Registering a Startup as a Diia.City Resident: Steps to Success with Our Legal Support

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Ukraine is considered one of the promising countries for business development in the field of information technology. To support this development, several initiatives have been introduced in our country, among which the key one is the Diia.City residency program. Today, registering startups as residents of Diia.City has become a strategic move for many young companies aiming to realize their potential and gain competitive advantages in the market.

Our recent client from Uzhhorod, who had just registered a company, deemed it necessary to promptly apply for residency. He entrusted this task to us, knowing that we have been providing quality and reliable legal support for IT companies for many years and have an impeccable reputation. Thus, using this case as an example, we will discuss the benefits of obtaining Diia.City resident status for a startup, what to consider when applying for residency, and how to choose a tax regime.

Benefits of Diia.City Residency for Startups: Special Conditions and Reduced Financial Burden

So, why was this decision truly beneficial for our client? By registering the startup as a Diia.City resident, the company has the opportunity to leverage numerous benefits aimed at supporting its development and reducing the financial burden. So, what are the benefits of Diia.City residency for startups? What should young companies pay attention to? Startups face fewer requirements to obtain Diia.City resident status:

- They are allowed to have fewer than 9 IT specialists.

- A lower average salary level is permitted compared to that set for "full" Diia.City residents, which is from 1200 euros.

However, it's important to note that if a company acquires residency as a startup in 2024, it must meet the requirements for the number of employees and average salary by December 31, 2025. Another advantage is the opportunity to almost immediately, from the beginning of the next quarter after the company's registration, take advantage of a special tax regime aimed at reducing the financial burden on IT businesses, provided that an application is submitted to the tax authorities. This will significantly reduce the company's financial expenses.

You may also like: Booking Military Obligated Employees: Opportunities for Diia.City Residents

What is Required to Register a Startup as a Diia.City Resident?

The first step we took with our client was to determine whether their newly established company meets the requirements of Diia.City. Initially, we needed to verify the types of activities the company plans to engage in the future. The client intended to engage in activities such as developing computer games, and other software, and activities in the field of information technology and computer systems. These activities fully comply with the requirements of the law. It is also worth noting that there are restrictions on the annual revenue for startups, which should not exceed 1167 minimum salaries (as of April 1, 2024 – 9,336,000 UAH). In our case, this was not a problem because the company had just been established, and there were no revenues as of the date of the application.

To optimize the process of applying for residency status in Diia.City, we opted for the electronic application form. Therefore, the next step we recommended to the client was to obtain an electronic digital signature. This is not only for the convenience of conducting business in the future but also because since the application is submitted electronically, it needs to be signed with an electronic signature. In this case, the signature of the director as a natural person is not suitable. It must be the signature of the director as the representative of the legal entity.

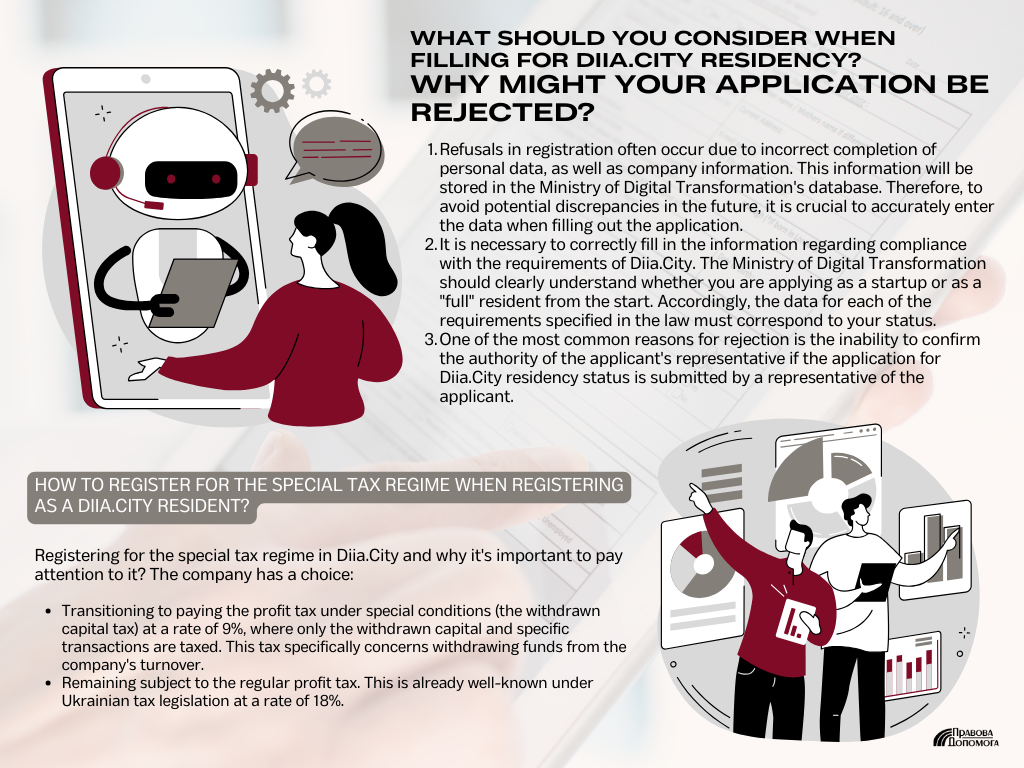

What should you consider when filling for Diia.City residency? Why might your application be rejected?

