How to Enforce the 80/20 Rule in a Non-Profit Organization?

Cost of services:

from 1400 USD/month

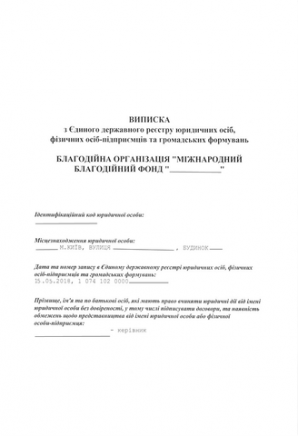

Legal support for a charitable organisation

from 850 USD

Documents to start activities

Reviews of our Clients

Vice President E. Nayshtetik , All-Ukrainian Council for Patients’ Rights and Safety

We highly appreciate professionalism of your team as well as your personal qualities in the field of regulatory support of activities of charities, contractual formalization of relations, tax legislation

Non-profit organizations have many organizational and legal forms. Each of them is regulated by a specialized law, but their accounting and tax accounting is quite similar.

The most common in recent years are charitable foundations and public organizations.

At the time of registration of the organization, experienced lawyers will definitely draw your attention to the main difference between a charitable foundation and other non-profits - the administrative costs of a charitable foundation should not exceed 20% of annual income.

Dear visitor, the full text of this article is available only in Ukrainian and Russian versions.

If You are interested in this issue and You want to get a paid consultation on the topic - contact us via the forms of communication, by phone or through any other convenient way.

With all respects,

Team of "Pravova dopomoga" law firm

Our clients