proper preparation the procedure can take months, and any inaccuracy in documents or delays from regulatory authorities creates risks for owners and managers.

For entrepreneurs who want to avoid a long bureaucratic process and minimize their involvement, there is a legal option called alternative liquidation.

This is a lawful procedure that provides for changing the owner and management of the company instead of carrying out a classical liquidation process.

As a result, the company continues to exist legally, but the new owner takes anti-crisis measures and either brings the business to a new level or assumes full responsibility for dealing with creditors, debtors, and completing the liquidation procedure.

Alternative liquidation with us means:

- the fastest way to close an LLC, usually within 3 to 5 days;

- no tax audits and no bureaucratic delays;

- Full legal compliance and registration of all changes in the Unified State Register;

- Confidentiality and minimal involvement of the owner in the process.

We provide complete legal support to ensure that the liquidation of your company is carried out as quickly, safely, and comfortably as possible, allowing you to receive the result without unnecessary stress and risks.

Ready to remove formalities and risks? Get a personalized strategy for liquidating your business today by contacting us!

Our clients