Liquidation Of A Foreign Company Representative Office: Frequently Asked Questions

Cost of services:

Reviews of our Clients

Termination of a foreign company representative office is a long and multi-step procedure, which we described in detail in one of our previous publications.

Today we will fully explore the topic and provide answers to frequently asked questions of our Сlients.

How long does the liquidation procedure take?

You can wait months for the tax inspection appointment. Especially if you do not persistently draw attention to yourself.

The main mistake is just to wait until everything will work itself out. If you don’t have the opportunity to constantly monitor the work of the authority and communicate with representatives of the tax authorities, it’s better to contact qualified lawyers. This will significantly save your time.

If wages and taxes were duly paid, and all reports were submitted in good faith and in time, the tax inspection will take about ten days.

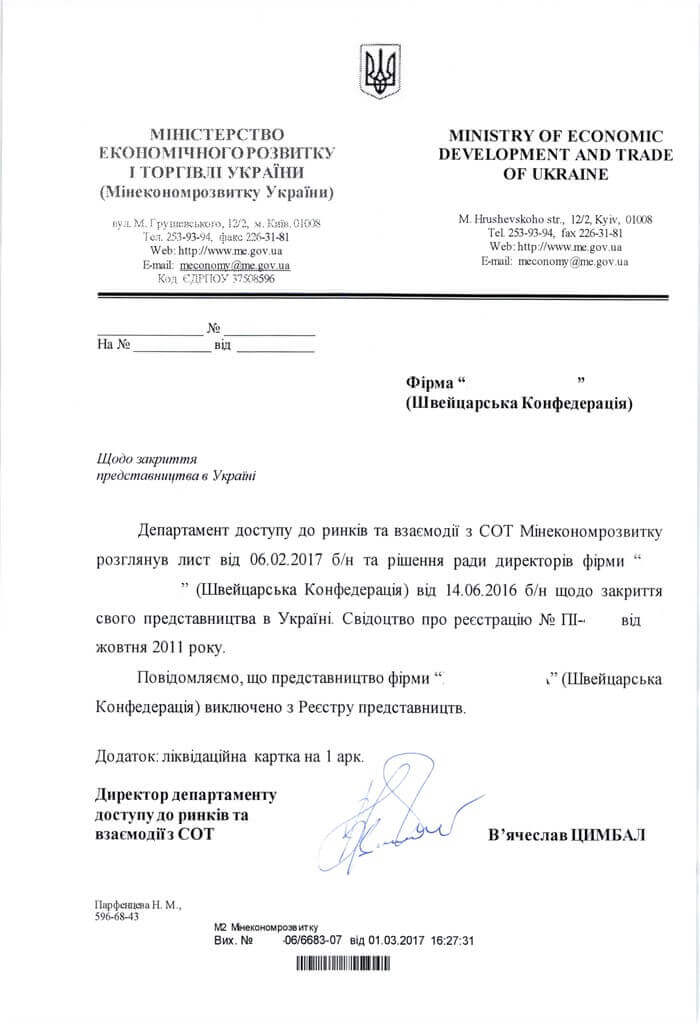

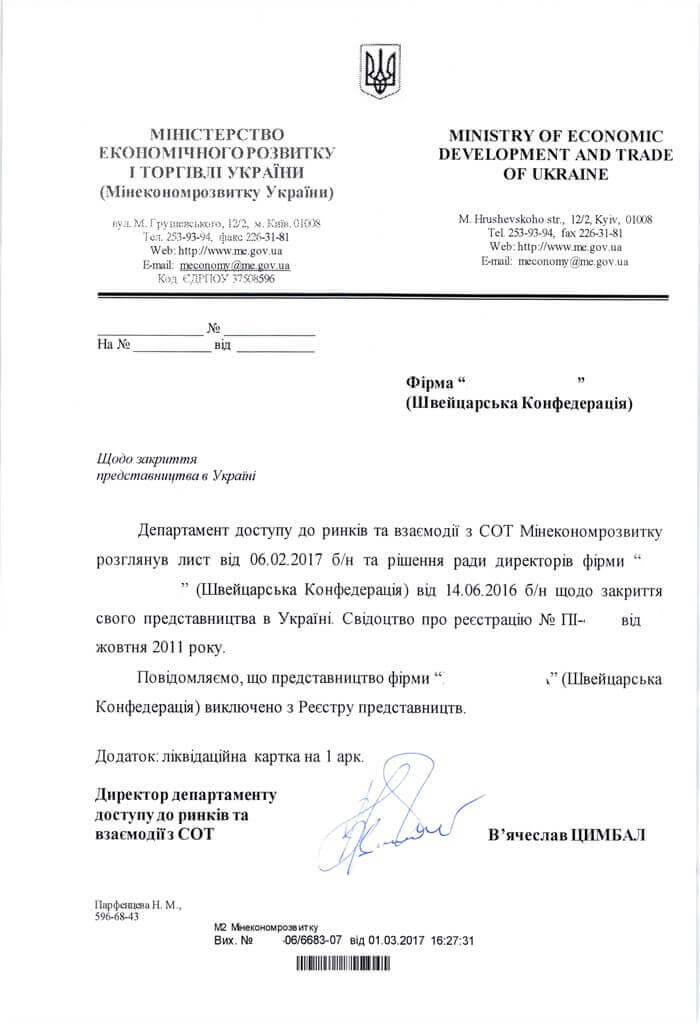

After removal from the register of the State Tax Service of Ukraine, the next stage is the removal from the register of the Ministry of Economic Development and Trade, which considers the documents within one month.

You can’t undergo the de-registration procedure at the State Tax Service and the Ministry of Economic Development and Trade simultaneously, because the documents to be submitted to the Ministry of Economic Development and Trade include also a certificate of withdrawal of registration at the State Tax Service.

To complete the procedure, you also need to obtain a certificate of withdrawal of registration at the State Statistics Service of Ukraine.

On average, the liquidation procedure of a representative office in Ukraine lasts for a year and a half.

Related article: Liquidation Of A Representative Office In 8 Months

Liquidation of a representative office without debts: Will it speed up the process?

Unfortunately, this fact does not affect the speed of the tax inspection appointment. The absence of debts and ordered source documentation can only ensure “painless” inspection.

Liquidation of a representative without activity and without employees.

