What to do with the company's property during its liquidation?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

When conducting business activities in Ukraine, entrepreneurs may encounter the need to dissolve their companies. The reasons for dissolution may vary, but the procedural steps generally follow a consistent pattern.

Company liquidation is a complex process. In this article, we will elaborate on the steps for liquidating assets held on the company's balance sheet. This pertains to both real estate and various types of equipment. The liquidation procedure cannot proceed without completing this step.

In the liquidation phase, the ownership rights to the assets of the LLC transfer from the legal entity to the individual founders who participated in the establishment of the company's charter capital.

We assist our clients in ensuring that this transition occurs as smoothly as possible, mitigating the risk of conflicts or legal disputes. Our approach adheres to legal frameworks, and we carefully select the appropriate course of action.

You may also like: Change of Director in an LLC with Debts

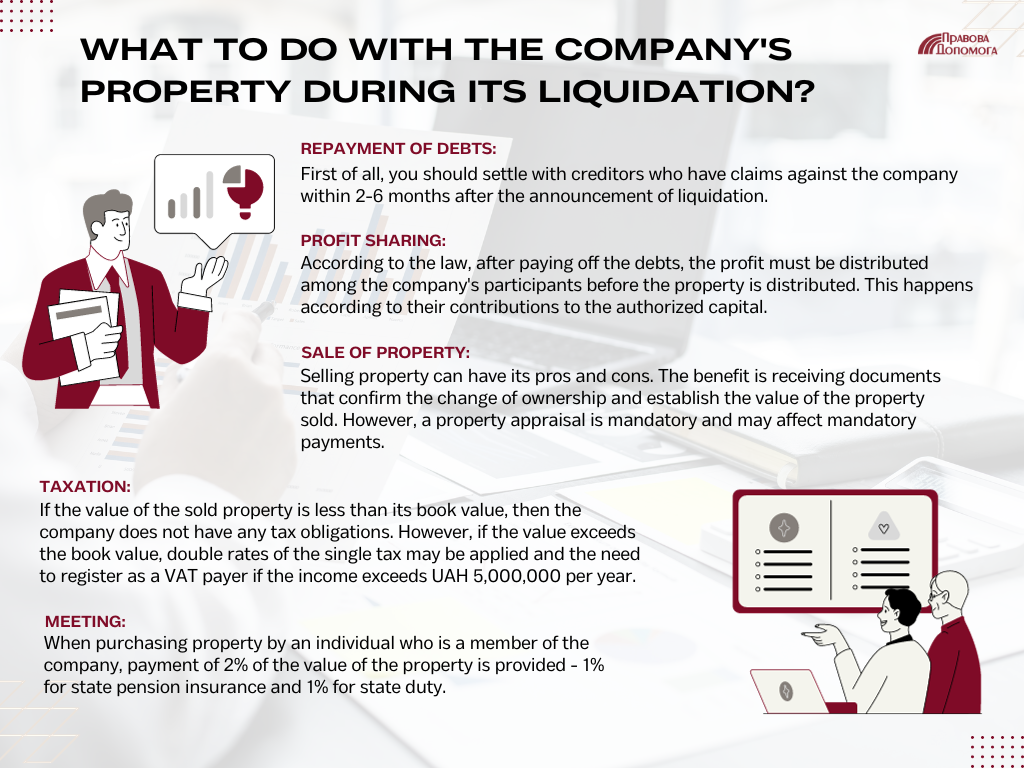

Initial Steps: Settling Debts and Distributing Assets

The first crucial step is to settle any outstanding debts within the LLC. As per current legal regulations, once the registrar marks the beginning of the liquidation process in the Unified State Register, creditors have a window of at least 2 months and a maximum of 6 months to submit their claims.

It's important to adhere to this timeframe and handle the claims methodically to ensure a successful liquidation process and attain the desired outcome at the end.

Under the legal framework, it is necessary to distribute the earned profits among the LLC members. Only after this distribution can the process of asset division begin, taking into account the size of their contributions, which represents a specific share of the authorized capital.

Please note! You can receive your share in both cash or in kind. Property is allocated proportionally among the members, corresponding to their respective stakes in the authorized capital. If the assets are in kind, they are initially sold, and the proceeds are subsequently distributed among the founders based on the size of their shares.

The advantages of selling assets include obtaining documentation that confirms the change of ownership and establishes the value of the sold assets.

The disadvantages include the requirement for a mandatory asset assessment, which determines the amount of mandatory payments. If, at the time of selling the assets, more than 12 months have passed since the official commencement of their operation, and the value stated in the sales contract, as confirmed by the assessment, is equal to or less than the asset's book value, no income needs to be taxed within the company for this transaction.

If the value exceeds the book value, this difference becomes income for the company. If the total income for the calendar year exceeds 5,000,000 hryvnias, a double rate of the unified tax must be applied to the excess amount, and the company must also register as a VAT taxpayer within the timeframe specified by the law.

Furthermore, when an individual member of the company acquires assets, they will be required to pay 2% of the asset's value, which includes a 1% state pension insurance fee and a 1% state duty.

The seller is either the liquidator or the head of the liquidation commission.

The sale of equipment or raw materials and products is conducted through purchase and sale agreements.

You may also like: A Step-by-Step Guide to Company Liquidation

Is it possible to gift a company's assets?

Considering the option of transferring assets through a gift agreement is questionable, as it runs counter to the objective of profit generation and lacks documented confirmation of the asset's value. This would immediately draw the attention of tax authorities.

It's essential to note that the individual member of the company receiving the gift must treat it as income and pay a personal income tax at a rate of 18%, along with a 1.5% military fee based on the asset's value.

Furthermore, after the Gift Agreement is signed, it's necessary to decide to reduce the company's charter capital (by the value of the gifted asset) and formally record this in the Register and the financial statements of the company.

We thoroughly assess the client's situation and offer the most suitable approach for liquidation in their specific circumstances. We aim to find ways to minimize potential risks for shareholders and company leadership while also helping with tax optimization, which provides an opportunity to mitigate risks not only during the liquidation process but also after its completion.

Our company's team not only prepares all the necessary documentation but also manages the entire company liquidation process. We offer the services of a trusted notary and oversee every stage.

Didn’t find an answer to your question?

Our clients