Raising funds for business: different approaches and successful cases

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Creating a business entails more than just registering a legal entity and formulating legal development models. It also involves optimizing the company's workflow, ongoing efforts to enhance processes, client acquisition, and more.

We won't discuss the complexities of conducting entrepreneurial activities in today's conditions or the challenges with management or tax burdens. However, we'll share practical insights on attracting funds to a business, their utilization, and control.

Attracting Funds for Business: Various Approaches and Successful Cases

A client approached us with the need to secure funds for their business, aiming to purchase specific equipment and sustain the overall operation of the enterprise. The client wasn't considering options involving capital participation in the company but sought an alternative structure. After several meetings with the client, we understood that they needed to secure funds and ensure their repayment. We devised a solution involving a short-term, interest-free loan secured by the acquired assets. The client provided the funds, the assets were purchased, and a collateral agreement was established with the client. This is one example of how funds can be attracted for business operations.

Drawing from our practical experience, we can delineate various methods of fundraising for businesses:

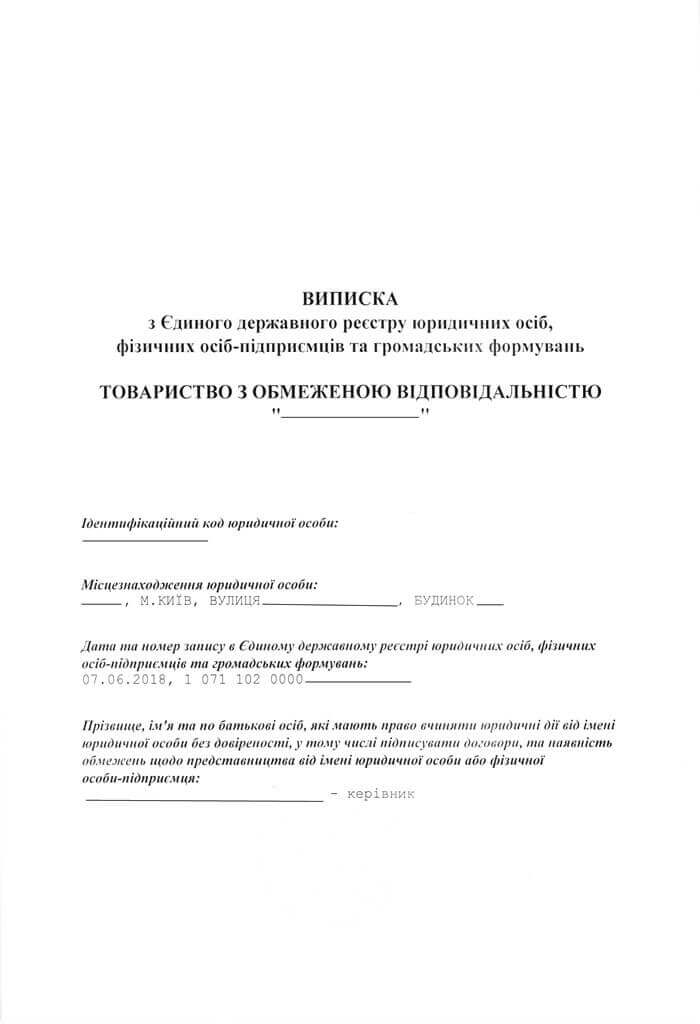

Authorized capital: This is the prevailing approach in Ukraine for securing funds for businesses by directly injecting contributions from company participants. The company's authorized capital can be augmented with both monetary funds and assets or property rights. For instance, real estate or vehicles are occasionally incorporated into the authorized capital. It's crucial to note that if a participant contributes property or funds to the authorized capital, such assets become the property of the company.

In a case involving one of our clients, whose parent company is situated in the EU, there arose a necessity to raise funds for business operations. The decision was made to augment the authorized capital of the company. We prepared the requisite documents, facilitated the registration of the increase in authorized capital, and assisted with the payment. Consequently, the client successfully met its financial requirements and attracted funds for business operations from the parent company.

Equity or business reinvestment: Companies can allocate undistributed profits to finance various projects within the company, effectively reinvesting funds. This practice is quite prevalent when a business utilizes its available funds to invest in its own activities. This may manifest, for example, through the acquisition of vehicles or real estate.

In our practical encounters, clients frequently express the desire to acquire specific valuable assets using the company's funds. It is common for funds generated from business activities to be directed towards the acquisition of vehicles, real estate, or other assets.

Debt Capital: Engaging in loans or securing business credit is a widespread practice. Debt capital comes with its own dynamics, where the debtor commits to repaying the debt under specific conditions. For instance, consider a practical scenario.

Our client faces periodic needs for additional funds to sustain business operations while awaiting settlements from debtors. To address this, the client acquires repayable, interest-free financial assistance by contributing their own funds, repaying them as soon as corresponding payments are received from clients.

Investments: Investments represent a highly popular means of fundraising, particularly in European and U.S. contexts. However, investment, in one form or another, takes shape as debt capital, authorized capital (corporate rights), securities, or options and futures. Concluding an investment agreement involves corresponding regulation and the completion of specific bureaucratic procedures, such as investment examination. This is why investors often find it more convenient to allocate their funds through alternative means, labeling them as investments.

Joint Venture: A prevalent model involves multiple businesses creating and executing a specific project without the need for legal entity registration. Essentially, parties enter into a joint venture agreement, outlining terms for participation in the collective venture, profit distribution, and contract termination. Joint venture agreements necessitate registration with the state tax service in accordance with the Order of the Ministry of Finance dated December 9, 2011, No. 1588, "On the Approval of the Procedure for the Registration of Taxpayers and Levies."

It's crucial to note that any fundraising requires legal support, as errors made independently could lead to financial losses.

You may also like: What is an Investment Agreement in Ukraine? How Can Businesses Securely Attract Investments?

The Story of an Unsuccessful Investment: Why Legal Assistance is Crucial

We know cases where foreign investors invest funds in Ukrainian companies, only to have dishonest partners misappropriate the funds, withdraw them from the company, and exit independently. Consequently, the investor is left with corporate rights in the company but without their initial investment. Alternatively, in cases where parties utilize long-term debt instruments but fail to discount them and receive tax notifications-decisions following tax inspections.

In any case, if you intend to attract funds or assets for your business, seeking legal guidance is crucial. Our specialists have relevant experience working with companies and are prepared to assist your business. We offer a comprehensive range of services:

- We'll assess your situation and help you choose the best option for your business.

- We'll prepare the appropriate structure for the chosen model and develop the necessary documents.

- We'll guide you through every stage of project implementation.

- We'll provide recommendations and ongoing support for your business.

Contact us today, and you'll ensure your business has the necessary legal backing.

Learn more about the cost of business support services here.

Learn more about the cost of establishing and launching a foreign business here.

Our clients