What documents are required upon liquidation of a representative office?

Cost of services:

Reviews of our Clients

Liquidation of a representative office is a complex and lengthy procedure, during which it is necessary not only to develop a package of documents that will comply with current legislation, but also to repeatedly visit state authorities. And the main problem is not that it is quite difficult to figure it out on your own, but rather that the procedure requires concentration and organization of a large number of parallel processes, which without technical knowledge will take up a lot of time, effort and nerves.

In this article we shall review all the liquidation processes based on our practice and extensive work experience and tell you how we can simplify your life and help you to liquidate your representative office quickly and legally.

The main liquidation stages of the representative office of a foreign company in Ukraine

The most common reason for terminating the representative office of a foreign company is the liquidation of the representative office by the decision of the foreign legal entity.

In general, the procedure of representative office liquidation consists of the following stages:

- A decision is made to terminate the representative office (according to the form corresponding to the legislation of the country where the parent company is registered). The decision appoints a liquidator or liquidation committee and a deadline for filing creditors’ claims.

- The next step is to notify the Ministry of Economy of the liquidation of the representative office.

- Then we proceed to the dismissal of employees of the representative office in accordance with the legislation of Ukraine.

- At the same time one shall close all bank accounts.

- Then comes the inventory of the property of the representative office.

- Preparation and passing of inspections in the tax office, obtaining a certificate with the subsequent de-registration.

- Collection of debts from debtors and settlement with creditors, payment of fines.

- Return to the Ministry of Economic Development and Trade of service cards of foreign employees, the certificate of registration of the representative office.

- Transferring the documents of the representative office to the archive.

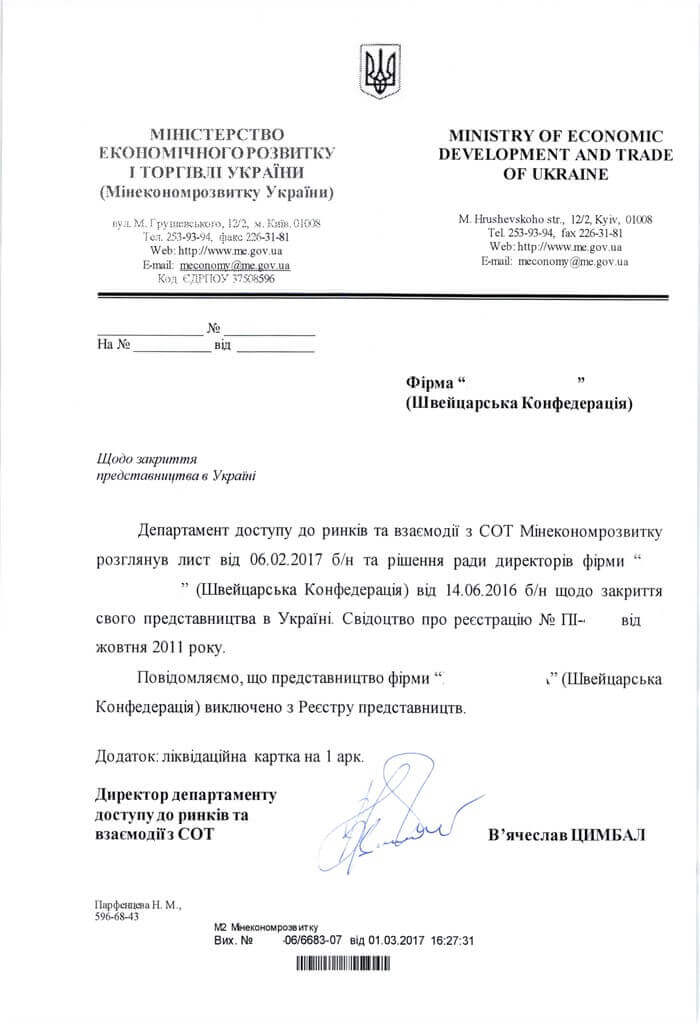

- Receiving the decision of the Ministry of Economic Development and Trade to cancel the registration record in the register of representative offices.

- Deletion from the register with the statistics agency (submit a special form).

- Destruction of seals and representation stamps.

Please note! Liquidation is considered to be successful after cancellation of the registration in the register of representative offices.

You may also like: Liquidation of a Representative Office of a Foreign Company: Procedure and Documents

What documents must be prepared for liquidation of a representative office?

Since the procedure for liquidating a representative office is quite a lengthy process, you will need to prepare the following documents in advance:

- Original certificate of registration of the representative office (issued by the Ministry of Economy during registration, i.e. you must have it for the time of liquidation);

- The decision of the parent company to terminate the representative office;

- Power of attorney from the parent company granting authority to terminate (liquidate) the representative office.

Our lawyers will help you prepare the correct text of the decision and power of attorney. You will not need to have the necessary documents edited, properly attested or apostilled several times.

The following documents are also needed:

- Certificate of registration in the Register of Enterprises and Organizations (Certificate of Statistics);

- Certificate of registration as a taxpayer (Form 34-ОПП or 4-ОПП);

- Notification of registration as a payer of the unified social contribution;

The above documents are provided in the process of registering a representative office at the beginning of operation.

- Consulate’s accounting documents for the entire period of operation.

We will control everything and fully prepare the necessary documents for inspection by the tax authorities of Ukraine. If necessary, we will help with the analysis of fines, accruals, penalties, which are caused by improper accounting, failure to submit statements. Our specialists will consider possible options for resolving such situations.

You may also like: Liquidation of a Representative Office of a Foreign Company: FAQs

What option for liquidating a company can I choose in 2022?

The best option, given the complexity of the procedure, is turnkey liquidation of the representative office of a foreign company.

You may also choose an additional option. The liquidator is the head of the representative office. If a foreigner does not want to stay in Ukraine until the procedure is completed or to deal with sending documents from abroad, he/she can be replaced by our head even before the liquidation of the representative office. This ensures that there is no need to provide explanations and applications to state authorities.

Our specialists will not only make a preliminary analysis of the company’s activities, but also will prepare the necessary documents, will help to pass inspections with controlling bodies and will accompany all events related to liquidation of the representative office, until the procedure is completed successfully.

Didn’t find an answer to your question?

Everything about the liquidation of the representative office of a foreign company in Ukraine here.

Our clients