Import and distribution of humanitarian aid: how to organize for funds in Ukraine?

Cost of services:

Reviews of our Clients

In this article we will elaborate on the main issues of one of the hot topics at the moment – humanitarian aid and everything connected with it.

The fact is that the volume of humanitarian and charitable aid coming to Ukraine is enormous. And even despite the simplified procedure for importing most categories of items, if they are imported as humanitarian aid, any charitable organization needs to understand clearly how to register such aid.

Today, we will provide brief advice to charitable foundations and other organizations involved in importing, receiving and distributing humanitarian aid in Ukraine. If you need practical help, we cover all the needs of organizing work in Ukraine: accounting, legal and HR support, all types of reporting, hiring, procedures for working with volunteers, and migration services. All services in one place, you will not need other contractors.

You may also like: Can One Establish a Charitable Foundation in Wartime?

Simplified import of humanitarian aid to Ukraine.

The Ukrainian government has now simplified the import of humanitarian aid as much as possible. In particular, at the beginning of March 2022 the Cabinet of Ministers adopted Resolution No. 174 and Resolution No. 344, which greatly simplified and established the declarative principle of import of humanitarian aid during martial law. This means that you need only the Declaration to import humanitarian aid.

What is the procedure for importing aid under the Declaration, and what is it?

The Declaration has a prescribed form, which is provided in Attachment 1 to the above Resolution No. 344. It must be filled out by a person importing humanitarian aid. The declaration, among other things, must indicate the recipient and the actual destination of the cargo. The destination must be known in advance, such a principle as “the main thing is to import, and then we’ll figure out what goes where” does not work. In addition, the declaration must specify the sender, the type of aid (list of goods, quantity, volume).

Types of humanitarian aid and whether there is a difference in the import procedure.

Yes, there is. Attachment 2 to the above-mentioned Resolution provides a list of humanitarian aid to which a different clearance procedure applies. Such assistance includes, in particular, military goods:

- body armor plates;

- quadcopters;

- thermal imagers;

- night vision devices;

- non-civilian portable radios, etc.

To import goods from this list, one must submit, along with the Declaration, a letter of guarantee from the end user of these goods in the prescribed form (Attachment 3 to the Resolution).

The letter of guarantee partially duplicates the information from the declaration and includes a “receipt” that these goods will not be used for profit. And, accordingly, goods not included in this list are imported under the Declaration without allocation to subgroups.

You may also like: Obtaining Crypto Donations

Acceptance of humanitarian aid and transfer to the beneficiaries.

As we have repeatedly said, the Cabinet of Ministers by its Resolution No. 202 of March 05, 2022 simplified the procedure for receiving and accounting for humanitarian aid. Under martial law, the requirements for receipt, use, accounting and reporting of humanitarian aid, which were in effect before martial law, are not applicable.

It must be pointed out from the outset that the goods included in the above list from Attachment 2 are not entered in the accounting of the organization, as they are transferred to the transferee as quickly as possible.

In the case of both the receipt and transfer of assistance one must draw up acts of transfer and acceptance, because this will help prevent misunderstandings. It makes sense to draw up the same acts for receipt and transfer of other types of humanitarian aid, where possible.

Note: Following a certain procedure for receiving and transferring humanitarian aid will be your evidence base in case of any disputes or questions to you from the tax authorities.

Evaluation and registration of humanitarian aid in the State Department of the Treasury

If you want to register humanitarian aid with the State Department of the Treasury (this is not obligatory, but recommended in certain cases), you will need to make an assessment of the value of the items transferred.

If at the time of transferring the item the benefactor gave confirmation of its value, then everything is understandable. However, this is rarely the case. So the organization must perform an assessment itself, creating a special commission for this purpose. The commission must proceed from an understanding of the fair (or market) value of the property. After evaluation, a certificate of receipt in kind is drawn up and submitted to the State Department of the Treasury.

Peculiarities of registration of humanitarian aid for import to Ukraine abroad.

Foreign benefactors often need to obtain confirmation that they have transferred some kind of material values to charitable organizations for reporting purposes. This is why you should have in your saved files a draft agreement on providing charitable assistance and an acceptance certificate.

You may also be asked to provide copies of supporting documents and even show the originals, confirming that you are acting legally. We recommend our Clients to keep with them their founding documents and their translations.

Our company offers its assistance to charitable organizations which provide the backdrop for the daily struggles in Ukraine today. Our services include:

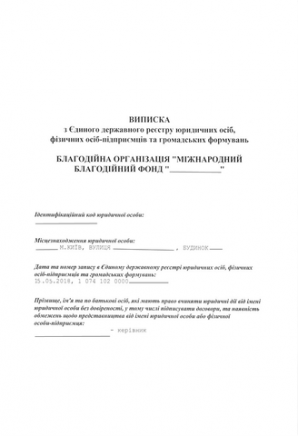

- Registration of charitable organizations in Ukraine;

- Development of the organization’s algorithm of actions for importing, receiving, transferring humanitarian aid;

- Consultations on registration of different types of humanitarian and charitable aid;

- Developing document templates for organizations to receive and register humanitarian aid;

- Assistance with the inclusion of the organization in the necessary registers;

- Making a declaration for the import of humanitarian aid, if necessary;

- Development of agreements on the provision of charitable assistance both with benefactors and recipients;

- Keeping records of the organization’s activities under the supervision of a lawyer, etc.

Our service fees:

Establishment of a charitable organization in Ukraine.

Legal advice and support for charitable organizations and their activities.

Our clients