Registration of charitable organizations in Ukraine: terms, documents and procedure

Cost of services:

Reviews of our Clients

Our law firm has a significant experience in registration of charitable organizations in Ukraine and legal support of all their activities.

Charitable organizations in Ukraine may be used not only for activities that serve public or specific group of individuals interests but also as a tool of tax minimization, money laundering or as a cover for other activities.

Therefore the state establishes a special procedure of registration of charitable organizations which significantly differs from an order provided for other legal entities. While registration of the majority of other entities (including business entities) is carried out according to the Law of Ukraine "On state registration of legal entities and individual entrepreneurs" the registration of charitable organizations - in the manner defined by the Law of Ukraine "On Charity and Charitable Organizations" and the resolution of Cabinet of Ministers № 382 adopted on 30.03. 1998. Due to this the risks of registration refusal are increasing drastically (mainly because of mistakes in documents).

Citizens of Ukraine, foreigners (including stateless persons) who are 18 years of age and legal entities (regardless of ownership and residency) may be founders of charitable organizations. Unlike NGOs, which are required to have at least three founders charitable organization may be founded by a single person (including legal entity). At the same time state and local authorities, state and municipal enterprises, institutions and organizations financed from the budget cannot be founders.

To create a charitable organization founder (founders) must decide on its approval, develop a statute or regulations, form a management body (executive, administrative and supervisory bodies) and have it registered at the Ministry of Justice of Ukraine.

It should be noted that most refusals of registration for charitable organizations have claims about incorrectly drafted statutes (regulations). Drafting these documents in the appropriate form requires not only compliance with the formal provisions of law but also an understanding of internal criteria for evaluation of documents that are common for public officers of State Registration Service of Ukraine.

A body that conducts state registration of a charitable organization depends on its status. Registration of all-Ukrainian (their activities should cover the entire territory of Ukraine and they must have departments (subsidiaries and representative offices) in most regions of Ukraine) and international (their activities should cover the territory of Ukraine and at least one other foreign country) charitable organizations is performed by State Registration Service of Ukraine. Registration of local charitable organizations (their activities cover the territory of a region or territorial unit) is performed by central departments’ units and justice departments of Ministry of Justice of Ukraine that ensure realization of powers by State Registration Service.

To register a charitable organization (foundation) in Ukraine your decision must be established in a form of protocol and within a month from the date of acceptance the following documents must be provided for registration:

1) Founder’s (founders’) request for registration. Signatures of founders (or their representatives) on the request application must be notarized;

2) Protocol of the meeting of the founders which must include a decision to establish a charitable organization, a decision on approval of its statute or regulations, a decision on election of its executive, administrative and supervisory bodies (the Board and Supervisory Board);

3) Two copies of the statute (regulations) of a charitable organization. The statute must include: name, legal address, regional status and legal form of a charitable organization; object, goals, objectives and planned forms of charitable activities; the procedure of formation and functioning of management bodies, funding sources and the procedure of funds and property usage; amending procedure for the provisions or statute; procedure of reorganization or liquidation of an organization or foundation, use of property and funds in a case of organization’s termination; terms and procedure of membership obtainment and membership termination; rights and obligations of members of a charitable organization;

4) Information about founders of a charitable organization:

- For individuals: full name, date of birth, place of residence and place of work, position;

- For legal entities: name, legal address, a notarized copy of the statute (regulations), a notarized copy of the registration certificate, a decision of management body or a protocol of general assembly of the group which confirms the authorization for the foundation of a charitable organization. Additionally legal entities must provide documents that demonstrate the founders’ ownership structure which allow to determine owners of substantial portions of these legal entities (10% or more). According to the Ministry’s of Justice letter № 32-32-424 dated 23.09.2010 these documents may include a statute or constituent agreement (provisions) of a legal entity which contain information about the members (founders) and prices of shares that belong to them. At the same time the Ministry of Justice of Ukraine requires that when there is a legal entity among founders of a legal entity that is a founder of a charitable organization, these entity’s statute must be provided as well. This trail continues until the specific individual - founder of the entity and his share in the founding capital of this legal entity is determined.

- For foreign legal entities: a document certifying their registration in the country of its location notarized in accordance with the laws of a state which issued it. The document must be translated into Ukrainian as well as legalized in the established order;

5) information about charitable organization’s management bodies and members of the executive body (name, date of birth, place of registration, place of employment and position; proof of legal address of an organization provided in appropriate form (guarantee letter from the premises owner, rental agreement etc.). When a founder’s apartment address is used for the registration the founder must submit information about family members and consent applications of family members that are of legal age;

6) Information about departments (subsidiaries and representative offices) of a charitable organization if there is any. The information is confirmed by protocols of departments’ general assemblies of members or their representatives;

7) Confirmation of payment of state registration.

International charitable organization must also submit notarized documents which prove that its activities cover the territory of at least one foreign country. As such documents may be provided: written statements, information about coordinators, orders, protocols, documents of legalization etc.

Registration application is reviewed by a registering authority within two months (in fact the actual term may be ever longer).

The decision of approval or refusal of state registration is made after taking documents into consideration. There may be following reasons for the refusal:

- Violation of founding procedure of a charitable organization (including inaccuracies in documents);

- Existence of a registered charitable organization with the same name;

- In case when there is a person related to terroristic activities among founders of legal entity or persons that have direct or indirect impact on a founder of entity and / or receives a substantial part of the profits from its activities.

An applicant is notified about the results of the review within 10 days from the date of the decision.

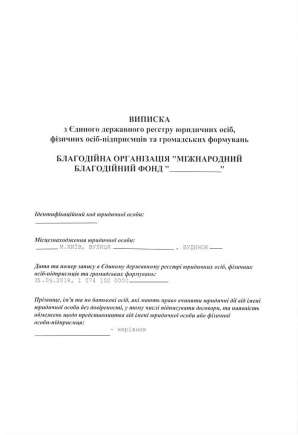

Registered charitable organization is listed in the Register of charitable organizations and its founders are issued a certificate of registration. After this the charitable organization must undergo the registration procedure with the state funds and tax inspectorate as any other regular legal entity but with obtainment of non-profit status from tax inspectorate.

From the moment of state registration a charitable organization obtains legal entity’s rights, it can exercise rights and must perform the duties of a charitable organization.

Our clients