Accounting for a Digital Agency in Ukraine in 2023

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

The goal of any business is, of course, to make a profit. Achieving this goal is 90% the responsibility of the company's main departments, namely sales and marketing.

However, the range of marketing services is improving and expanding every year. Today, starting a business, a company tries first of all to create its own website and to describe its activities on its social media page. It is digital agencies that help businesses to perform internet marketing functions.

Marketing as well as IT is a "favorite" direction of regulatory authorities. Business operations in these areas are often recognized by regulatory agencies as risky. Therefore, the lack of competent accounting and legal support can result in the company's activities being considered fictitious (fully or partially). This can lead to the suspension of business and legal disputes.

You may also like: Development of a Financial Model for Business in Ukraine

Optimal legal form for digital agency and qualification codes

If you plan to set up a digital agency, you must first decide on the legal structure of the company and the tax system. There are no restrictions for the marketing business. You can register as an LLC on the general or simplified taxation system, or as an individual entrepreneur.

When choosing, you should remember that the simplified system of taxation has limitations on the levels of income, the number of employees, and the list of people to whom you can provide services (depending on the single taxpayer group).

The most popular business models include:

- Sole proprietorship – single tax payer, group 3;

- LLC – general system of taxation or single tax payer, group 3.

When registering a digital agency, our experts recommend choosing the following qualification codes:

- 73.11 - Advertising agencies;

- 62.02 - Informatization consulting;

- 63.91 - Activities of information agencies;

- 63.99 - Provision of other information services;

- 73.12 - Mediation of advertising in mass media;

- 73.20 - Market research and public opinion polling;

- 82.99 - Provision of other business support services.

Why are there so many qualification codes, and can we limit ourselves to just one?

We recommend registering as many qualification codes as possible, because at any moment your business may expand, and you will provide various services to your clients.

Please note! If a company registered under the simplified taxation system does business that is not specified in the Unified State Register - this means a violation of the rules of the simplified taxation system and the necessity to move to the general taxation system (18% income tax) with the simultaneous charge of 15% tax on the amount of income received from this activity (not specified in the register).

VAT payers also fall under the risk of non-registered activities. When registering a tax invoice, it can be blocked and the income may be recognized as fictitious.

You may also like: What Taxes Does an Entrepreneur Pay for his Company's Social Security Package?

How to avoid the recognition of transactions fictitious and what documents will confirm the provision of services?

Marketing services are always under the scrutiny of regulatory authorities. The latter can carry out counter-inspections in order to determine the reality of providing/receiving marketing services.

