Required Documents for Opening a Company in Ukraine as a Foreigner in 2026

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Opening a company in Ukraine in 2026 remains an attractive option for foreign investors, business owners, and entrepreneurs seeking access to new markets, a highly skilled workforce, flexible corporate legislation, and opportunities linked to post-war reconstruction. The government continues to align the business environment with international standards, simplify registration procedures, and digitalize interaction with public authorities. Nevertheless, for non-residents, the process remains legally and procedurally complex.

Despite the formal simplicity of Ukrainian corporate law, foreign founders often face a number of practical questions:

- which documents are legally recognized in Ukraine;

- how foreign documents must be properly legalized;

- how to obtain a Ukrainian tax identification number;

- whether a foreign national can be appointed as director from the outset;

- without which documents registration is impossible.

Any mistake at the initial stage, whether in document legalization, certified translations, or ownership structure, can lead to significant delays, repeated submissions, loss of time, and even refusal of state registration. In some cases, errors may also result in a bank refusing to open an account for a company that has already been registered.

That is why, in this article, drawing on our practical experience supporting foreign clients, we outline the document package required for a foreign national to open a company in Ukraine in 2026, taking into account the current practice of state registrars and the requirements applicable during wartime. We also explain which legal form is more suitable, a limited liability company or a representative office, how to address the appointment of a foreign director, and which seemingly minor documentation errors most often lead to refusals.

You might also like: How Can Foreign Companies Obtain a Construction Permit in Ukraine

Which Legal Form Should a Foreigner Choose: LLC vs Representative Office

Ukrainian legislation does not restrict foreigners from doing business in the country. A foreign individual or a foreign legal entity may act as a founder of a company in almost any legal form. In practice, however, not all options are equally convenient or efficient.

Limited Liability Company (LLC): The Investment Standard

A limited liability company is the most popular and practical form for foreigners starting a business in Ukraine. Its key advantages include:

- a foreign individual or legal entity may act as the sole founder;

- no minimum share capital requirements;

- 100 percent foreign ownership is permitted;

- a foreign national may be appointed as director;

- a simple management structure;

- a clear and predictable registration and tax framework.

In 2026, this legal form remains the most stable and foreseeable option for foreign investors entering the Ukrainian market.

Representative Office of a Foreign Company: Higher Risks

This option, establishing a representative office of a foreign company in Ukraine, is chosen far less often due to its legal and tax complexities. Key considerations include:

- it is not a separate legal entity but a structural subdivision of the parent company;

- the registration procedure is more complex;

- it is subject to strict tax oversight and more frequent audits by tax authorities.

Other legal forms, such as joint stock companies or alternative corporate structures, are used much less frequently and typically only for large scale investment projects. For most foreign founders, these options are unnecessarily complex and financially impractical at the initial stage.

Mandatory Documents for Opening a Company in Ukraine as a Foreigner

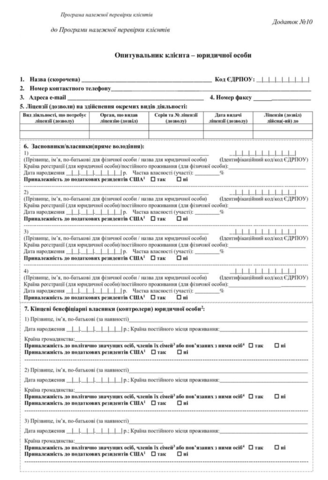

The required document set depends on whether the founder is an individual or a legal entity. However, there is a core package without which state registration of a company is not possible. So, which documents does a foreign national need to prepare to open an LLC in Ukraine?

Option A. Founder Is an Individual (Foreign National)

- An international passport, together with a notarized Ukrainian translation of the passport.

- A Ukrainian tax identification number (RNOKPP). Obtaining a tax number is mandatory regardless of whether the foreign national will also be appointed as the company’s director.

