Advantages of Limited Liability Company (LLC): Why It's Better for Business?

Cost of services:

Reviews of our Clients

Starting your own business, whether it's an online or offline venture, is a complex and significant endeavor. Making the right choice in terms of legal structure can greatly simplify this path. However, entrepreneurs often encounter a dilemma: which legal form should they choose for their business?

Our team has consistently offered advice and support to Ukrainian entrepreneurs and nationals from countries like Germany, Denmark, the United Kingdom, and the USA, who are looking to choose the most suitable legal form for conducting commercial activities in Ukraine. With more than 15 years of experience in the legal market, we have a deep understanding of the best options for efficiently running a business.

One of the most popular choices is to establish a Limited Liability Company (LLC). It's important to note that clients frequently have questions such as:

- Who can be a founder of an LLC, and what should be the minimum share capital?

- What are the possible management structures for an LLC?

- Are there any financial risks to the personal assets of LLC members?

- Is it feasible to engage in business with large enterprises through an LLC?

Leveraging our acquired experience, in this article, we will provide answers, discuss the benefits of a limited liability company compared to other types of legal entities, and share specific examples from our legal firm's practice.

You may also like: The Difference Between an LLC and a Representative Office. A Comparative Table

Setting Up an LLC: Legislative Flexibility as the Primary Advantage

Under Ukrainian law, both individuals and legal entities, including those from abroad, can establish an LLC. This opens up opportunities for innovation and allows foreign nationals and companies to become founders, an often crucial aspect for many ventures.

When it comes to the required capital for an LLC, Ukrainian legislation is notably lenient. This leniency allows entrepreneurs to tailor their initial investments and financial strategies to their needs. While the law permits setting up an LLC with nominal capital as low as 1-2 UAH, we recommend against such minimal figures. A nominal capital of this amount could adversely affect the company's image in the eyes of potential business partners.

Our law firm boasts substantial experience in guiding both Ukrainian businesses and international clients through the process of forming LLCs in Ukraine, thereby facilitating their market entry and investment opportunities. Our portfolio includes cases with a broad spectrum of charter capitals, ranging from 500 UAH to over 1 million USD.

Having worked with a diverse clientele, from small enterprises to large corporations, we are equipped to help you determine the most suitable charter capital for your LLC, taking into account your specific needs and financial capacity.

Management Flexibility and Decision-Making in an LLC

Effective management is key to the success of any business, and LLCs are no exception. The governance structure of an LLC typically includes:

- The General Assembly of Participants;

- The Supervisory Board (if formed);

- The Executive Body.

Our experience shows that most clients prefer a streamlined management approach, often appointing a single executive body, typically a director. This choice simplifies decision-making and enhances the efficiency of internal operations. Opting for a single executive body facilitates swift coordination and management, with the director bearing the responsibility for executing decisions and steering the company in line with its strategic goals and operational objectives.

You may also like: Governance in an LLC: Roles and Responsibilities

The Absence of Financial Risks Related to the Personal Capital of Members: A Key Advantage of LLCs

A significant advantage of Limited Liability Companies (LLCs) is their approach to member liability. LLC members are liable for the company's obligations only to the extent of their contributions to the share capital. This means that the personal assets of members are not at risk in relation to the financial obligations of the LLC. Even in the event of bankruptcy or legal issues, the personal property of the members remains protected.

This is a notable distinction from sole proprietorships, where the individual is personally liable for all the business's obligations. This is an important consideration for those looking to start a business while seeking to limit their financial risks and wondering whether to register as a sole proprietorship or an LLC.

Working with Large Businesses: Why Registering an LLC is Preferable

One of the substantial advantages offered by LLCs is the ability to conduct business with large enterprises. Our legal firm can share an example of our client, an English transportation company that operates globally. With our assistance, they successfully entered the Ukrainian market. Here's how we provided legal support:

- We simplified the process of establishing an LLC in Ukraine for the client, including drafting the charter documents, registration, and addressing issues related to national legislation.

- We helped understand the local nuances of successful operations in Ukraine, allowing for more effective adaptation to the local business environment.

Overall, an LLC in Ukraine becomes the ideal choice for entrepreneurs valuing flexibility, financial protection, and the opportunity to expand their business globally.

Our company provides a full range of legal services related to the establishment of LLCs, helping entrepreneurs maximize their advantages. Our services include:

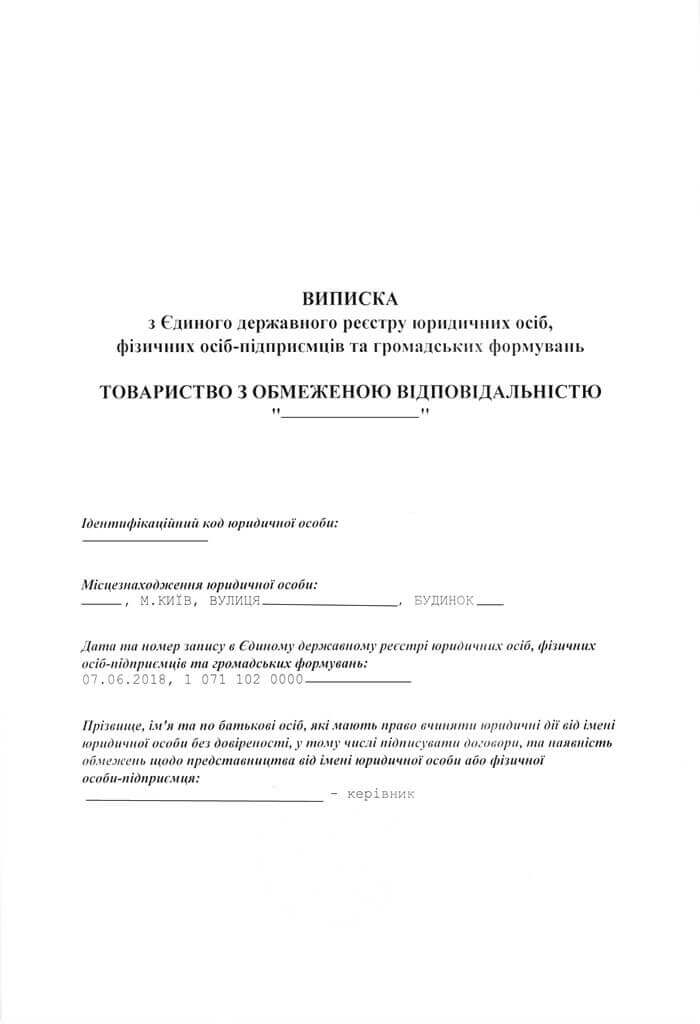

- Drafting foundational documents necessary for opening an LLC, including a "turnkey" company registration service.

- Preparing document drafts for legal entity founders, including resolutions from the parent company to establish a subsidiary in Ukraine.

- Drafting the minutes of the general meeting of participants on behalf of non-resident/foreign founders based on a power of attorney.

- Representing and registering the legal entity with the relevant authorities.

- Consultations and assistance in choosing the tax system, as well as registering the company in the VAT payers' registry and/or as a single taxpayer with the State Fiscal Service.

From consultations to registration and drafting necessary documentation, we ensure that the process of establishing your business is conducted in compliance with the law and tailored to your unique needs.

Learn more about our LLC registration services and pricing in Ukraine here.

Our clients