Alternative methods of settlements for business in Ukraine

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

The alternative to traditional business calculation methods is a highly relevant topic. We have become accustomed to making payments for services or purchasing goods through two methods: cash and cashless transactions.

However, in this dynamic world of economics, business, and market interactions between entities are constantly evolving, and the utmost importance lies in the swift and uncomplicated exchange of monetary funds. This is precisely what the new types of calculations offer.

Today, we will discuss the legal methods of conducting business transactions that are available in Ukraine. We will explore electronic money, barter, and promissory note payments.

The organization of your business's payment system and its proper accounting are crucial for ensuring the security and legality of your operations. If you wish to guarantee the effectiveness of your system or would like to delegate this task to professionals who can handle it on your behalf, feel free to reach out to our specialists.

You may also like: Registering an IT Company in Ukraine for Foreign Investors

Electronic Money for Business Transactions in Ukraine

Electronic money represents a form of cashless payments regulated by the Law on Payment Services. In Ukraine, legal entities have the privilege to open electronic wallets in both traditional banking institutions and non-banking financial establishments.

What are the available types of electronic payments?

1. Regular non-cash transactions involve placing the business's funds into current bank accounts.

2. Another option is using an electronic wallet (also known as E-Wallet or Digital Wallet) to store the electronic funds.

Below, we will address common questions that frequently arise for business owners in Ukraine concerning the use of electronic funds.

What are the advantages and differences between the available electronic payment methods?

Using electronic money offers several advantages, allowing for quick and convenient:

- Receiving or making payments for goods, services, or rendered work

- Issuing electronic funds for expense reports and business trips

- Paying taxes

The main difference between these two types of payment methods lies in the speed of processing the payment transactions. Payments made through electronic wallets are instantaneous. On the other hand, transfers through a bank account depend on the operating day regulations of the banking institution.

Please note! The current norms of the Ukrainian Tax Code permit the payment of taxes using electronic funds. Exceptions: it is prohibited to transfer funds to a unified account and the Single Social Contribution through electronic means.

Where are electronic wallets most applicable and relevant for usage?

Electronic wallets are primarily suitable for business sectors where:

- Direct bank payments are not appropriate, accessible, or too complex.

- Regular financial transactions occur, such as payment for telecommunication services, topping up fuel cards, or utilizing electronic wallets in the service industry, among others.

- Settlements take place between participants of the same corporate group. For instance, several legal entities controlled by a single beneficiary make fund transfers between each other (this may happen to reconcile debit/credit obligations).

Is cryptocurrency considered a legal form of electronic payment in Ukraine?

Many entrepreneurs mistakenly view cryptocurrency as a type of electronic money. However, according to the current legislation, cryptocurrency:

- Is not recognized as legal tender within the territory of Ukraine.

- Does not qualify as electronic money.

So, what sets cryptocurrency apart from electronic money? Electronic money holds a fixed value, whereas the value of cryptocurrency constantly fluctuates.

Please note! It is strictly prohibited to accept or make payments with cryptocurrency for goods, services, or work within Ukraine.

What requirements exist for digital wallets?

The usage of digital wallets for payments comes with specific legal requirements:

- Payments with digital money between Ukrainian residents can only be conducted through digital wallets opened with a Ukrainian resident issuer. The issuer must possess the necessary permission (license) from the National Bank of Ukraine to perform such operations.

- Receiving payment from a non-resident can be done into a digital wallet in the currency of the non-resident's payment service provider. However, the transaction amount should not exceed 400,000 UAH.

Please note! It's important to mention that the opening of a digital wallet (similar to a bank account) is reported to the tax authorities. The reporting is carried out by the issuing institution, whether it's a banking or non-banking financial institution.

Additionally, funds held in digital wallets are treated similarly to those in bank accounts. Consequently, if a legal entity violates the legislation, its account may be blocked. Furthermore, the funds may be seized or collected to repay existing debts.

How are transactions with digital money taxed?

As previously mentioned, digital money is treated similarly to funds held in bank accounts. Therefore, taxation of transactions involving electronic wallets depends on the company's tax system, either general or simplified. Value Added Tax (VAT) on transactions with digital money is charged and paid to the budget based on the ordinary principle of the first event.

