Preparing Documents on the Origin of Funds: How to Take Cash Abroad Without Confiscation

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Crossing the border with a large amount of cash is always stressful, especially today, when financial monitoring rules are becoming stricter not only in Ukraine but also across the EU.

Many people mistakenly believe that simply declaring the amount is sufficient. In reality, without proper supporting documents, customs authorities have the right to detain the funds and, in some cases, confiscate them. Moreover, even if the money is successfully taken abroad, a European bank may refuse to credit it to an account if there is no clear and transparent explanation of the source of funds.

In this article, based on practical experience in supporting cross-border cash transportation, we explain how to prepare the necessary documents and what to pay special attention to in order to pass customs control calmly and legally.

You might also like: Comparison of Cash Declaration Rules in Ukraine and the EU

When Is a Written Cash Declaration Mandatory?

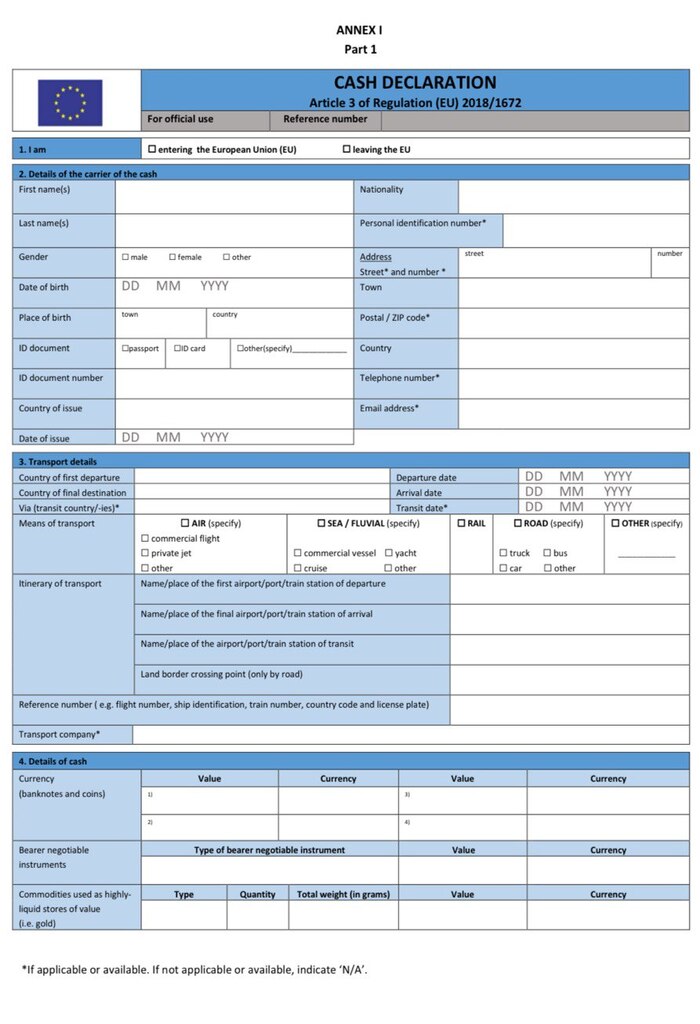

The rule is straightforward. If the amount of cash you are carrying, in foreign currency or hryvnia, is equal to or exceeds EUR 10,000 (or its equivalent) per person, you are required to:

- Complete a customs declaration.

- Provide documents confirming the withdrawal of these funds from bank accounts.

Please note: The EUR 10,000 threshold applies to each individual separately, including minor children. However, proof of the source of funds is required for the entire amount exceeding the limit.

Documents Required to Confirm the Source of Funds When Crossing the Border

It is important to understand that simply presenting a property sale agreement or a salary certificate covering several years is not sufficient for transporting cash across the border.

To move an amount exceeding EUR 10,000, the documents must confirm either the withdrawal of cash by an individual from their own bank accounts or the execution of a currency exchange transaction, if applicable.

The following documents are accepted as proof of the lawful origin of funds:

- Cash withdrawal payment order if the funds were withdrawn through a bank cashier.

- ATM receipt and or payment terminal receipt, card slip and or cash withdrawal receipt if the cash was withdrawn using payment devices, including ATMs or payment terminals.

