How to Safely Take Money Out of Ukraine: What You Risk for Non-Declaration

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Declaring cash at the border is an important safeguard that protects both travelers and businesses from problems with customs. The €10,000 limit, set by Ukrainian law and widely used around the world, acts as a basic financial security threshold. If you’re carrying more than that, you must declare it. If you don’t, customs can treat it as a violation, which may result in fines or even confiscation of your money.

Cash declaration helps ensure transparency in the movement of funds and confirms the legal origin of the money. For travelers, it reduces the risk of unwarranted suspicion; for entrepreneurs, it creates a legal pathway to move capital abroad for investments, business operations, or purchases.

The topic is becoming increasingly relevant. Many people transport cash to open foreign bank accounts, buy property, support relatives, or fund business expansion abroad — yet many are still unfamiliar with customs requirements.

In this article, we break down when you must declare cash, what documents customs officers may request, when money can be seized, and what steps to take if that happens. We explain everything the same way we do for our clients, clearly, practically, and without unnecessary complexity.

You might also like: Comparison of Cash Declaration Rules in Ukraine and the EU

When You Need to Declare Cash

Under the Customs Code of Ukraine and NBU Regulation No. 3 dated January 2, 2019, any individual may bring into or take out of Ukraine up to €10,000 in cash (or the equivalent in another currency) without having to submit a written declaration.

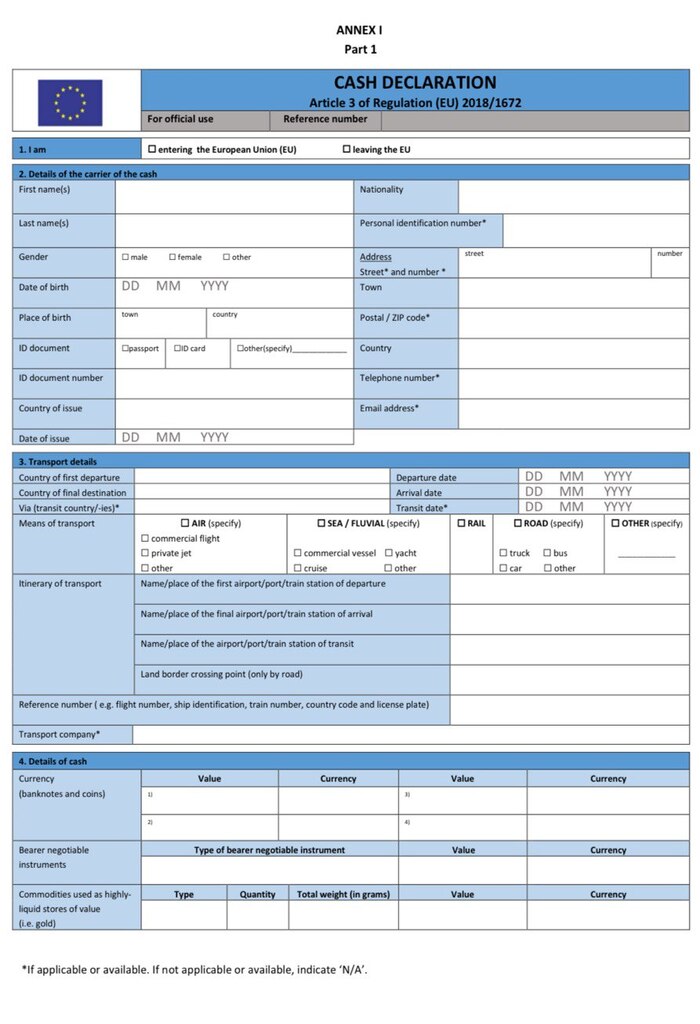

If the amount is €10,000 or more, even by a few euros, it must be declared in writing by completing a customs declaration when crossing the border. This document requires you to provide:

- the exact amount of cash you are carrying;

- your personal information;

- the origin of the funds, along with supporting documents if necessary, such as bank statements, withdrawal receipts, or sale and purchase agreements.

It is important to understand that customs officers are allowed to request proof of the lawful origin of your funds. If you cannot provide such documentation, or if the documents raise doubts, customs may prepare a report on a violation of customs regulations.