Recognition of tax obligations is based on the first of the following events:

- Crediting digital funds to the electronic wallet

or

- Dispatch of goods/work/services.

Recognition of tax credit is based on the first of the following events:

- Debiting digital funds from the electronic wallet

or

- Receipt of goods/work/services.

Opening a digital wallet for business in Ukraine

The process of opening a digital wallet involves several stages. To do this, you need to take the following steps:

1. Choose a payment system through which funds will be received. It can be Mastercard, Visa, or the National Payment System "Prostir."

2. Select the issuer of digital money. For example, currently, AB "UkrGasBank" has a license to issue digital and collaborates with the National Payment System "Prostir."

3. Legally formalize relationships with the payment system agent and the issuer of digital money.

To open a digital wallet, you will need:

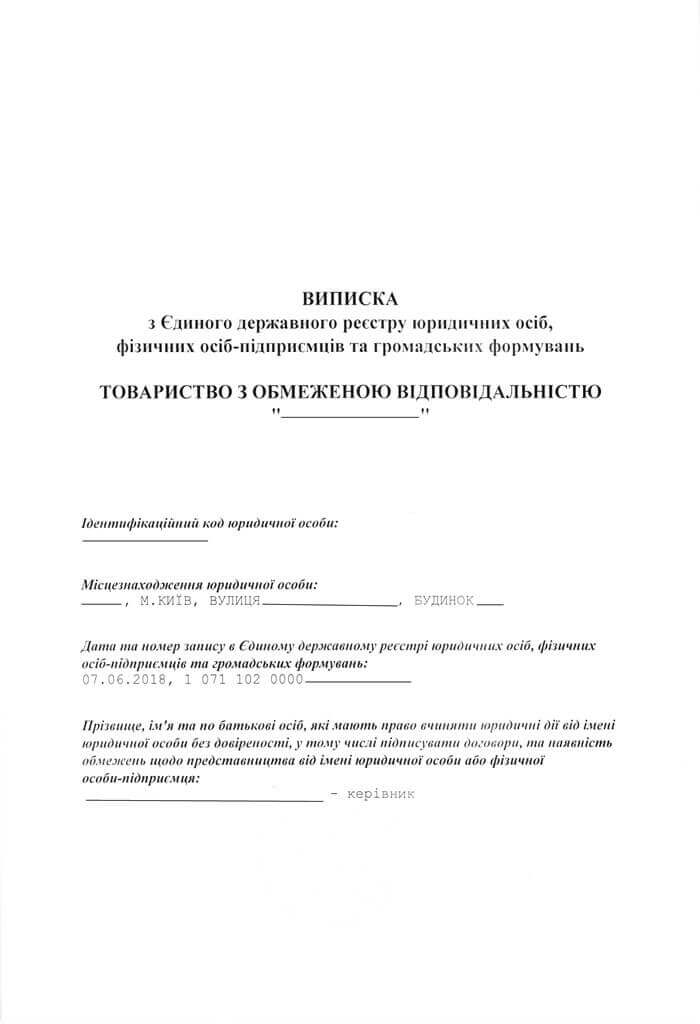

- An original registration certificate of the organization.

- The original charter of the organization.

- An original description of the documents provided to the state registrar.

- A schematic representation of the ownership structure.

- The original protocol of the appointment of the manager.

- The original order of the manager's appointment.

- Original documents of the manager: passport/ID card, Tax Identification Number (TIN). If the manager is a foreigner, a Work Permit is additionally required.

- Original documents of the authorized representative: passport/ID card, TIN.

Note: The document list is not exhaustive, and the bank may request additional information or documents.

Electronic payment has become the preferred option for many companies because it offers the following benefits:

- Quick and convenient settlement of transactions.

- Easy payment processing for customers.

- Increased sales volume due to smooth and reliable payment processing.

If you are interested in using an electronic wallet for your business, feel free to contact us. We can provide you with legal assistance throughout the process.

Additionally, Pravova Dopomoga Law Firm offers comprehensive accounting and consulting services, which can help you understand:

- Tax advantages.

- Potential drawbacks of working with digital money, specifically tailored to your business needs.