Our client relied entirely on us throughout this process, understanding the risks involved – the possibility of receiving a rejection from the Ministry of Digital Transformation. This could result in wasted time and disruption to the company's plans. So, why might you face rejection when applying for residency status in Diia.City?

Refusals in registration often occur due to incorrect completion of personal data, as well as company information. This information will be stored in the Ministry of Digital Transformation's database. Therefore, to avoid potential discrepancies in the future, it is crucial to accurately enter the data when filling out the application.

It is necessary to correctly fill in the information regarding compliance with the requirements of Diia.City. The Ministry of Digital Transformation should clearly understand whether you are applying as a startup or as a "full" resident from the start. Accordingly, the data for each of the requirements specified in the law must correspond to your status.

One of the most common reasons for rejection is the inability to confirm the authority of the applicant's representative if the application for Diia.City residency status is submitted by a representative of the applicant.

In this case, we offered the client a foolproof option: submitting the application electronically on their behalf as the director of the company, with electronic signature confirmation, as described earlier.

You may also like: Full Resident of Diia.City or Startup: What to Choose?

How to register for the special tax regime when registering as a Diia.City resident?

Registering for the special tax regime in Diia.City and why it's important to pay attention to it? The company has a choice:

- Transitioning to paying the profit tax under special conditions (the withdrawn capital tax) at a rate of 9%, where only the withdrawn capital and specific transactions are taxed. This tax specifically concerns withdrawing funds from the company's turnover.

- Remaining subject to the regular profit tax. This is already well-known under Ukrainian tax legislation at a rate of 18%.

After analyzing the specifics of our client's business activities, we recommended switching to the special tax regime. This means that the funds reinvested in the business are not subject to taxation. This incentivizes investment and business development. For example, if an investor chooses not to receive funds earned by a Ukrainian company in the form of dividends and invests them in other Ukrainian projects, they will not pay corporate tax.

Furthermore, according to Ukrainian tax and labor legislation, a full-time employee working under an employment contract pays 18% personal income tax (PIT), 22% unified social contribution (USC) based on the minimum wage, and 1.5% military fee. The total tax burden seems quite significant, so to encourage employment in Diia.City, their employees will pay reduced tax rates, including 5% PIT + 22% USC based on the minimum wage and 1.5% military fee.

We advised our client on all the possible advantages and risks of both tax systems and recommended the Diia.City regime, with which they wholeheartedly agreed. Therefore, our next step was to transition our client's company to the special tax regime. When filling out the application to obtain the status, the system immediately offers simultaneous completion of the application and submission to the tax authorities, which we took advantage of. The next step was awaiting decisions:

- From the Ministry of Digital Transformation — regarding residency;

- From the tax authorities — regarding the change in the tax system.

Although the Ministry's document review period is up to 10 business days, we received a decision on the successful acquisition of the status and inclusion of the company in the Registry the next day, indicating the correct completion of the application and the company's full compliance with all the requirements for obtaining the status.

We had to wait for the tax authorities. This is due to the 15 business days processing time for this application and the heavy workload of the tax authorities. But despite the waiting time, we also received a positive decision from the tax authorities, leading to the successful operation of our client's company under the chosen regime. We warned that the special tax regime is established from the beginning of the next quarter in accordance with Ukrainian legislation. This allowed them to protect themselves from financial risks.

Useful Information: We invite you to review our presentation for Diia.City residents

Obtaining Diia.City resident status for your startup: Legal Assistance

Registering your startup as a Diia.City resident is a significant step towards its future success and growth. Opting for the special tax regime offers substantial benefits, including reduced tax obligations and incentives for business expansion. Becoming a Diia.City resident opens up numerous opportunities for development, enhancing your company's competitiveness in both domestic and international markets.

If you require assistance in obtaining Diia.City residency and addressing other legal matters, we are here to help. Our team of experts is ready to provide comprehensive support and guidance at every stage of this important process. Our services include:

- Consultations on obtaining Diia.City resident status

- Guidance on taxation for Diia.City residents

- Completion of the application for Diia.City resident status

- Assistance in compiling the necessary document package for Diia.City residency

- Consultations on employee recruitment, working with individual entrepreneurs (FLP), and gig contracts

- Preparation of gig contract templates, and more

Don't delay – reach out to us today, and let us assist you in achieving your business goals efficiently and profitably. You can call our toll-free number at 0 800 201 809 or submit a consultation request through the "Request a Call" button. We look forward to hearing from you!

Our clients