Remote Opening of Bank Accounts for Ukrainian Companies and Personal Accounts for Non-Resident Directors

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Many businesses operate across multiple countries, presenting additional challenges in meeting legal requirements and managing finances. One key task for such companies is opening bank accounts in the country of operation—both corporate accounts for the company and personal accounts for directors, particularly non-resident directors. This need is especially common among Ukrainian companies with foreign directors, as well as companies whose beneficial owners are foreign nationals. These businesses often face stricter compliance requirements, including the necessity for in-person presence during the account opening process. However, directors or business owners may not always be able to physically travel to Ukraine, creating significant obstacles. In such cases, it is crucial to have a solution or partner who can facilitate the remote opening of bank accounts for foreign individuals.

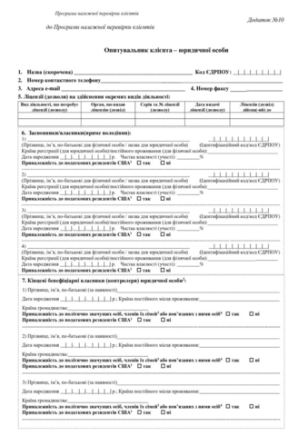

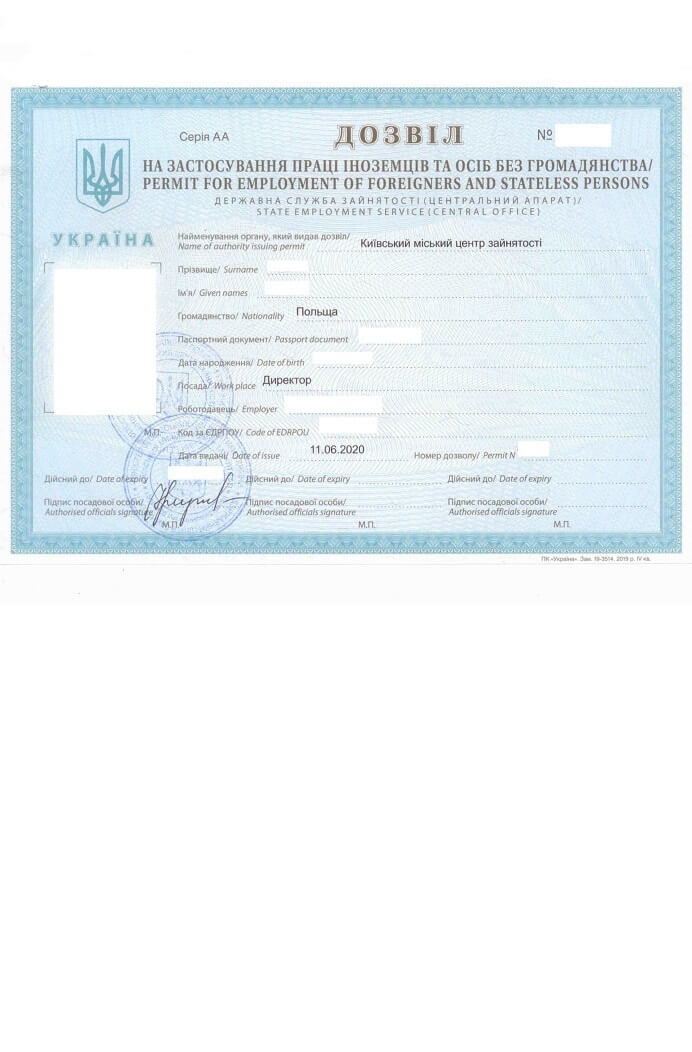

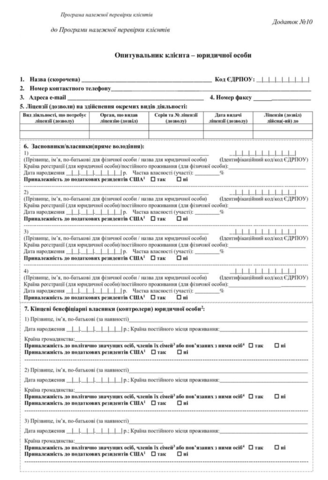

One of our clients, a Czech private security company expanding into the Ukrainian market, encountered a similar challenge. They decided to extend their operations by establishing a security company in Ukraine. With the support of our legal team, the company was successfully registered in Ukraine, and legal operations were set up under the leadership of a non-resident director, including obtaining a work permit for the foreigner. Later, our clients faced the necessity of opening bank accounts, a crucial component for ensuring the company’s smooth operations and financial management. In this article, we will share how we resolved the issue of remotely opening a bank account for a non-resident.

You might also like: Establishing a Security Company in Ukraine as a Foreigner: Can a License Be Obtained with a Foreign Security Specialist?