You may also like: Planning and Development of Market Operations Model in Ukraine

Barter transactions as an alternative method of conducting settlements in Ukraine

In the modern world, many companies engage in multiple collaborations simultaneously. A typical example is when Company A orders raw materials from Company B while simultaneously selling goods to Company B. As a result, debtor-creditor obligations arise between these businesses, which are settled through money transfers between bank accounts.

To reduce the number of non-cash transactions and save on banking fees, the current legislation allows for the utilization of barter as a form of exchanging goods.

When is barter advantageous?

Barter (or countertrade) is the exchange of goods by the seller to the buyer in return for a similar or dissimilar product of equal fair value. Barter transactions are commonly used:

- In settlements between participants of companies belonging to the same group. For instance, several legal entities (controlled by the same beneficiary) transfer funds between each other to reconcile debtor-creditor obligations.

- In transactions with regular customers.

Barter transactions are based on a barter agreement, which should contain the following mandatory information:

- The subject of exchange.

- The exchange price and the method of determining fair value.

- The duration of the exchange.

Barter offers its advantages, and that's why companies resort to this type of settlement whenever possible. The benefits include reducing the number of non-cash transactions and saving on banking fees.

A typical example of a barter transaction is the collaboration between a coffee shop chain and coffee machine manufacturers/sellers.

The working model is as follows:

1. The coffee shops engage in two types of activities: selling coffee as a product (in packages) and selling coffee as a beverage.

2. The coffee shop acquires coffee machines through barter in exchange for selling (through barter) packaged coffee.

3. The coffee machine seller/manufacturer utilizes the coffee acquired through barter as raw material to implement a franchise for coffee machine installations.

In this case, there is an exchange of dissimilar goods, even though the transaction value was equal and did not involve additional payment (the cost of the coffee machine equals the cost of the batch of packaged coffee).

To execute barter transactions, the parties involved:

- Determine the fair value of the exchanged items.

- Enter into a barter agreement.

- Formalize acceptance and transfer documents for the exchanged items.

Please note! Taxpayers under the unified tax regime are prohibited from using barter operations.

Taxation of barter transactions

When barter transactions involve mutual offset of liabilities, it applies only to the monetary balance on the balance sheet. Taxation for corporate income tax and value-added tax (VAT) follows general principles based on the date of shipment or receipt of goods.

The main criteria for proper accounting and tax treatment of barter transactions:

1. Transfer of ownership rights

In barter transactions, both parties to the barter agreement act as both sellers and buyers of the goods/services being exchanged.

Correctly determining the moment of acquiring ownership rights is crucial for the proper taxation of the transaction, both for corporate income tax and value-added tax (VAT).

According to current legislation, the moment of transfer of ownership rights to the goods subject to barter occurs simultaneously for both parties after fulfilling the obligation of transferring the property by both sides.

For example, if Company A transferred goods to Company B on June 1, 2023, and Company B transferred goods to Company A on June 5, 2023, both parties acquire ownership rights on June 5, 2023. This date, June 5, 2023, is the date of recognizing income and VAT tax liability.

2. Determination of the similarity criterion

Items (goods, services) with the same functional purpose and fair value are considered similar.

Please note! Both conditions must be simultaneously met when determining the similarity of objects.

When a seller transfers similar objects, no income or cost of goods sold is recognized. On the other hand, the buyer reflects the receipt of the object on the balance sheet at its carrying value.

Please note! If the carrying value of a similar object exceeds its fair value, the initial cost is determined by the fair value, and the difference is recognized as the current expense of the company.

Objects (goods, services) that do not meet the concept of similar objects are considered dissimilar.

In exchanges involving dissimilar objects, the seller's income and the buyer's carrying value are determined based on the fair value of the object.

If you plan to engage in barter transactions, feel free to consult our specialists, who will not only help you with the legal documentation of the transaction but also provide guidance on correctly reflecting the transactions in accounting and accurately calculating taxes.

You may also like: Better to Call PRAVDOP: Legal Services in Kyiv

The bill of exchange as an alternative payment method in Ukraine

A bill of exchange is a negotiable instrument that signifies the drawer's (buyer's) obligation to pay a specified amount to the payee (seller) at a predetermined future date. It offers a convenient way to conduct non-cash transactions, such as settling debts or making payments for goods received.

