Accounting support of construction and installation works by a foreign company in Ukraine

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Each area of activity has not only its technological features, but also the rules of legislative regulation. Construction business is not an exception.

Before starting business in Ukraine, a foreign company should find out all nuances of Ukrainian legislation and profitability of the project in Ukraine. Our specialists will help you to understand all legal issues.

How does a foreign construction company operate in Ukraine?

In order to carry out construction and installation works it is necessary to:

- register a legal entity or representative office of a foreign company;

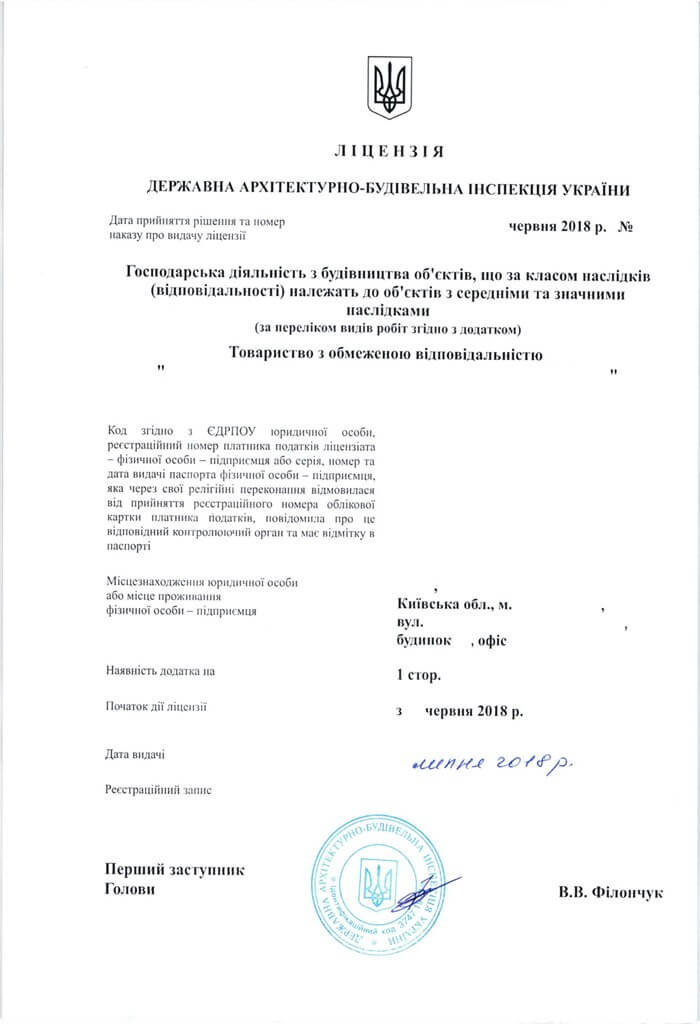

- obtain a license for construction and installation works (if the works are of medium and high responsibility);

- to find an architectural company or a certified architect;

- obtain a work permit or declaration of conformity;

- get a permit to employ foreign nationals (if the work will involve employees of a foreign company).

Our specialists can help you register a company and obtain all the above mentioned documents.

Foreign companies can choose the following business forms:

- a permanent establishment;

- a legal entity in the form of LLC (registered in Ukraine).

Most often foreign companies carry out construction activities through representative offices. But there are a number of cases when business chooses to establish a separate legal entity in Ukraine.

Differences between a representative office and a separate legal entity:

- a representative office does not operate independently, but on behalf of a foreign company;

- the period of registration of a representative office is longer than the period of registration of a legal entity;

- there is no state fee for the registration of a legal entity, unlike the registration of a representative office.

In accordance with the current legislation, a construction site, construction installation or related supervisory activities carried out by a non-resident (through its employees or other hired personnel) is equated with the concept of a permanent establishment.

Non-resident, carrying out activities through a permanent establishment, shall register with the supervisory authority (tax service) within 10 business days from the date of registration (accreditation) of the establishment.

Note. For comparison, a legal entity is subject to automatic registration at the moment of state registration.

Considering the above, the process of registration of a separate legal entity is much easier. However, still some non-residents choose the representative office.

The choice of business form mainly depends on the business model and organizational aspects:

- the legal responsibility of the company;

- how to finance the company/representative office;

- transfer of machinery and equipment to the balance of the representative office;

- joint activities of two or more non-residents in the fulfillment of a contract;

- application of double taxation agreements.

