Gave legal advice on double taxation and obtained a tax residency certificate

Features of obtaining a tax residency certificate

In the past our Client had already practiced in communicating with public authorities, since he tried to obtain such a certificate on his own, but did not get the desired result, because he was unable to fully understand the requirements of the law.

Moreover, peculiarity of the client's work and his permanent stay abroad did not allow visiting Ukraine in the near future.

The main problem of the client was that he could not determine to which public authority he need to apply.

According to the Law of Ukraine "On the Legal Status of Foreigners and Stateless Persons" Tax residence arises from any connection between a person with a state: temporary or permanent residence, activity in the territory of Ukraine, registration or simply location, and since our client was a citizen of Ukraine, therefore, on the basis of above mentioned the following questions arose:

- is it a jurisdiction of the State Migration Service of Ukraine, which has to provide a certificate confirming the registration of a person as a citizen of Ukraine, which will provide the characteristics of a resident to our Client?

- is it a jurisdiction of the State Fiscal Service of Ukraine, which only needs to issue a tax residency certificate at the place of registration of such a person, that can also confirm such status?

The approach of lawyers to resolving the client's situation

Based on the needs of the client to avoid double taxation, we determined that it was necessary to contact a territorial body of the State Fiscal Service of Ukraine.

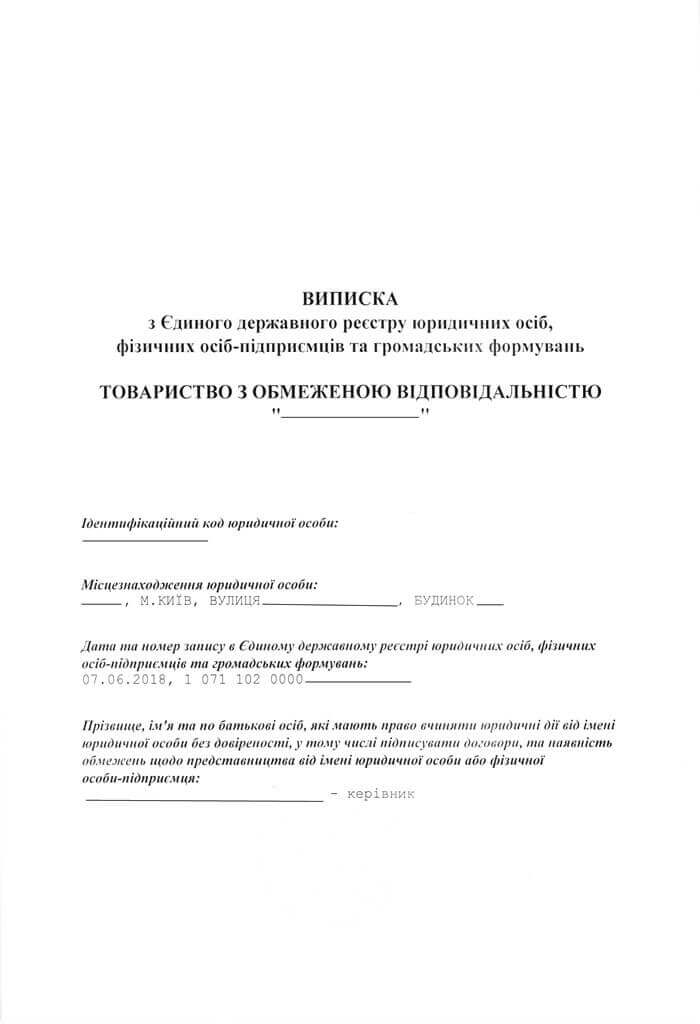

After obtaining a power of attorney from the client who worked in Cyprus and collection of all necessary documents, our lawyers were able to obtain a tax residency certificate within a specified time.

It should also be mentioned that the procedure for obtaining the certificate is regulated by the Order of the State Tax Administration of Ukraine, that is, even on the basis of a name of the order, we see that this issue is regulated by the State Fiscal Service of Ukraine, although some mistakenly contact the State Migration service of Ukraine.

Conclusion

The case demonstrates an importance of the help of specialized lawyers in issues regarding a tax legislation, since the latter contains a large number of rules that may not be fully understood by persons, who are not in touch with this area of ??law in everyday life.

Consultation is an important stage in our cooperation, because by holding it we help our clients to determine appropriateness of their decisions and explain possible consequences.

In the case, we proposed an optimal and most productive scheme of cooperation, after which our lawyers helped to collect and develop the necessary list of documents for the Client and subsequently prepared everything necessary for obtaining a tax residency certificate.

Cooperation with residents who are abroad is one of the key practices of our firm, so we can help to resolve any issue in this area if necessary.

Our clients