How a Foreign Citizen Can Obtain or Restore a Tax Identification Number (TIN) in Ukraine

Cost of services:

Reviews of our Clients

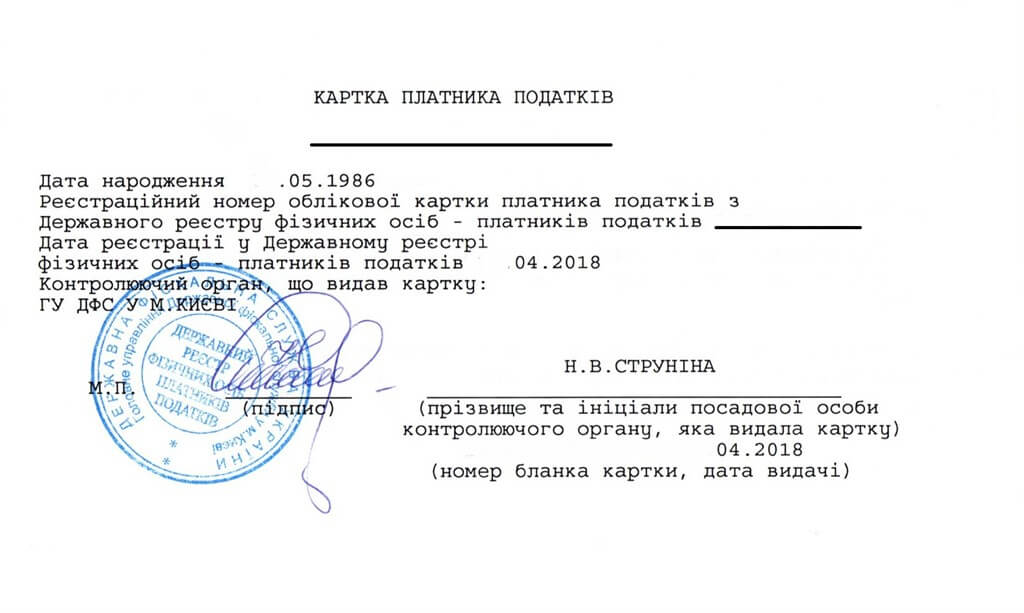

In Ukraine, any individual, including a foreign national, who plans to carry out financial or legal transactions must obtain a Tax Identification Number. In Ukrainian legislation, this is known as the RNOKPP (registration number of the taxpayer’s record), and in English it is commonly referred to as a TIN (Tax Identification Number).

However, if you are outside Ukraine, completing this procedure on your own can be challenging. The tax authorities require a correctly formatted power of attorney, flawless notarized translations, and, in practice, the requirements often vary from region to region. As a result, what should be a straightforward process frequently turns into months of delays due to seemingly minor technical issues.

Our team has many years of experience assisting foreign nationals with the remote issuance and restoration of TINs in Ukraine. We are familiar with the practical pitfalls that are rarely mentioned in official guidelines. That is why this article provides a detailed overview of all possible scenarios for obtaining a TIN and, most importantly, highlights the common mistakes that most often lead to refusals.

You might also like: Immigration Lawyer in Ukraine: When You Need One and How They Can Help

Why a Foreigner Needs a TIN in Ukraine

A tax identification number is required not only for investment purposes but also in any situation where you plan to:

- obtain official employment and receive salary payments;

- open a bank account;

- start a business, register a company, or register as a sole proprietor;

- conduct real estate transactions, including purchasing or selling property, or entering into an inheritance;

- enter into contracts;

- carry out transactions that involve the payment of taxes.

Documents Required for a Foreigner to Obtain a TIN

The procedure depends on where you are located and whether you have residence documents in Ukraine. Below, we review several common scenarios.

Scenario 1. The foreigner is in Ukraine and holds a residence permit

This is the simplest option. To obtain a tax identification number, a minimal set of documents is required:

- a taxpayer registration card (application form);

- passport;

- permanent or temporary residence permit in Ukraine.

Scenario 2. The foreigner is in Ukraine but does not have a residence permit

In this case, one of two options is available:

- submit the taxpayer registration card (application) in person together with the original passport and its notarized Ukrainian translation;

- issue a power of attorney to a representative who will submit the taxpayer registration card (application) on behalf of the foreign national, along with a notarized copy of the passport and its Ukrainian translation.

Scenario 3. The foreigner is outside Ukraine (maximum control required)

Documents in Ukraine may be submitted only by a representative acting under a power of attorney. This option requires strict legal compliance:

- issue a power of attorney and notarize a copy of the passport. Where required, complete legalization or apostille;

- arrange notarized Ukrainian translations of the passport and power of attorney in Ukraine;

- submit the taxpayer registration card (application) and notarized translations of all documents on behalf of the foreign national.

Where to Submit Documents to Obtain an RNOKPP (TIN)

Foreign nationals may obtain a taxpayer identification card (TIN) either at their place of registration or at their place of actual stay in Ukraine. The complete set of documents must be submitted to a Taxpayer Service Center of the State Tax Service of Ukraine.

Fees and Processing Time for Obtaining a TIN for a Foreigner

No administrative fee or state duty is charged for issuing a tax identification number (TIN) to a foreign national. This service is free of charge. The processing time for issuing an RNOKPP is up to three business days.

You might also like: How a Foreigner Can Move to Ukraine: Legalizing Your Stay

How Can a Foreigner Restore a Lost Tax Identification Number?

If a tax identification number has been lost, the foreign national or their authorized representative acting under a power of attorney must submit an application using Form 5-DR to obtain the TIN again. The RNOKPP is reissued, but the identification number itself remains unchanged.

Common Mistakes When Applying for a TIN

Obtaining or restoring a TIN for a foreign national in Ukraine is generally a fast process, provided the documents are prepared correctly. Most issues arise due to the following mistakes:

- Incorrect translation of the passport or power of attorney. If documents are issued in a foreign language, the translation must be notarized.

- Missing entry or exit stamps in the passport. If the foreign national applies in person or if the power of attorney is issued in Ukraine, copies of passport pages showing entry and exit stamps must be included. These stamps confirm the foreigner’s lawful stay in Ukraine.

- Lack of legalization of documents issued abroad. If there is no bilateral agreement between Ukraine and the foreign state, the documents must be either legalized or apostilled. An apostille is sufficient for countries that are parties to the Hague Convention.

- An improperly drafted power of attorney. The power of attorney must clearly specify the actions it authorizes, such as “submission of documents for obtaining an RNOKPP,” and indicate the relevant authority, namely the State Tax Service. A power of attorney issued abroad usually requires notarization and, depending on the country, an apostille or legalization. A Ukrainian translation is also required.

Expert Support for Obtaining a Tax Identification Number (TIN)

In practice, it is often the small details, such as document translations, the wording of a power of attorney, or the specific requirements of a local tax office, that cause delays or, worse, refusals to issue a TIN to a foreign national. This is especially true when the applicant is outside Ukraine and applies through a representative under a notarized power of attorney.

If you need to obtain a tax identification number and want to avoid wasting time and money on correcting documents, we take full responsibility for the process:

- prepare and review the complete set of documents, including those issued abroad;

- provide power of attorney templates that are accepted by the State Tax Service;

- arrange certified legal translations;

- submit the documents, monitor the process, and deliver the issued TIN to you or your representative.

We work with clients both in Ukraine and abroad, helping foreign nationals obtain or restore a tax identification number without stress or repeated submissions.

If you need a TIN quickly and with a guaranteed result, contact our specialists. Your time is valuable, and it should not be put at risk.

Our clients