How to get an international grant for a Ukrainian public organization?

Cost of services:

Reviews of our Clients

The procedure for obtaining any grant requires meticulous preparation, from crafting the project idea to documenting its financial feasibility.

When it comes to international grants, additional conditions come into play, with an expanded set of requirements that grantees must meet. Each grantor establishes their own project selection criteria.

In this article, we'll delve into the key commonly accepted requirements for nonprofit organizations seeking international grants.

International organizations place considerable emphasis on the following aspects during competitive procedures:

- Competence of nonprofit organization leaders and project managers.

- Financial justification of the project budget.

- Track record of the nonprofit organization in executing similar projects.

- Internal governance and control mechanisms of the nonprofit organization.

- Adherence to legal norms and transparent accounting practices.

Let's explore each of these aspects in detail.

The policy of the public organization for obtaining international grants

Many organizations tend to overlook the importance of developing internal policies, considering it a time-consuming task without much value.

First and foremost, internal policies define the rules and principles governing the organization's work and provide a framework for monitoring and decision-making. If not explicitly outlined in the organization's bylaws, these policies should address the following:

- Methods and strategies for achieving the organization's goals.

- Structured and organized activities to ensure efficiency.

- Control mechanisms to track progress and address any deviations.

International organizations funding grants want to ensure that their resources are entrusted to organizations that demonstrate the following:

- Effective financial management, avoiding unnecessary expenses.

- Accountability for the outcomes and impact of their activities.

- Compliance with legal regulations without attempting to bypass them.

- A commitment to ethical practices, avoiding fraud and corruption.

- Transparent and understandable operations.

In essence, by examining an organization's bylaws and policies, potential donors seek answers to key questions:

- What is the organization's core mission and activities?

- How does the organization approach its work to achieve desired results?

- How is the organization's performance monitored and controlled?

- Who is responsible for delivering results and being accountable?

If you're planning to secure funding from international sources, it's important to give attention to developing organizational policies.

While there are various policies to consider, some key ones for a nonprofit organization include:

- Accounting Policy: Establishing rules and standards for financial record-keeping and reporting.

- Financial Management Policy: Outlining strategies for budgeting, planning, and financial control within the organization.

- HR Policy: Defining principles for recruitment, personnel management, and improving employee performance.

- Anti-Corruption Policy: Setting forth guidelines and measures to prevent corruption in organizational activities.

- Privacy Policy: Ensuring the proper collection, processing, and safeguarding of confidential data.

- Payment Procedure Policy: Establishing protocols for approving and executing payments.

- Asset Management Policy: Establishing guidelines for managing and controlling organizational assets.

- Procurement Policy: Defining procedures and criteria for conducting procurement activities and tendering.

- Travel Policy: Providing guidelines for travel arrangements and reporting requirements.

- Document Management Policy: Outlining procedures for efficient document handling, storage, and retention.

- Personal Data Processing Policy: Defining principles and responsibilities for processing, accessing, and using personal data while ensuring compliance with privacy regulations.

- Others.

If you prefer not to invest your own time in developing these policies, our specialists are here to assist you. With our expertise and knowledge of the specific focus areas of government bodies and international partners, we can help you craft policies that align with your objectives and lead to desired outcomes.

You may also like: How will NGOs in Ukraine work with volunteers, especially foreigners?

Adherence to Legal Norms and Transparency in Accounting for Nonprofit Organizations

When a grant provider considers a candidate for funding, they want assurance that the organization:

- Maintains accurate and proper accounting practices.

- Fully complies with tax obligations to the country's budget.

- Ensures that funding is not involved in fraudulent schemes.

During the grant application process, international grant providers may seek clarification on the following:

- How does the organization handle its accounting practices: through an accounting system or manual record-keeping?

- What specific accounting system is utilized? What financial documents and registers are employed for manual record-keeping?

- How are primary documents and financial reports stored, and for what duration?

- What methods of control does the organization employ?

- Who assumes responsibility for accounting errors?

The rules and principles governing the accounting practices of a nonprofit organization are outlined in the Accounting Policy.

If you have concerns about the effectiveness of accounting procedures within your nonprofit organization, feel free to contact us.

Our experts can conduct an audit of your organization's activities, develop an accounting policy, and assist in streamlining financial processes.

You may also like: Financial Reporting for Public Organizations in Ukraine: How to Receive Funding?

Official employment of NGO leaders, project managers, accountants, and project workers.

One of the key factors considered is the proper filling of job positions and the accurate payment of taxes to the budget by the employees. However, this criterion often raises concerns and questions among non-governmental organization leaders.

Let's address some of the main inquiries:

- What documents are required when hiring an employee?

The essential documents include a staff schedule, employee application, employment contract, hiring order, and job description (if the specific role is not explicitly mentioned in the employment contract).

- Is it necessary to sign additional documents with the employee to confirm work completion?

The completion of assigned tasks and responsibilities is considered sufficient proof of the employee's work performance. While there is no legislative obligation to sign additional documents, you may choose to implement internal reports to track monthly or weekly work outcomes.

