Aspects of receiving charitable assistance in Ukraine

Cost of services:

Reviews of our Clients

Registration of a charitable foundation is only the first step on the way of its full-fledged functioning. When starting your activity as a founder of a charitable foundation, you should understand exactly not only the direction of your activity, but also how exactly the foundation must operate in Ukraine in order to fulfill its objectives without comments on the part of controlling bodies.

For example, in case of improper registration of a charitable foundation, you risk losing its non-profit status, and thus all the advantages it gives, including the possibility of working with volunteers.

Our company has been assisting in establishing and developing charitable organizations in Ukraine for over 14 years. Today we will talk about such an important aspect of the foundation, as receiving donations and their accounting.

If you have any questions concerning registration and activity of your charitable organization in Ukraine, please contact our specialists for personal consultations.

You may also like: Registration of a Foundation with a Foreign Founder

What type of assistance may a charitable foundation accept?

A charitable organization can generate several types of income from its work:

-

Target income comprises funds, assistance gathered and received for a certain project. For example, a specific amount of money needs to be raised for a surgical procedure;

-

General income — funds transferred to the foundation without specifying the purpose;

-

Passive income is the funds received by the foundation as bank interest, income from leasing out property, etc.

Please note! Loans cannot be the source of a foundation’s assets.

If the income to the foundation’s account is properly documented, you will keep your non-profit status and have no problems with the tax authorities.

The most important difference between these types of income is that target income can only be used to achieve the goal specified in the transfer, but the general and passive income can also be used to maintain the foundation.

Please note! If a foundation has hired employees (not volunteers) who need to be paid a salary — they can be paid only at the expense of the general or passive income. Such wages are taxed in the usual manner.

You may also like: Financial Repayable Assistance to a Charitable Foundation

What if the charitable foundation is donated with financial assistance other than money?

Charitable assistance may be provided not only in the form of monetary contributions, but also in the form of other material goods, which can then be used by the foundation to fulfill its goals.

We often see examples of books, furniture, computer equipment and even specialized equipment being donated to foundations, which then either dispose of these items to fulfill the foundation’s goals or sell these items to obtain funding, which is also aimed at achieving the foundation’s goals.

Please note! If the foundation has received financial assistance, for example, computers, and decides to sell them — all proceeds must be used to cover the foundation’s expenses. Only in this case, the sale will not be considered income, and thus there will be no need to pay taxes.

In order for such a transaction to be correctly accounted for, you will need to draw up an act of material assistance, as well as an accounting statement on the sale of these items. Read more here.

Please note! All the nuances of receiving donations by the foundation need to be specified at the stage of drafting the foundation’s constituent documents.

Our company offers you a full complex of services for starting and operating a charitable foundation:

-

Legal advice on the functioning or registration of a charitable foundation;

-

Assistance in organizing the accounting of the foundation’s activities, staff training;

-

Development of constituent documents for the charitable foundation;

-

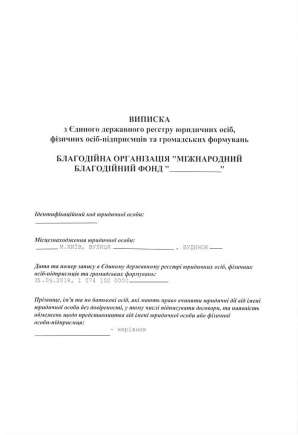

Registration of a charitable organization in Ukraine;

-

Legal and accounting services for foundations and charitable projects in Ukraine.

Do you want to understand the regulations for charitable foundations in Ukraine? Don’t hesitate to contact us! We will not only ensure simple and effective registration of the charitable foundation in Ukraine, but also provide you with all the necessary information for its successful operation.

Didn’t find an answer to your question?

Everything about the registration and operation of the Charitable Foundation in Ukraine here.

Our clients