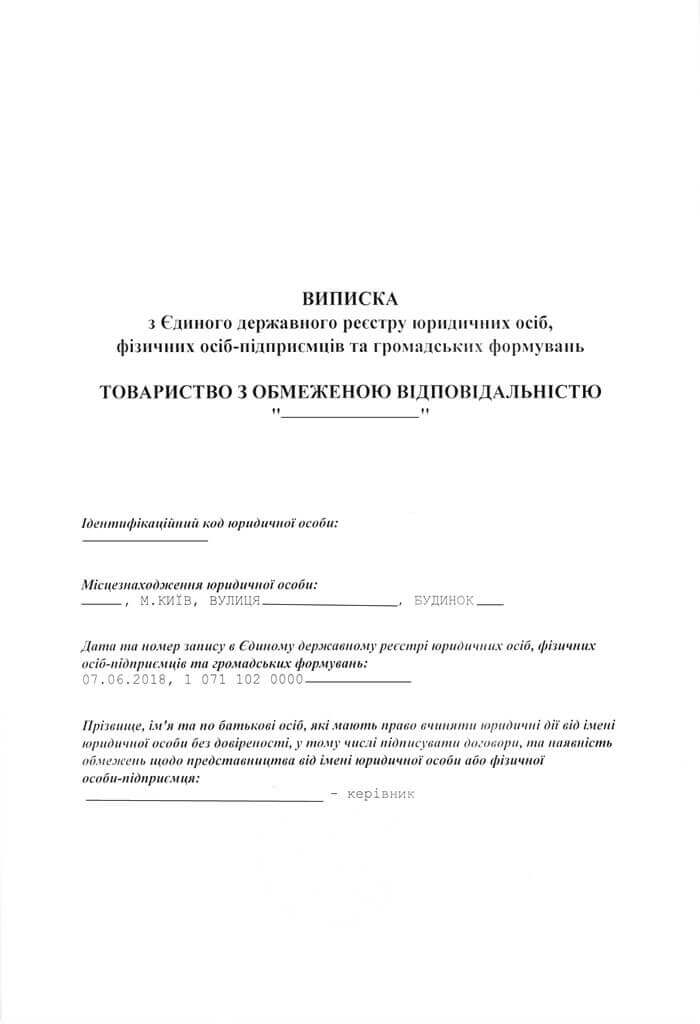

Option B. Founder Is a Foreign Company (Legal Entity)

In this case, the document list is broader and all foreign documents must be properly legalized (apostille/ consular legalization):

- An extract from the commercial or corporate register of the country of incorporation.

- Constitutive documents of the foreign company indicating its shareholders and their ownership interests.

- Passports of the beneficial owners of the foreign company, together with notarized Ukrainian translations.

Documents for the Ukrainian company:

- A decision to establish the company, executed as a written decision of the sole shareholder or as minutes of a shareholders’ meeting.

- The company’s charter, notarized in Ukraine.

- An application for state registration of the company.

- Documents confirming the ownership structure.

- A power of attorney for filing documents, if applicable.

- Personal details of the company’s director.

You might also like: How a Foreigner Can Obtain or Restore a Tax Identification Number (TIN) in Ukraine

Legalization of Foreign Documents for Opening a Company in Ukraine

One of the main practical challenges foreigners face when opening a business in Ukraine is document legalization. This is the stage where delays and refusals most often occur, even when all other registration requirements are met. The reason is straightforward: for Ukrainian public authorities, a foreign document has no legal force until its origin and validity are properly confirmed.

The method of legalization depends on the country where the document was issued. In most cases, this involves affixing an apostille in accordance with the Hague Convention. It is important to note that an apostille can only be issued in the country of origin of the document, not in Ukraine. In addition, an apostille confirms the authenticity of the signature and the authority of the issuing official, but it does not eliminate other requirements, such as the validity and up-to-date status of the document itself.

If a document is issued in a country that is not a party to the Hague Convention, consular legalization is required. This is a more complex procedure that involves several levels of certification, including legalization through a Ukrainian consulate.

Translation is another critical aspect. All documents submitted for state registration must be in Ukrainian, and even minor inaccuracies in the transliteration of a person’s name or a company’s name may result in the registration being suspended. In practice, we frequently encounter situations where documents are formally legalized but cannot be used due to translation errors and must be corrected before submission.

