Why Does a Foreigner Need a TIN in Ukraine?

Cost of services:

Reviews of our Clients

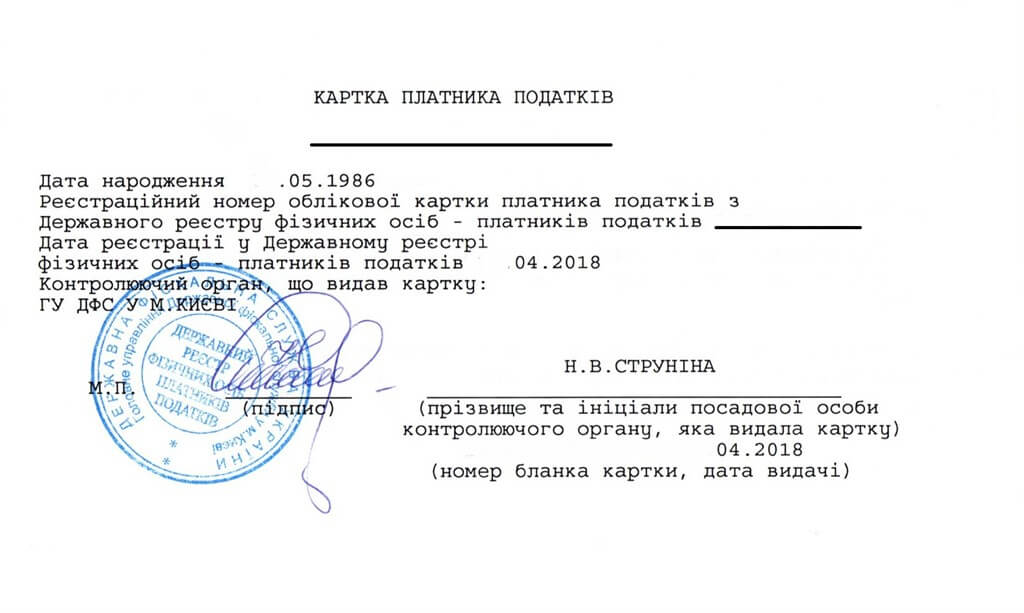

Tax Identification Number (TIN) or code is a digital number issued to an individual taxpayer in Ukraine.

This code will be needed for any transactions related to the need to pay taxes in Ukraine, so if you are going to:

-

Obtain a Work Permit in Ukraine;

-

Start a business in Ukraine (for example, in the form of LLC);

-

Buy real estate or effect other transactions in Ukraine;

-

Open a bank account in Ukraine;

-

Go to a Ukrainian university;

-

Obtain any permits and licenses for a business in Ukraine;

-

Get inheritance in Ukraine, etc. –

You need to apply for a TIN. You will also need a TIN in any case, if you plan to stay in Ukraine on the basis of a Temporary Residence Permit, Permanent Residence Permit or citizenship on the grounds that you have.

Please note! To get a TIN, a foreigner does not need to be personally present in Ukraine - it can be done through our lawyers on the basis of power of attorney. Obtaining a TIN is usually included in the cost of basic services that our Clients need, for example:

-

Legal support of the purchase of real estate in Ukraine;

-

Obtaining a Temporary Residence Permit in Ukraine;

-

Legal support of inheritance in Ukraine.

You may also like: How to Open an Account in a Ukraininian Bank for a Foreigner?

How to get a TIN: The requirements for obtaining a TIN in Ukraine

The step-by-step guide for obtaining a TIN in Ukraine is as follows:

-

Preparation of documents for obtaining a TIN, which include a copy of a foreigner’s passport (used for entering Ukraine) with a notarized translation into Ukrainian language. It is also required to correctly fill in the application form.

Note: In the case of obtaining a TIN by our lawyers, a power of attorney will also be required. We take care of all the paperwork.

-

Submission of documents to the local tax office. To do this, you need to come to the territorial tax office and submit documents on a first-come-first-served basis. Standard period for issuing a TIN takes about 5 business days.

Note: If necessary, our lawyers can obtain a TIN in Ukraine in 1 day.

-

As soon as the TIN is issued, you need to come back to the tax office for it.

Please note! If there is a need to obtain a TIN in Ukraine for a minor or incapacitated person, the procedure is performed on behalf of a parent or legal guardian.

You may also like: What to Choose for Business in Ukraine: A Company or a Sole Proprietorship?

Advantages of obtaining a TIN with the lawyers of our company:

-

In addition to a TIN, you get a lawyer’s advice on the procedure and terms of obtaining it, as well as introductory information about your case and its solution in Ukraine;

-

We can get a tax identification number in Ukraine in 1 day;

-

A TIN can be obtained remotely, especially if you need it for a procedure such as obtaining a Work Permit - this will help you better organize your time in Ukraine;

-

When ordering a service that requires obtaining a TIN, such as a Temporary Residence Permit, Work Permit in Ukraine, support of the real estate purchase transaction - the price of a TIN may be included in the price of legal services in Ukraine.

Remember, getting a TIN is only the first step on the way to your goal in Ukraine. We will help you achieve the result in the simplest and most effective way.

Do you need help with any legal procedures in Ukraine? Don’t hesitate to contact us! We provide legal support even for complicated processes in Ukraine.

Didn’t find an answer to your question?

See detailed information about the procedure for obtaining a TIN in Ukraine here.

A full list of services provided by our company to foreign nationals here.

Our clients