Comparison of Cash Declaration Rules in Ukraine and the EU

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Every person crossing a state border with cash is subject to the currency and customs regulations of both the country of departure and the country of arrival. Lack of knowledge of these rules often leads to unpleasant consequences such as customs checks, temporary seizure of money, fines, and other issues.

Although the rules in Ukraine and the European Union are generally similar because both jurisdictions set a basic limit of 10,000 euros, the differences lie in the details. These include the declaration procedure, document requirements, forms of control, and the consequences for violations.

Understanding these nuances is especially important for those who travel frequently, conduct business between Ukraine and the EU, or invest abroad. Even a small mistake in the declaration can cause delays in accessing your cash.

In this article, we will review in detail:

- what cash declaration rules apply in Ukraine and EU countries;

- what documents confirm the legal origin of funds

- what the main differences and similarities are between the two systems;

- what typical mistakes travelers make;

- and how legal support helps avoid risks when transporting cash across borders.

You might also like: How to Declare Cash When Traveling Across Multiple Countries

Cash Declaration Rules in Ukraine

The movement of cash across the state border of Ukraine is regulated by resolutions of the National Bank of Ukraine and the Customs Code of Ukraine. The main purpose of these rules is to prevent illegal capital outflow and money laundering.

The limits on the import and export of cash allow an individual, whether a resident or nonresident, to bring in or take out up to 10,000 euros (or the equivalent in another currency) without a written declaration. If the amount exceeds this threshold, a customs declaration must be completed and documents confirming the origin of the funds must be provided.

Please note! Customs officers evaluate the total amount of currency a person carries, including cash in different currencies.

Filling out the declaration is free and does not take much time, but it requires attention to detail. Mistakes or missing confirmations may result in the cash being delayed or an administrative report being issued.

For amounts starting from 10,000 euros or more, it is mandatory to have documents that confirm the legal origin of the funds. These documents may include:

- a bank certificate confirming withdrawal of funds from an account, issued no more than 90 days before the date of export;

- currency exchange receipts if applicable;

- an account statement showing the movement of funds.

It is important that these documents are official and issued by authorized institutions. If proper confirmation is not provided, customs authorities will not allow the money to be taken out of the country.

Cash Declaration Rules in the EU

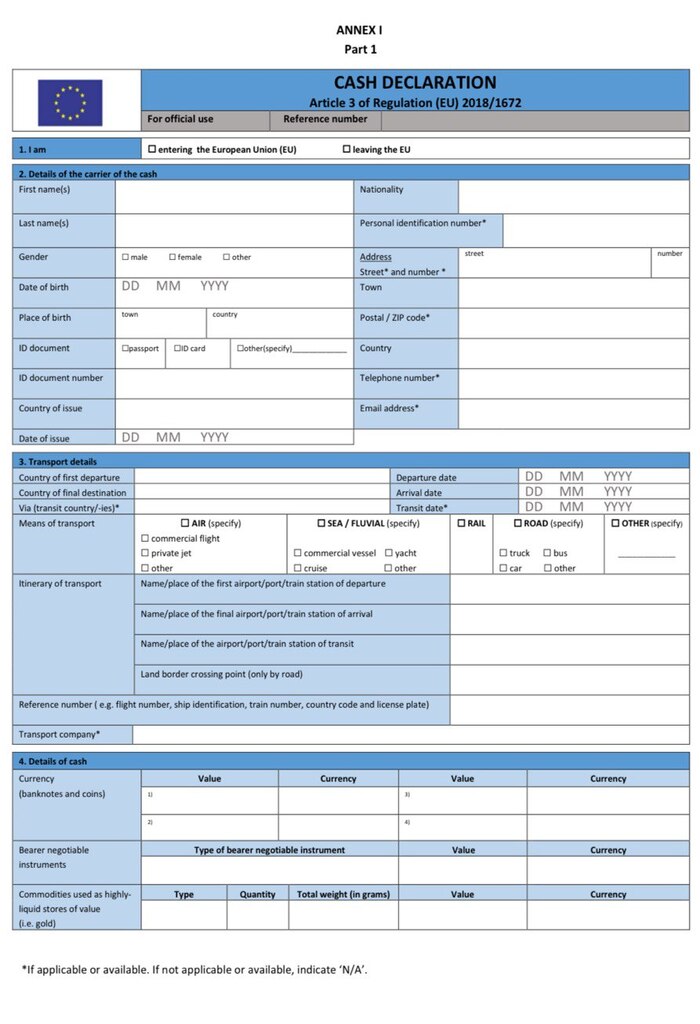

The European Union has established unified rules for moving cash across the external borders of member states in order to prevent illegal capital transfers. These rules are regulated by Regulation EU No 2018/1672 of the European Parliament and of the Council of 23 October 2018.