You may also like: Development of a Financial Model for Business in Ukraine

Tax implications for the representative office of a foreign construction company in Ukraine

If a non-resident works on the territory of Ukraine, including through its permanent establishment, it is obliged to become registered with the controlling body.

Please note! If the representative office of a non-resident carries out activities qualifying it as a permanent establishment, but carries out activities without the registration - this situation entails:

- imposing a fine on non-resident in the amount of UAH 100K;

- additional charge of 18% of income tax on the financial result obtained during the activity.

Income tax

Permanent establishment shall pay income tax on the general basis.

Amounts of income received by non-residents through the activities of their representative offices are subject to taxation in the general order, namely the financial result of the representative office is taxed with 18% income tax:

Income - Expenses = Financial Result * 18%.

Note. For tax purposes, permanent establishments are defined as independent of the non-resident taxpayer. If the non-resident has several separate permanent establishments, income is determined separately for each establishment.

VAT

If the income of a permanent establishment exceeds UAH 1 million, it must register as a VAT payer.

Note. Additionally a representative office has the right to register as VAT payer voluntarily.

Tax reporting

Tax and statistical reports of such permanent establishments are submitted separately at their place of registration (at the location of each representative office).

You may also like: What Taxes Does an Entrepreneur Pay for the Company's Social Security Package?

Tax implications for a Ukrainian legal entity

The right choice of taxation system is one of the components of the financial liquidity of a business. After all, a properly drawn up financial model of the project/business allows you to optimize tax costs and direct the saved funds to the development of activities.

When registering a legal entity, a company chooses a system of taxation:

- simplified system – 5% single tax without VAT or 3% + 20% VAT;

- general system of taxation – 18% income tax and the VAT payer status optionally;

- special regime of taxation for the period of martial law – 2% single tax without VAT.

Please note! If you like the special tax regime of 2% of the single tax for the period of martial law, you should consider that first of all you choose the basic system of taxation (general or simplified group 3. And already after the registration with the tax service you apply for the transition to a simplified) taxation system. After the cancellation of martial law, the tax service automatically returns the taxpayers to their initial system of taxation).

The choice of the tax system depends on the following factors:

- your suppliers of consumables (VAT payers or not);

- the legal relationship between you and your customers (e.g., you perform construction and installation work for a VAT-paying customer, or you build premises using your own resources and transfer/sell them to individuals or VAT non-payers);

- your strategic goals;

- whether you plan to attract investment and in what form;

- other points related to the activities of your business.

If you have chosen the simplified tax system, you must accrue and pay the following taxes:

1. Single tax

- payment of 5% of the amount of funds credited to the current account

or

- payment of 3% from the amount of funds that are credited to the current account (in case you have registered as a VAT payer)

or

- payment of 2% of the amount of funds credited to the current account (for the period of martial law).

Please note! When choosing the simplified tax system, it is necessary to understand the limitations it imposes, namely:

- it is forbidden to carry out activities not specified in the company's qualification codes (if you did not choose all the necessary qualification codes when registering, you can add them and then carry out business operations);

- the simplified taxpayers of the third group have restrictions in terms of receipts to the settlement account (as of 2023 - not more than UAH 7.818 mln per year);

- there are no restrictions on the number of employees;

- prohibited methods of settlements: barter, netting, payment of wages in kind, assignment of the right of demand.

2. VAT

If you are registered as a VAT payer, you must pay VAT monthly.

The amount of tax is calculated on the basis of taxable sales and purchase amounts.

For example, in December 2022 you performed construction work for the amount of UAH 6 million (including VAT of UAH 1 million). You used materials in the amount of 4 million UAH (including VAT of 666 thousand UAH) to perform the works.

As of December 2022 your company will pay VAT in the amount of UAH 333k (UAH 1 mln. - UAH 666k.).

Important! When carrying out business operations subject to VAT the company must issue and register a tax invoice in the Unified Registry of Tax invoices.

The current legislation establishes a system of automatic control over the reality of economic transactions on the basis of tax invoices sent to the Unified Register of Tax Invoices. If the supervisory authority has insufficient facts about your company, or considers the operation to be risky - the tax invoice will be refused to be registered.

In order to avoid such situations, before performing construction and installation works, it is necessary to make sure that:

- your company has provided information to the tax office about the legal and actual location (20-ОПП);

- the company has enough personnel to carry out the work (for example, if a building is under construction and there are 3 people on staff, receiving a minimum wage - the operation is risky);

- the company has sufficient logistical support (equipment can be both owned and rented);

- all business operations are documented (in accordance with the legal and accounting rules).