Opening a Bank Account for a Foreigner Without Visiting Ukraine: Real Experience from Our Client

The need to open a company bank account can arise for various reasons, and its importance cannot be overstated. After establishing a company, one of the first essential steps is opening a corporate bank account to manage financial transactions. Without it, the company cannot receive payments, pay employees or partners, or fulfill tax obligations. This is a foundational step for ensuring the smooth operation of any business.

Furthermore, if a company plans to work with international clients or partners, opening a bank account in Ukraine is essential for receiving international payments and currency conversion. In addition, Ukrainian legislation mandates that companies have bank accounts for key financial operations, including tax payments, contributions to state funds, and maintaining proper accounting records.

When the company’s director is a non-resident and unable to travel to Ukraine to open an account in person, the need for a remote solution arises. This often becomes a decisive factor for businesses operating in a globalized environment. This was precisely the case with our client, who approached us to facilitate the opening of a bank account for a non-resident without traveling to Ukraine. We began by analyzing the client’s situation and identifying a bank that offers a comprehensive range of services enabling the entire process to be completed remotely using a power of attorney and electronic documents. Below, we outline the key steps involved in this process:

STEP 1: Preparation of Required Documents. To confirm the authority of the company’s director or representative, we gathered the necessary corporate documents, including the company’s charter, the resolution or protocol appointing the director, and copies of passports and identification codes. These documents were essential for passing the bank’s compliance review.

STEP 2: Drafting a Power of Attorney. We prepared a power of attorney (POA) for opening the bank account. Since the company’s director was unable to visit the bank in person, the POA authorized our representatives to act on their behalf. The POA had to be notarized, apostilled, and translated into Ukrainian.

STEP 3: Submitting the Power of Attorney to the Bank. Our representative submitted the power of attorney to the bank for verification. The bank reviewed the authority granted by the POA and confirmed the possibility of opening the account. Once the POA was approved, we proceeded to the next stage—submitting the application for a corporate account.

STEP 4: Submitting the Online Application and Compliance. After submitting the application, the bank initiated a legal review of the documents. This process can take anywhere from a few days to several weeks, depending on the complexity of the case and the completeness of the provided documents. In our case, since the company’s founder was another Czech non-resident company, the review process was more extensive. We provided additional supporting information upon the bank's request, successfully completed the compliance process, and opened the account for the non-resident director.

STEP 5. Account Activation. After successfully opening the account, we assisted the client in gaining access to all banking services, including online banking. This enabled them to perform international transactions, currency exchanges, and other financial operations.

It is important to note that the process of opening bank accounts for a company and for its non-resident director can differ significantly. These differences arise from variations in legal requirements and the procedures for corporate and personal accounts. Proper consideration of these nuances is crucial when opening accounts for non-residents. In the case of our client, the purpose of opening the account was specifically for the director’s personal financial operations, such as receiving income, salary payments, and managing investments, rather than conducting the company’s business activities.

To successfully open the account, we remotely prepared and submitted a set of documents to the bank, including:

- A notarized translation of the director’s passport.

- The director’s tax identification code.

- A notarized, apostilled, and translated power of attorney for our representative.

- Documents confirming the director’s appointment (the contract, employment agreement, and the order appointing the director to the position).

The procedure for opening a personal account is quite similar to the steps involved in opening a corporate account, but it can often be completed more quickly, especially if all documents are properly prepared. Since we handle the preparation of all necessary documents, our clients can focus on their priorities without worrying about bureaucratic hurdles. This ensures not only the successful opening of the account but also efficient financial management in Ukraine.

You might also like: Assistance with Opening Bank Accounts for Non-Residents and Companies

Legal Assistance for Non-Residents in Opening Corporate or Personal Bank Accounts

Opening a bank account for a Ukrainian company or a personal account for a non-resident director is a process that requires strict adherence to legal requirements and meticulous preparation of necessary documents. However, with the right approach and proper legal support, these procedures can now often be completed remotely. Our legal firm has years of experience assisting clients in opening bank accounts for both Ukrainian companies and their foreign directors. We offer:

- Consultations at every step. We guide you through the entire process and explain the requirements for opening corporate and personal accounts.

- Document preparation and review. We ensure all necessary documents are correctly prepared and verified to avoid delays or rejections.

- Legal support. We handle all interactions with banks, including the preparation of powers of attorney for remote account opening.

Contact us today to receive professional legal assistance in opening bank accounts for non-residents and ensure the successful launch of your business in Ukraine. Our team of experts is ready to support you at every step of the process!

You might also like: Acquiring a Security Company as a Foreigner: Why It’s Better Than Obtaining a License

Our clients