Please note! Non-governmental organizations are obligated to maintain personnel time records. This is documented in a timesheet, which serves as the basis for salary calculations.

- What should be done with hired employees once a project and its funding come to an end?

For employees specifically hired for a particular project, a fixed-term employment contract is established. This contract includes information about the project, its duration, and the employee's role. Once the employment contract expires, the working relationship between the public organization and the hired employee is terminated, unless stated otherwise in the contract.

- Can employees be paid the minimum wage?

According to current legislation, it is mandatory to calculate and pay salaries to personnel not lower than the minimum wage (as of January 1, 2023, it amounts to 6700.00 UAH).

However, we recommend setting wages at a competitive market rate for employees.

- How should labor costs be allocated between projects if an employee is working on two simultaneous projects?

In such cases, it is advisable to establish separate wage rates for the employee on each project, as outlined in the Order determining the wage rate. Consequently, labor costs are distributed between the two projects per the specified order.

When assisting our clients in grant applications, we thoroughly assess both financial reports and the organizational capacity of the human resources department. In some instances, we even offer comprehensive support by managing all types of reporting for public organizations during and after the utilization of grant funds.

You may also like: Cash Transactions in Nonprofit Organizations: How to Record Cash Receipts on the Organization's Balance Sheet?

Internal Control of a Non-Governmental Organization in Grant Acquisition

Grantors attach significant importance to the internal control practices implemented by non-governmental organizations when receiving grants. They closely examine how the organization manages its activities and finances, who is responsible for oversight, and the timelines involved.

Please note! It is essential for a non-governmental organization to have designated individuals responsible for the following:

- Managing the bank account (approving payments, monitoring fund balances, reconciling bank records with the accounting system).

- Reviewing and approving expenditures (ensuring the appropriateness of expenses and adherence to the budget).

- Preparing financial reports for project financing.

- Managing assets.

- Recording business transactions and submitting reports.

Effective financial planning and budgeting serve as the cornerstone of efficient financial management and control. These principles provide organizational leaders and teams with a clear understanding of the feasibility of their ideas, financial prospects, and expenditure limits. The principles of planning and budgeting are outlined in the Financial Management Policy.

When applying for financial support, including grants, it is crucial to include a comprehensive financial model or project budget as part of the application package.

Grantors thoroughly evaluate the financial model or project budget to ensure its alignment with realistic expectations and to prevent overestimating the funding request.

Each project's budget is meticulously crafted, providing a detailed breakdown of expenditure categories.

Please note! Once funding is secured based on an approved budget, the non-governmental organization must strictly adhere to the budgeted allocations. Any changes in expenditure categories require prior approval from the grantor.

We are here to assist you in developing a well-structured budget and establishing robust mechanisms to monitor compliance with the budgeted expenses.

You may also like: How to Prepare an Annual Report for a Charitable Foundation in Ukraine?

Does work experience and collaboration with other organizations have an impact on the grant committee's decision?

Typically, grant applications include a section where you need to provide a list of past projects and organizations that the non-governmental organization has collaborated with.

One common mistake made by many organizations is to "exaggerate" their achievements. Why is this a mistake? The information you provide undergoes thorough analysis and verification by the grantor. The grantor not only checks public sources but also reaches out to the organizations you have worked with to gather recommendations.

Engaging qualified accounting and legal support reduces the risk of facing rejections from grantors.