- Bank account statement showing the movement of funds, which is mandatory.

- Receipt confirming a currency exchange transaction or a transaction involving the purchase of bank metals with physical delivery, if such operations were carried out through a bank.

Each document must be provided as an original or a certified copy, contain your personal details, and clearly indicate the amount involved.

You might also like: How to Declare Funds When Traveling Abroad as a Family

Document Requirements and Validity Periods

Most problems at the border arise not from unlawful intent, but from a lack of awareness of critical rules. Each document you present must clearly confirm the amount of cash being declared and explain its source. Any errors, inconsistencies, or incomplete information may serve as grounds for refusal to allow the funds to be taken across the border.

A key point is that bank certificates and withdrawal documents have a limited validity period. Documents confirming cash withdrawal are valid for 90 days from the date of the transaction, not indefinitely.

Example: You withdrew funds on January 1 and plan to cross the border on April 5. For customs purposes, those documents are no longer valid. You must deposit the funds back into the account and withdraw them again to refresh the date.

Another crucial rule is that only the owner of the funds may transport them across the border. Even if you hold a notarized power of attorney to manage the assets of your spouse, parent, or business partner, you are not entitled to physically carry their cash in excess of the EUR 10,000 limit as your own. A representative may withdraw funds from the account, but only the account holder may personally transport the cash across the border.

What to Do If You Have a Non-Standard Situation

Cash kept “under the mattress,” gifts from parents, proceeds from sold cryptocurrency, or money withdrawn from an account more than three months ago all fall outside the standard documentation framework. In such cases, the usual set of documents will not work, and a customs officer has full legal grounds to question the lawful origin of the funds.

Is there a solution in these situations? Yes, but it requires individual legal support. We help structure a set of supporting evidence that is acceptable both to Ukrainian customs authorities and to the financial monitoring systems of European banks.

Do not take unnecessary risks by attempting to transport cash that may appear “questionable” to customs. Seeking professional advice in advance is far more cost-effective.

Successful case: Legal Transfer of Funds Abroad and Remote Account Opening in the EU

Common Mistakes When Taking Money Abroad: Pre-Trip Checklist

Even if you have collected all receipts, risks still remain. The most common mistakes include:

- Submitting an incomplete set of documents. For example, a property sale agreement without proof of receipt of funds is insufficient. It is essential to follow the guidance of the State Customs Service of Ukraine and the National Bank of Ukraine regarding documents that confirm the source of funds.

- Errors in documents. Even bank-issued receipts may contain inaccuracies, such as operator errors or incorrect payment descriptions. Always verify all details, as human error can result in lost time or even financial loss.

- Mismatch of amounts. The amount of cash you are carrying must exactly match the amounts stated in the customs declaration and supporting documents. Any discrepancy can trigger delays and additional inspections.

- Transporting funds by someone other than the owner. As noted above, even with a power of attorney, a representative may not carry cash exceeding the EUR 10,000 limit as their own. Only the actual owner of the funds may transport them across the border.

Why Choose Our Legal Support

Our law firm specializes in supporting financial operations and in the targeted preparation of documents for customs and banking inspections. We have extensive experience working with clients who:

- Transport significant amounts of cash abroad.

- Open accounts with foreign banks.

- Make investments or purchase real estate overseas.

Our team of experienced lawyers is ready to provide:

- Comprehensive legal consultation. Clear guidance on lawful ways and procedures for taking money out of Ukraine or transferring funds abroad.

- An individualized action plan. A proven, case-specific solution that is the most effective and reliable for your situation, taking into account available documents and the intended use of funds abroad.

- 360-degree risk analysis. Assessment of potential risks related to transporting cash both in Ukraine and in the destination country.

- Turnkey document preparation. Full support in preparing all documents required for the legal export and import of funds.

- Flawless declaration. Detailed instructions on what and how to declare when crossing the border, including completion of customs declarations for taking funds out of Ukraine and legally bringing them into another country.

Do not let bureaucratic mistakes cost you your financial safety net.

Need to urgently transfer funds or review your documents before travel? Contact us and we will develop a reliable and lawful action plan tailored to your specific situation.

Our clients