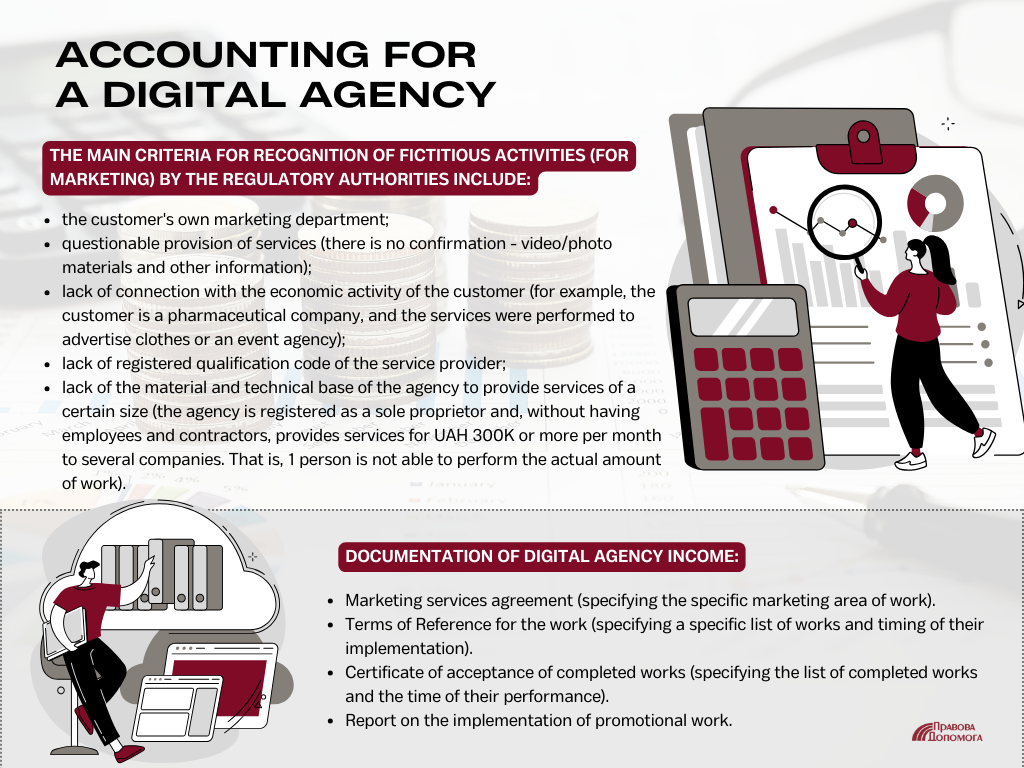

The main criteria for recognition of fictitious activities (for marketing) by the regulatory authorities include:

- the customer's own marketing department;

- questionable provision of services (there is no confirmation - video/photo materials and other information);

- lack of connection with the economic activity of the customer (for example, the customer is a pharmaceutical company, and the services were performed to advertise clothes or an event agency);

- lack of registered qualification code of the service provider;

- lack of the material and technical base of the agency to provide services of a certain size (the agency is registered as a sole proprietor and, without having employees and contractors, provides services for UAH 300K or more per month to several companies. That is, 1 person is not able to perform the actual amount of work).

To prove the legitimacy of the activities, the company must have a complete documentary list of proof of income and expenses.

Documentation of Digital Agency income:

- Marketing services agreement (specifying the specific marketing area of work).

- Terms of Reference for the work (specifying a specific list of works and timing of their implementation).

- Certificate of acceptance of completed works (specifying the list of completed works and the time of their performance).

- Report on the implementation of promotional work.

The company can develop individual forms of documents (mentioned above). When developing document forms it is necessary to observe the main condition - the presence of mandatory details of primary documents (document name, date, name of the customer/executor, details of the customer/executor).

Our specialists can help you elaborate on your own set of documents that would confirm the validity of a business operation to the maximum extent possible.

The marketing agency can provide services both with the help of full-time employees and outsourcing companies. Expenses incurred in the process of providing services to the customer must also be documented. This is done similarly to documenting income.

Our company provides accounting support services. By using our services, you will get rid of your accounting routine and will manage the promotion of your business.

Please note! If we are talking about promoting the business of a legal entity, all expenses must be paid from the company's current account (or corporate card). When using your own card (or the card of any individual), the company will not be able to confirm the expenses incurred.

You may also like: Accounting and Tax Audit of Payroll Operations

Taxation and payment confirmation on various advertising platforms (Google, Facebook, Twitter, Instagram, etc.)

Digital agency services are directly related to social networks and various advertising platforms. Depending on the business transaction (for which services and to whom we make payment) taxation of operations has certain differences.

Let's look at several options for advertising payments.

Option 1: Payment for advertising on advertising platforms.

In this case, the agency purchases advertising services from a resident.

The agency makes payments based on invoices (or contracts) and recognizes expenses (based on a properly executed act of work).

The services are received in Ukraine, therefore, if the executor and the customer are VAT payers, a tax invoice is made at the rate of 20%.

Option 2. Paying for advertising on Google.

Google has a representative office registered in Ukraine, so the settlements shall be made using the same method as in Option 1.

Option 3. Payment for advertising on foreign platforms (Facebook, Twitter, Instagram, etc.)

If you want to make payments to foreign advertising platforms (non-residents), you can use your corporate card. Payment by corporate card is equal to payment from the current account.

But just like transactions in Ukraine, you must have documentary proof.

Such documents may be:

- an order for the company to advertise on the relevant site;

- a bank statement of the corporate card account;

- an invoice from the non-resident's advertising platform;

- transcript of the business account advertising debit transactions;

- photo/video report, screenshot, or other supporting information about the advertising campaign.

Tax laws are constantly changing, so businesses must quickly respond to all the latest updates. Our specialists can help you with this.

We offer packages of accounting support services for different types of activity in Ukraine and abroad.

Check the cost of audit and accounting support services here.

Our clients