Registration in EFSMS and URETI (Unified Register of Excise Tax Invoices): what is it and why is it necessary?

A licensing system for petroleum products was implemented together with the Electronic Fuel Sales Management System (EFSMS register) as a part of the state policy on market unshadowing.

This news affects anyone who is going to get a license for any fuel operation, since from now on, along with the submission of documents for the license, the business entity is required to get registered in the aforementioned register.

As the regulatory body explains, such innovations are intended to improve the state of the market, as well as create favorable conditions for the development of small gas stations, agricultural enterprises, small industrial enterprises, etc.

We will discuss all the innovations, their impact on obtaining licenses, and whether there is any need to get registered there at all?

Our service: Obtaining a license for oil products retail / wholesale trade, their production and storage

Who should get registered with EFSMS?

The new law provides that if you sell fuel in containers up to 5 liters or if you use fuel only for your own needs, you do not need to get a license. Accordingly, there is no need for getting listed in the register.

Important! In the above situation, the exception is the managers of excise warehouses which must be registered with EFSMS in any case.

An excise warehouse is any territory or premises on which fuel is sold, and the sale is understood by the controlling authorities to mean any physical actions with oil products (that is, their transfusion, transportation, mixing, etc.).

Thus, we can conclude that all other entities in the oil market that:

- sell fuel in containers of more than 5 liters;

- use fuel for profit -

- must be listed in EFSMS.

Important! The reporting system has also been changed; hereafter, it must be submitted to the Unified Register Of Excise Tax Invoices (or URETI). And this call for for an electronic signature, the drawing up an electronic application and the opening of corresponding accounts.

What’s the registration process like?

Registration in EFSMS calls only for a digital registration procedure, which we will cover in more detail.

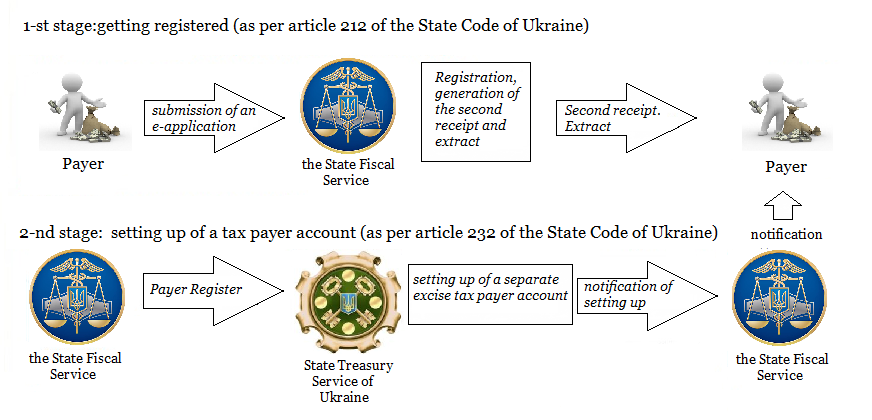

1. Registration of a tax payer in the System is carried out on the basis of submitting an application three working days before the start of the import or sale of fuel.

On the basis of an application for registration by a tax payer, registration of all excise warehouses also takes place almost simultaneously. That is, cars, premises, cans, tanks and other places of sale, processing or storage of fuel.

If the audit is successfully completed and the application is accepted, the State Fiscal Service (SFS) issues the so-called second receipt and an extract from the register of excise tax payers confirming the registration.

2. The SFS transfers the data to the Treasury, which opens an electronic account for paying taxes and notifies the applicant.

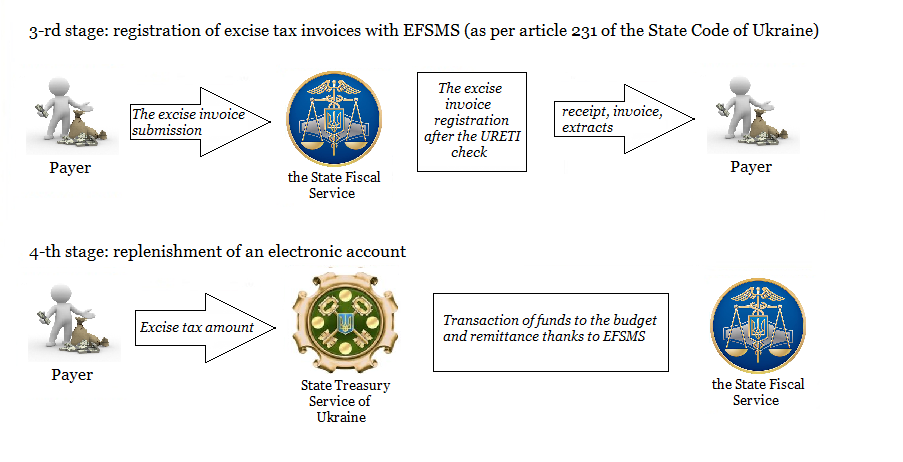

3. Work with URETI. The applicant must submit excise invoices and indicate the warehouses mentioned in the documents for the SFS, and the Unified Register already generates all the necessary receipts and statements.

4. As a final stage, the electronic treasury account is replenished by the payer. The transaction of funds is due to EFSMS.

Congratulations! You have successfully been registered in EFSMS!

Of course, you may have difficulties during registration and reporting, but our lawyers will be happy to help you.

What will happen if you fail to get registered on time and file tax returns?

In this case, the Tax Code provides for penalties depending on how long you are not registered as an excise tax payer.

The number of days for which the registration deadline and the corresponding fine are violated:

- up to 15 calendar days - 2% of the cost of oil products;

- from 16 to 30 calendar days - 10% of the cost of oil products;

- from 31 to 60 calendar days - 20% of the cost of oil products;

- from 61 to 90 calendar days - 30% of the cost of oil products;

- from 91 calendar days - 40% of the cost of oil products;

- more than 120 calendar days - 50% of the cost of oil products.

However, violations of this kind do not always correspond to the approved form and are justified. Therefore, in addition to getting registered in the system, our lawyers can also help with appealing messages received from the regulating authorities.

Our service: Legal service of appeal against tax violation notification letters in Ukraine