Legal advice on taxation and optimal form of business conduction

Cost of services

Reviews of our Clients

What we offer

- perform analysis of the documents and situation of a foreign Client;

- consult on types of taxes in Ukraine and advise the Client on the best option for taxation;

- work through all possible legal and financial risks on the basis of the Client’s data in regards to financial operations;

- provide assistance in tax planning taking into account the types of activities of the Client;

- help to get VAT, single tax or to stay on the general taxation system.

For tax advice is necessary

Service packages offers

- Consulting on taxation in Ukraine for individuals and legal entities

- Legal analysis of the execution of individual transactions and business schemes of Clients in order to identify possible tax risks

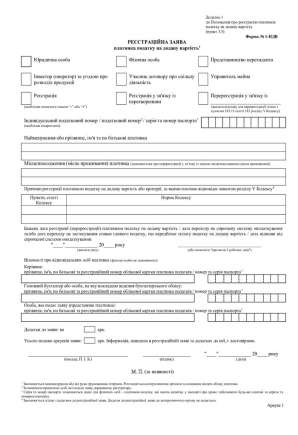

- Consulting on accounting in tax authorities and filing tax and statistical reports

- Consulting on taxation of activities of foreign missions

- Legal analysis of the execution of individual transactions and business schemes of Clients in order to identify possible tax risks, as well as checking the accounting of business transactions in order to minimize the tax burden

- Keeping records in tax authorities and filing tax and statistical reports

- Development of individual documents on economic activities, taking into account their tax consequences

- Preparation of reasonable requests to regulatory authorities and providing responses to them

- Legal analysis of the execution of individual transactions and business models of Clients in order to identify possible tax risks, as well as checking the accounting of business transactions in order to minimize the tax burden

- Development of optimal business schemes taking into account tax consequences (tax planning of operations)

- Development of individual documents on economic activities, taking into account their tax consequences

- Accompanying the Client in legal relations with tax authorities (preparation of justified requests to regulatory authorities and providing answers to them, support of tax audits)

- Resolving tax disputes of any complexity (appealing tax notices-decisions, representing the Client in litigation)

Legal advice on business taxation in Ukraine

Consultation of a lawyer on taxation will be useful for everyone who has a business in Ukraine. At such a consultation you can ask all your questions to a specialist and he will answer them clearly and thoroughly. For You, as a Client, the advantage is that You get only useful information, not just a formal quotation of the laws.

What you get by ordering legal advice on taxation:

-

Preliminary analysis of your activities and recommendations for setting up your business based on this.

-

An opportunity to choose the optimal system of taxation to reduce the burden on your business.

-

Calculation of possible risks and assistance in avoiding problems with the tax authorities.

The cost of legal advice on taxation may vary according to the assigned task and the initial data. The minimum cost of an introductory consultation is 5000 UAH. Based on the results of the work, we provide an accurate calculation of the time spent on each step. If you order the service from us, its price will include the cost of introductory consultation.

We offer legal assistance to foreign companies not only at the start of their activities in Ukraine, but also in the process of business development.

Our offer of cooperation for foreign Сlients.

Why us

Our clients

Legal advice on taxation lookup

The question of optimal form of doing business in Ukraine and its optimized taxation is important for any entrepreneur, both resident and non-resident. However, for non-residents, this theme is especially important and require consideration, since their activities inside the territory of Ukraine create a number of special conditions and opportunities, which are not always applied to the residents.

This situation is associated with specific legal requirements in respect of doing business inside the territory of Ukraine, and in addition, there are many international agreements, the provisions of which should be taken into consideration when choosing the optimal tax optimization scheme. The right choice of the form of doing business and the form of its taxation is one of the key factors that affects the efficiency of your business.

Our firm provides tax consulting services both for individual operations and for business tax optimization in general. An additional point is that we will help you to choose the best and most effective type of legal entity for your business, and we will also register it in accordance with the requirements of legislation.

Both businessmen carrying out their activities inside the territory of Ukraine and international companies with interests in Ukraine are our Clients for this type of services.

Answers to frequently asked questions

What taxation system will be the best suitable for an enterprise providing services with a turnover of up to UAH 4 million per year?

It is important to be acquainted with the details before providing recommendations. Generally, in the case when the enterprise specializes in provision of services inside the territory of Ukraine and has a small amount of expenses, as a rule, it would be appropriate to choose a single tax and pay 5% from the amount of income. As a result, the tax amount will be up to UAH 200,000/per year.

Is it necessary to record securities transactions in income tax declaration?

In accounting, securities are recognized as financial investments or financial assets intended for resale. Accordingly, you need to record these transactions in declaration if the investment income (the fact of asset sale) was received during the accounting period.