As in the previous case, this will reduce the workload of the inspectors, but will not speed up the inspection appointment. In addition, it does not affect the process of removal from the register of the Customs and the Ministry of Economic Development and Trade.

Can a representative office be liquidated without inspection?

No. Even if the representative office is non-commercial, the activities were not conducted and all reports were duly submitted, inspection will still take place. It can just be quite formal.

The confirmation that there are no claims to the representative office is a certificate of absence of debts and withdrawal of registration. Without it, the Ministry of Economic Development and Trade will not even accept the documents for termination of the representative office.

Related article: Liquidation Of A Representative Office Of The Cyprus Company

Can the Ukrainian state authorities refuse to liquidate a representative office of a foreign company?

In Ukraine there is no such notion as refusal to terminate (liquidate) business. But if the documents were executed inappropriately, they will simply remain without consideration and the liquidation procedure will not begin.

If there is nothing wrong with the documents submitted for initiation of liquidation, but the inspection revealed the presence of debts - the representative office has time to pay them before the end of the inspection. The tax inspection lasts 10 days, and for large taxpayers the inspection period may be extended up to 15 days.

Therefore, if during this time the debt is not repaid, the inspector will write an inspection report and indicate the debt found. In this case, the representative office will not be removed from the register. It will remain under termination and the procedure may be suspended for a long time.

An endless liquidation procedure can only be avoided if:

- You prepare all the documents in advance and make sure that they are properly executed;

- You keep in constant contact with the state authorities, monitoring the status of your case.

If you want to safely liquidate a representative office of a foreign company in the shortest possible time, don’t hesitate to call us.