3. Payroll taxes

If a company has hired employees (which is mandatory for construction and installation work), your business must pay the unified social tax at the rate of 22% of the payroll.

The payroll consists of:

- basic salary;

- additional wages;

- other compensation and bonuses.

Also the company acts as a tax agent and is obliged to withhold 18% of personal income tax and 1.5% of military tax from the salaries of its employees.

That is, if an employee works on a full-time basis and earns UAH 8 thousand, the company withholds and remits to the budget:

- 18% personal income tax = 8,000*18% = UAH 1,440

- 1.5% military tax = 8,000*1.5% = UAH 120

The employee receives a salary minus taxes, namely: 8,000-1,440-120 = UAH 6,440.

Tax reporting of a construction company

Operating under the simplified taxation system, the company shall file:

- Single tax declarations;

- VAT declaration (when registering as VAT payer);

- Unified reporting on the amounts of income received by employees and payment of taxes (personal income tax, social security tax, military tax);

- Financial statements (Balance Sheet, Profit and Loss Statement);

- Statistical reports.

If you have chosen the general tax system, you will be subject to the following taxes:

Income tax

The income tax rate for construction and installation activities is 18%. The tax is assessed on the company's cash total.

Note. The financial result is the difference between the company's income and expenses (after deduction of VAT amounts).

Profit tax payable to budget = Income - expenses = Financial result * 18%

VAT

The payment of VAT is made by the algorithm similar to the single tax payers.

Please note! ЕIf your company is on the common taxation system and is not registered as VAT payer, it is obliged to make this registration after reaching the income of UAH 1 mln.

Payroll taxes

Charge and payment of income tax, unified social tax and military tax is made in the same way as described for the single tax payers.

Tax Reporting

Operating under the general taxation system, a company must file the following:

- Income tax declarations;

- VAT declaration (when registering as VAT payer);

- Combined reporting on the amounts of income received by employees and payment of taxes (personal income tax, unified social tax, military tax);

- Financial statements (Balance Sheet, Profit and Loss Statement);

- Statistical reports.

You may also like: Accounting and Taxation of Grants by Residents of Ukraine

Features of accounting for construction and installation works in Ukraine

Even though construction and installation work is one of the most material-intensive areas of activity, accounting is quite simple.

For the purpose of operative and convenient management of construction and installation business we recommend using business process automation.

Income and expenses:

- Income from the provision of services is determined on the basis of full costing and the approved contractual price.

- Income from services rendered is reflected in the accounting balance sheet 703.

- Construction costs are calculated and attributed to the cost of production in accordance with the approved construction estimates and costing charts.

Expenses for construction and installation work are accumulated in the 231 production account during the period of work performance and are attributed to the production cost at the moment of transferring the completed work to the customer.

Cost of services includes (but is not limited to):

- material costs (construction and consumables);

- depreciation of equipment involved in the project;

- labor remuneration of employees involved in the project;

- rent payments (in case of equipment lease);

- expenses for the permits and approvals;

- other costs associated with the project.

Transactions on the movement (acquisition, relocation, write-off) of materials must have documentary evidence and assigned responsible persons at each stage of movement.

Analytical accounting of work performed can be made :

- іn the context of orders;

- in the context of the types of work;

- in the context of constructions, on which the work is carried out.

Documentation of construction and installation work:

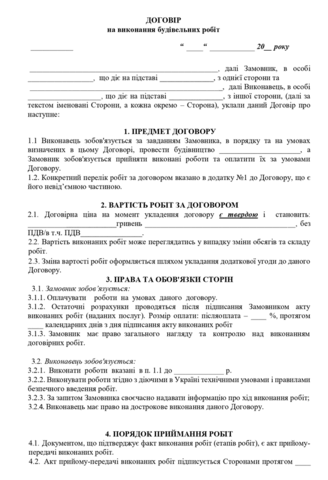

- Agreement on the performance of construction and installation work.

- Statement of the cost of construction work performed.

- Estimate of the cost of construction work.

- Certificate of acceptance and transfer of performed construction work.

A construction company's accountant must not only understand all these nuances, but also be able to put it all in order.

Our company offers foreign construction companies a simpler option. We provide legal and accounting outsourcing services in Ukraine with company support. Starting from registration and getting a construction license to maintaining all accounting and other records and support in participation in grants, etc.

If you are planning to start a business in Ukraine, don't hesitate to contact us. Be sure to find a reliable legal partner in Ukraine beforehand.

Check out the cost of accounting support services here.

Cost of foreign business registration here.

Please contact our specialists for a personal package of services.

Our clients