How to open a business incubator in Ukraine in 2023?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Start-up is one of the most popular designations of recently created innovative companies. Creating an idea for a business is not an easy task. But getting that idea to market and creating a profitable business is even harder.

Very often we hear the expression "startup gone bad." Why? The reason is not necessarily the imperfection of the idea or the belief in it on the part of the founding team. As a rule, the problem comes down to:

- Lack of experience in starting a business;

- Lack of the right community;

- Inability to communicate with investors;

- Lack of funding.

The founders can present the MVP perfectly, but the lack of arguments about the financial attractiveness of the project will not allow them to get funding.

Business incubators are created specifically to support startups. Business incubators are very popular abroad. Recently this direction has started to develop actively in Ukraine as well.

You may also like: Software Rights for an IT Startup in Ukraine.

What is a business incubator?

A business incubator is a type of business (usually non-profit) that helps startups with the creation and promotion of an idea from its development stage and pre-seed funding stage.

Note. Business accelerators are another source of support for entrepreneurs. These are companies that help existing businesses to eliminate problems/gaps and bring the business to a new level of development and profitability.

A business incubator by its nature is an organization or a structure that provides the financial, informational, consulting and other support of startups. The principal advantage of cooperation with a business incubator is that a newcomer entrepreneur minimizes the organizational and management expenses, and also time expenditures, getting a possibility to concentrate on implementation of an innovation idea.

As a rule, business incubators conduct competitions among startups, according to which results the selected projects get the corresponding support. However, there are structures which do not raise any special requirements for startups that are based on innovation ideas. The only rule is the understanding of the mechanism of implementation of a promising idea.

According to results of competition or consideration of application, an agreement is concluded for placing a project in a business incubator. In fact, in accordance with which, certain services are provided for a startup, including:

- providing office rooms, and if necessary, production facilities;

- consulting services in the matters of creation, functioning, reorganization and liquidation of business entities, and also taxation, accounting, crediting, legal protection and further development of the firm, planning the economic activity, skill improvement and training, and other services provided by officers of a business incubator;

- access to information resources and databases;

- postal and secretarial services;

- assistance in selection of the needed premises after expiration of lease period.

As a rule, in case a business entity complies with terms and conditions of the lease agreement, such services are provided by a business incubator free of charge.

In fact, in exchange for their services, business incubators mostly get a certain share in the authorized capital of the startup, and that condition is essential for getting support.

What kind of assistance do business incubators provide?

Each business incubator independently determines the list of services that the company will provide to startups. Predominantly such services include (but are not limited to):

- Providing co-working zones for free or on a rental basis at below-market prices;

- Providing consulting services (product management, marketing, legal, accounting and financial services);

- Mentorship;

- Assistance in finding an appropriate community to share knowledge and experience;

- Providing use of the Fab lab;

- Conducting business training, seminars, and workshops;

- Assistance in finding investors and attracting investments.

The main goal of a business incubator is to support and promote startups. Statistics on the development of small businesses indicate that among newly created companies (in the first 2-3 years of their existence) about 20% stay in operation.

However, among the companies supported by business incubators, almost 85% of the businesses survive. At first glance, it seems that a business incubator is a free business school that will create a hothouse environment for you and help you create a profitable business. But it's not that simple. Each business incubator develops its own terms of membership and services, which have its own price.

These terms of cooperation include (but are not limited to):

- transfer of the business share to the incubator (investor);

- transfer to the incubator (investor) of the right to a patent (in whole or in part) for the startup's technology;

- sale of the business to the investor;

- after the business incubator leaves the company, the latter pays the indexed % for the services provided.

These and other conditions should be discussed in detail and set out in the agreement. Our lawyers can assist you in drafting a cooperation agreement with business incubator members.

The development of high-tech innovation and talent in the country promotes:

- investment attractiveness;

- export of domestic goods/services;

- creation of new jobs.

You may also like: Taxation of Diia City Residents: What Taxes Will IT Companies Pay in Ukraine?

How to register a business incubator, its requirements

When setting up a business incubator, you must have:

- The premises (owned or rented);

- Consultants and mentors;

- A training base;

- Meeting rooms;

- Equipped lecture/training rooms.

When registering a business incubator, one usually chooses the following business structures:

- Public associations (public organization or union);

- A foreign representative office;

- LLC, sole proprietorship.

The business structure depends on the following factors:

- the goals of the business incubator;

- ways and means of financing;

- availability/absence of own equipment and premises;

- taxes;

- other factors.

Depending on the goals and model of your business incubator, it can be a profitable or non-profitable organization.

At this point, the tax forecasting concept comes into play. Here are several possible options for the operation of a business incubator.