Even if you are fully confident in the legality of your income, correctly declaring your cash is a reliable way to protect yourself, avoid misunderstandings, and pass customs without complications.

Liability for Not Declaring Cash

The rules for declaring cash are regulated by Article 471 of the Customs Code of Ukraine, which defines the penalties for failing to declare currency valuables when crossing the border. The law treats this as a situation where a traveler does not provide accurate and truthful information about the funds they are carrying into or out of the country, even if the omission was unintentional. This can happen, for example, when someone chooses the green corridor.

What Article 471 of the Customs Code of Ukraine Says

According to part one of Article 471:

Failing to declare currency valuables that exceed the amount permitted for movement without declaration, which is €10,000, results in a fine equal to 20 percent of the amount that exceeds this limit. The calculation is based on the official NBU exchange rate on the day the violation occurred.

For example, if a person is carrying €15,000 and does not submit a declaration, the excess is €5,000. The fine is calculated from that amount, which means 20%, or about €1,000.

In practice, customs officers may temporarily seize the cash while they clarify the circumstances. In some cases, the court may order the confiscation of undeclared funds if it finds that the person acted intentionally or attempted to evade customs control.

Not declaring cash is an administrative offense that carries significant financial penalties. This is why anyone planning to cross the border with a large amount of money should prepare the declaration and proof of the funds’ origin in advance. Doing so helps avoid fines, legal expenses, and the risk of losing your money.

You might also like: How to Declare Cash When Traveling Across Multiple Countries

When Cash Can Be Seized at the Border

As mentioned earlier, customs authorities have the right to seize cash. This can happen in the following situations:

- The amount exceeds €10,000 and no written declaration was submitted.

- There are no documents confirming the legal origin of the funds, such as bank statements, withdrawal receipts, or sale and purchase agreements.

- Customs officers detect an attempt to hide the cash, for example, in luggage, clothing, hidden compartments of a suitcase, or inside a vehicle.

- There is suspicion that the funds may have an illegal origin or could be connected to prohibited activities.

In these situations, customs prepares a report on a customs violation and temporarily seizes the cash until the circumstances are clarified.

What to Do if Customs Seizes Your Cash

If your cash has been seized, the most important thing is to stay calm and act step by step. Do not argue with customs officers or refuse to sign the report. However, you should read it carefully before signing. Make sure the document includes your correct personal information, the exact amount of money, the currency, and the place and time of the incident. Always request a copy of the report, since it will be essential for protecting your rights later.

Your next step is to contact a lawyer who specializes in customs matters. A legal expert will help you prepare written explanations, prove the lawful origin of the funds, and file a complaint if the seizure was improper. If your funds were obtained legally and the failure to declare them happened due to a misunderstanding or a technical mistake, there is a strong chance of recovering the full amount without confiscation.

Please note: the seizure of cash is a temporary measure and not a final decision on confiscation. Your main task is to gather all documents that confirm the legal origin of the money and work with an experienced lawyer who can defend your interests and help you get your funds back through the proper legal process.

Successful case: Legal Transfer of Funds Abroad and Remote Account Opening in the EU

How to Avoid Penalties: Legal Support

To avoid fines and issues with customs authorities, it is important to prepare your documents in advance and understand the legal requirements for declaring cash. In practice, even a small mistake or the absence of proof showing the legal origin of the funds can become grounds for a report, a seizure of cash, or even a court case.

Violations most often occur when a person does not know what amount must be declared, how to complete the documents correctly, or what types of proof of origin are accepted by customs. This is why it is essential not to rely on guesswork and instead consult specialists who understand the Customs Code and have experience with customs inspections.

Our legal team will assist you in the following ways:

- preparing for crossing the border, reviewing limits, currency, and documents to eliminate the risk of non-declaration;

- completing the customs declaration and assembling proof of the funds’ origin in accordance with the Customs Code of Ukraine;

- protecting your rights if a customs violation is alleged.

Consulting with our lawyers is the most reliable way to avoid misunderstandings and financial losses. We know exactly how to proceed so that your money remains secure and you can cross the border confidently and legally.

Write to us or call, and we will help you pass customs control without stress, fines, or loss of funds.

Our clients