Foreign Director: Key Considerations

A foreign national is legally permitted to hold the position of director of a Ukrainian company, but this is also where most legal misunderstandings arise. Many foreign founders mistakenly assume that once the company is registered, they can immediately begin performing director-level duties. In reality, Ukrainian law draws a clear distinction between formal appointment and the legal right to engage in employment activities.

A foreign national may be listed as a director in the company’s registration details, but may begin performing managerial functions only after obtaining a work permit for foreign nationals. This permit serves as the legal basis for employment and for subsequently applying for a temporary residence permit in Ukraine. Until these documents are obtained, actual management of the business may be regarded as a violation of migration and labor regulations.

In practice, companies often use an interim solution. After incorporation, a temporary director who is a Ukrainian citizen or another authorized individual is appointed to represent the company during the period required to process the foreign national’s documents. In parallel, the work permit is obtained, after which the director is officially replaced without interrupting the company’s operations.

Common Mistakes Foreigners Make When Opening a Company in Ukraine

Despite the relative accessibility of business registration in Ukraine, foreign founders often encounter issues that delay the process or create legal risks after the company has already been established. These problems usually stem from a lack of upfront planning and a misunderstanding of Ukrainian regulatory requirements.

Based on our practical experience, we have identified the most common critical mistakes:

1. Identification issues (ID and bank compliance)

One of the most frequent problems is errors in translations. Inconsistent transliteration of a person’s name across the passport, tax identification number, and incorporation documents may seem minor, but for state registrars and banks it is a formal ground to suspend the procedure. Over time, such discrepancies complicate bank account opening, director replacement, and even the sale of the business.

2. Migration restrictions

Foreigners often overlook migration requirements for directors. A company may be registered and a director formally appointed, but without a valid work permit the director cannot legally manage the business, sign documents, or reside in Ukraine lawfully.

3. Formal deficiencies in documentation

Based on our practice, the following issues most often jeopardize registration:

- improper or missing legalization of foreign documents;

- attempts to avoid obtaining a Ukrainian tax identification number;

- submission of outdated extracts from foreign corporate registers;

- incorrect disclosure of ownership structure;

- appointment of a foreign director without a work permit;

- Cost-cutting on legal support that ultimately results in repeated registration procedures.

The consequences of such mistakes go far beyond mere bureaucratic delays. They include the direct loss of valuable investment time, additional costs for reprocessing and legalizing documents abroad, and the risk of a complete refusal of state registration. In the worst case, bank accounts of an already established company may be blocked due to non-compliance with banking and compliance procedures.

You do not have to navigate this complex process alone through trial and error. The safest approach is to delegate it to professionals who understand the internal workings of the Ukrainian registration system and can secure a successful outcome on the first attempt.

You might also like: Migration Lawyer in Ukraine: When You Need One and How They Can Help

End-to-End Legal Support for Opening a Company in Ukraine as a Foreigner

We work with foreign nationals and foreign companies entering the Ukrainian market through a full scope, end-to-end legal support model. Our goal is not simply to register a company, but to build a stable, compliant, and business-friendly structure from the outset. Our legal team:

- analyzes the client’s situation and selects the optimal business structure;

- prepares the complete set of documents;

- organizes document legalization and translations;

- obtains a Ukrainian tax identification number for a foreigner;

- completes state registration of the company;

- supports the employment of a foreign director;

- provides post-registration advice on tax and corporate matters.

We value your time, which is why we offer the option to open a company entirely remotely. By issuing a power of attorney to our lawyers, you avoid the need to plan complex travel or visits to Ukrainian notaries or tax offices. This authorization allows us to act as your legal representatives at every stage while you remain in your home country, including company registration, obtaining the tax identification number, and completing related formalities. It is the most convenient solution for investors who want to launch a business quickly and without unnecessary logistical costs.

If your objective is to establish a company in Ukraine within tight timelines and with full confidence in the accuracy of the documentation, contact us. Our team will deliver a result you can rely on.

Our clients