There are two types of bills of exchange:

- Simple Bill of Exchange. This type does not allow for transfer to a third party.

- Transferable (Negotiable) Bill of Exchange. This type can be transferred to a third party.

The distinctive feature of a bill of exchange is its transferability to another business entity. This payment method offers several key advantages:

- It allows for the postponement of payment under the contract when there is a lack of available cash at the current moment.

- It helps in reducing overdue debts.

Please note! A company cannot create a bill of exchange on its own, but it can obtain the required form (a strict reporting form) from a commercial bank.

Now, let's proceed to address the most frequently asked questions that business owners have before dealing with bills of exchange.

How is payment made by a bill of exchange?

When establishing contractual relationships, the seller and the buyer agree on the payment method - a bill of exchange. After the shipment of goods and/or the provision of services, upon completion of the work, the buyer issues a bill of exchange (previously obtained from a commercial bank) for the amount of the commercial transaction and hands it over to the seller.

Note: Settling the debt through a bill of exchange is not considered a securities transaction.

How is the transfer of the bill of exchange recorded?

At the legislative level, the process of accepting and transferring a bill of exchange is not regulated. However, to confirm the fact of conducting this transaction, the supplier and the buyer sign an Act of Acceptance and Transfer of the bill of exchange.

Please note! The Act of Acceptance and Transfer must be signed no later than one day before the deadline for payment. Otherwise, the bill holder loses the right to claim interest for delayed payment (in case of a delay in payment).

Mandatory details of the Act of Acceptance and Transfer of the bill of exchange:

- Full names of the parties involved.

- Requisites of the parties (EDRPOU code, legal and actual addresses, IBAN, phone numbers, email address for correspondence).

- Type, number, date of the bill of exchange presented for payment, payment term, and place.

- The obligation of the person issuing the bill to make the payment.

- The obligation of the person presenting the bill to return the original bill of exchange to the issuer after the bill is paid.

How should the seller handle the received bill of exchange?

- Wait until the payment date and then collect the funds from the bank.

- Sell the bill of exchange as a negotiable instrument to a third party.

- Use the bill of exchange to settle a debt owed to another party.

What are the rules for transactions involving a bill of exchange?

- The bill of exchange should only be issued to settle an actual debt arising from the sale of goods, provision of services, or completion of work.

- The sales contract or supply agreement must include provisions for payment by a bill of exchange.

- The payment amount on the bill of exchange must not exceed the actual value of the goods or services provided.

Payment by a bill of exchange cannot be considered as a subscription or accounts receivable.

Please note! Failure to comply with the rules for transactions involving a bill of exchange may result in penalties for the issuer of the bill, ranging from 6,800 to 8,500 UAH.

Is it possible to use a bill of exchange for international trade settlements?

Yes, it is possible to use a bill of exchange under the following conditions:

- The contract must allow for payment by a bill of exchange.

- The funds must be credited to the account within 180 days from the date of shipment of the goods or provision of services.

Please note! Payment by a bill of exchange is not permitted for taxpayers under the unified tax system.

Taxation of transactions involving a bill of exchange

As previously mentioned, payment through a bill of exchange can only be made as a deferred payment for:

- Delivered goods.

- Completed works/services.

No additional taxation, such as corporate income tax and VAT, arises from using a bill of exchange. The company continues to calculate and pay taxes according to the regular taxation scheme based on the registered tax plan.

Our team at Pravova Dopomoga Law Firm can help you with the legal documentation for a bill of exchange transactions. We are ready to provide comprehensive accounting support, from the process of acquiring bills of exchange to recording the data in the accounting books.

You can learn more about financial products and their potential applications here.

We also offer the following services:

- Planning various business structures in Ukraine with the involvement of corporate, tax, labor, and even immigration law experts.

- Business registration in Ukraine.

- Auditing and development of financial business models in Ukraine.

- Auditing existing business systems and providing recommendations for improvement.

- Automation and streamlining of accounting processes in businesses.

- Comprehensive legal and accounting support for businesses in Ukraine.

For the cost of setting up or planning a turnkey business, click here.

Our clients