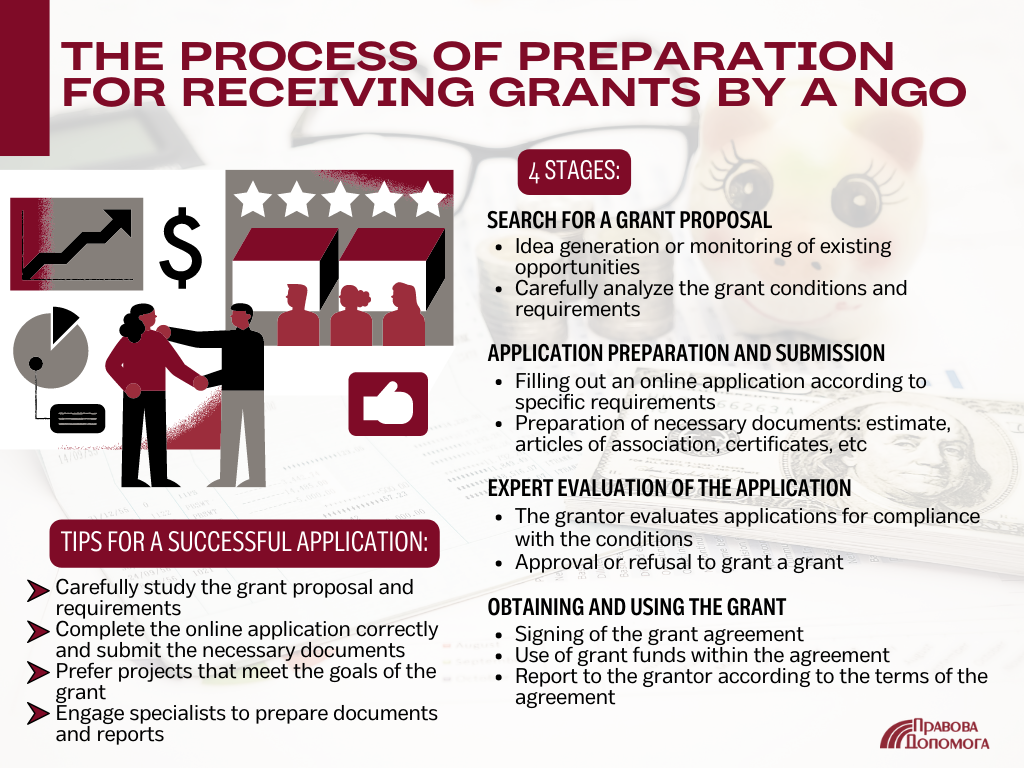

The procedure of preparing to acquire a grant for a non-governmental organization

The process of preparing to acquire a grant can be divided into several stages:

- Finding grant opportunities

- Preparation and submission of a grant application

- Получение гранта и отчетности по результатам работы (в случае согласования грантовой заявки).

Stage 1: Finding grant opportunities

There are several ways to search for grant opportunities:

- The non-governmental organization generates an idea and seeks funding to bring it to life.

- The non-governmental organization actively monitors grant offerings and explores ways to integrate them into its activities.

Each grant has its own unique characteristics and collaboration requirements. The key factors to consider when selecting a grant competition are:

- Project and sector alignment: Determine if the grant supports projects in your specific field and if your project aligns with its focus area.

- Organizational eligibility: Check the criteria to see which types of organizations are allowed to participate in the competition.

- Participant requirements: Review the specific requirements for participants, such as the need for non-profit status or a track record of similar projects in the past two years.

- Grant amount and disbursement terms: Consider the grant amount and how it will be disbursed. For example, some grants may be given in multiple installments, while others provide the full amount upfront.

- Covered and non-covered expenses: Understand what expenses the grant will fund and what costs you will be responsible for. For instance, the grant may cover equipment purchases, but your project focuses on raising public awareness.

- Project timeframe: Take note of the project's timeline and any associated deadlines.

Once you have identified the most promising grant opportunity, you can proceed to the next stage.

Stage 2: Preparation and submission of the grant application

The grant application for participating in the competition is provided by the grant organizers, typically through an online platform.

Note: Each grant provider has its own unique application form and set of questions.

Commonly encountered questions in grant applications (not limited to) include:

- Project title

- Legal name and address of the applying organization

- The legal status of the organization

- Contact details of the representative for the grant competition

- Organization's website

- Project Idea

- Issues that the project aims to address

- Experience in similar project implementation

- Target audience to be reached

- Previous partnerships and collaborations

- Implementation plan for the project and potential partners involved

- Project's strengths and weaknesses

- Existing projects currently being implemented

- Collaborations with international organizations.

The grant application must be accompanied by the following documents (not limited to):

- Project budget or cost estimate

- Organizational founding documents (copies of the charter, certificate of state registration as a non-profit organization, decision on inclusion in the registry of non-profit entities)

- Statement of open bank accounts

- Documentation related to the official employment of the organization's director (appointment order, employment contract)

- Internal organizational policies

- Standard document templates for working with suppliers and contractors (contracts, invoices, service delivery reports, expense statements, etc.)

- Copy of the latest audit report (if available)

- Copies of annual tax and financial reports for the past three years

- Annual report (descriptive report on the organization's activities).

Once the application, along with the required documents, is submitted, it undergoes an evaluation process by the grant provider within the specified timeframe outlined in the grant program. Based on the evaluation results, the application may be approved or rejected.

If the application is approved, the non-governmental organization proceeds to the next stage.

Stage 3: Receiving the grant and reporting on results

The final phase of the grant competition program involves the signing of the grant agreement. Once the grant is awarded, the non-governmental organization commits to:

- Utilizing the funds strictly per the terms of the grant agreement.

- Providing regular reports to the grant provider, following the specified conditions and reporting format outlined in the agreement.

- Adhering to the terms and conditions of the agreement

Typically, the grant competition program lasts approximately 2 to 3.5 months, as determined by the grant providers:

- 1 to 1.5 months: Allotted time for non-governmental organizations to prepare and submit their applications.

- 1 to 2 months: Evaluation period during which experts assess the submitted applications.

It is advisable to enlist the services of a knowledgeable lawyer and accountant. They can help:

- Save time by assisting with document preparation.

- Identify any potential errors, inaccuracies, or areas for optimization, etc.

- Adequately prepare for both the grant receipt and the management of grant funds.

If you are considering participating in a grant program and are seeking grant funding, don't hesitate to contact us. We will assess your specific situation and provide you with the most suitable collaboration options.

Our clients