Option 1: A non-profitable Ukrainian business incubator

In this case, the business incubator is not aimed at making a profit, and therefore:

- this company is registered in the form of a public association;

- the business incubator receives a status of non-profitability;

- the incubator is financed by donations and charitable contributions;

- the incubator's expenses are aimed only at achieving the statutory goal.

Option 2. A profitable Ukrainian business incubator

In this case, the business incubator aims to make a profit, and therefore:

- this company is registered in the form of an LLC or sole proprietorship;

- the company is registered as a taxpayer under the simplified system (single tax 5% or 3%+20% VAT) or under the general system of taxation (income tax 18% +20% VAT/without VAT);

- the incubator is financed from the income received from consulting, legal, accounting services/rent of the incubator's premises/other related business;

- the incubator's expenses are limited to the performance of business activities only.

Option 3. Business incubator through a foreign representative office

When a foreign business incubator plans to open a representative office in Ukraine, it is necessary to:

- register a permanent representative office;

- the company shall be registered as an income tax payer (18% +20% VAT/without VAT);

- The incubator is financed from the income received from consulting, legal, accounting services/rent of the premises/other related business/funds of the parent company;

- the incubator's expenses are limited to the execution of business activities only.

Option 4. A non-profit Ukrainian business incubator plans to make a profit in order to allocate it further to the organization's goals

A public organization with the status of a legal entity has the right to receive income (from the sale of services or goods). However, this income must be aimed at achieving the statutory goals.

Please note! The cost of services or goods sold by a non-profit NGO must be lower than the market price.

Otherwise, the organization may lose the status of non-profit and will have to pay income tax according to the general rules (18% income tax on the amount of income). For example, if the profit received will be distributed among the founders or the price for goods was higher than the market price.

In this case, the business incubator is registered according to the following procedure:

- the company shall be registered in the form of a public association;

- the business incubator obtains a non-profit status;

- the incubator is financed by donations/charitable contributions, income from services/sales of goods;

- the incubator's expenses are aimed at achieving the statutory goal only.

Before registering a company, our specialists conduct an initial consultation with the owner. This allows us to choose the most optimal business incubator structure.

Accounting of a business incubator is carried out in accordance with the chosen legal form (public association, foreign representative office, or LLC/sole proprietorship).

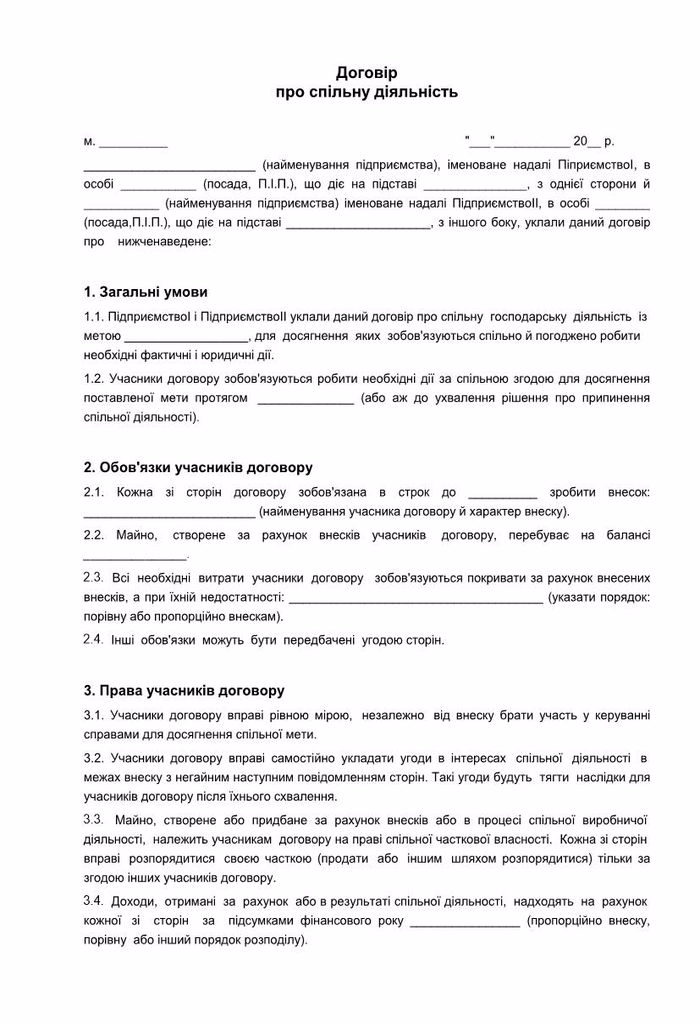

It is crucial for a business incubator to have the right legal framework for cooperation with the incubator's residents. It is the partnership agreement that defines the rules of "who owes what to whom".

If you want to know more about your opportunities and obligations when starting a business incubator, please contact our experts.

Our clients