Any person entering or leaving the territory of the EU who carries cash in the amount of 10,000 euros or more (or the equivalent in any currency) must declare these funds in writing at customs. As in Ukraine, the declaration is submitted when entering or leaving EU territory, and customs authorities have the right to verify the accuracy of the information provided.

Although the main requirements are unified, some EU countries introduce additional internal rules. For example, an internal declaration may be required to later deposit the funds into a bank account, or additional documents confirming the origin of the money may need to be provided.

Various sanctions may apply for failing to declare or for improperly declaring cash in the EU. Depending on the country, these may include:

- a fine ranging from 500 to 50,000 euros;

- temporary seizure of the cash.

In addition, violating customs rules can cause complications during future border crossings.

Successful case: Legal Transfer of Funds Abroad and Remote Account Opening in the EU

Comparison of Ukraine and the EU

Although Ukraine and the European Union follow similar principles for controlling the movement of cash, there are important legal and procedural differences between them. Understanding these nuances helps avoid problems at customs and ensures the fully lawful transportation of money.

|

Criterion |

Ukraine |

European Union |

|

Non-declaration limit |

Up to 10,000 euros (equivalent) |

Up to 10,000 euros (equivalent) |

|

When a declaration is required |

If the amount exceeds 10,000 euros, written declaration is mandatory |

If the amount exceeds 10,000 euros, written declaration is mandatory when entering or leaving the EU |

|

Additional checks |

Usually applied when the limit is exceeded or when there is suspicion about the legal origin of funds |

Possible even for amounts below 10 000 euros if customs officers suspect money laundering |

|

Proof of origin of funds |

Required for amounts above 10,000 euros (bank certificates, account statements, and other documents) |

Usually not required except in certain cases when requested by national authorities |

|

Declaration procedure |

Completing a paper customs declaration in the Ukrainian language |

Completing the European declaration in English or in the national language |

Despite the differences in procedure, Ukraine and the EU share common basic principles for controlling the movement of cash:

- the same basic limit of 10,000 euros or the equivalent in another currency;

- mandatory written declaration when this amount is exceeded;

- the need to confirm the lawful origin of the funds.

What Travelers Should Pay Attention To

- Prepare in advance all documents that confirm the legal origin of the funds.

- Consider currency fluctuations. If part of the amount is in dollars or another currency, the equivalent may exceed the limit at the time of inspection.

- Pay attention to transit countries. When flying through several states, each of them may have its own rules for controlling cash.

- Avoid splitting money between passengers. Some countries may treat a family as a single unit.

- Keep copies of declarations if you have already declared funds when entering the EU or Ukraine. This will help confirm the legality of further transportation.

Typical Mistakes and Risks When Crossing the Border With Cash

The most common problems when transporting cash across a border usually arise not from intentional violations but from a lack of knowledge about procedures or from underestimating formal requirements. Below are typical situations that can lead to financial or legal complications:

- Taking money out without proof of origin.

Many people believe that if the money belongs to them personally, no confirmation is required. However, customs authorities must verify the lawful origin of funds, especially when large amounts are involved. - Incorrect or incomplete declaration.

Issues often occur due to formal mistakes, such as an incorrectly stated amount, a missing signature, incorrect currency, or inaccurate personal data. Therefore, it is important to carefully check every point before submitting the declaration or seek assistance from a legal professional. - Exceeding the limit due to a misunderstanding of the rules.

A common situation arises when travelers assume that the limit of 10,000 euros applies separately to each currency. In reality, customs officers calculate the total equivalent of all currencies carried. Lack of awareness of these nuances does not exempt a person from responsibility.

You might also like: How to Declare Cash When Traveling Abroad with the Whole Family?

Legal Support for Transporting and Declaring Cash

Our company provides full legal support for clients who plan to transport or declare cash when crossing the border of Ukraine or EU countries. We offer:

- Consultations on current rules for importing and exporting cash, limits, and declaration requirements.

- Assistance in preparing documents that confirm the legal origin of funds.

- Practical advice on how to safely and legally transport cash abroad for personal needs, investments, or business.

We work with foreign citizens, Ukrainian entrepreneurs, and private individuals, ensuring complete legal safety for their financial operations.

Contact us to receive an individual consultation before your trip. One conversation can save you thousands of euros and protect you from stress at the border.

Our clients