Property of civil organizations in Ukraine: procedure and methods of formation

Cost of services:

Reviews of our Clients

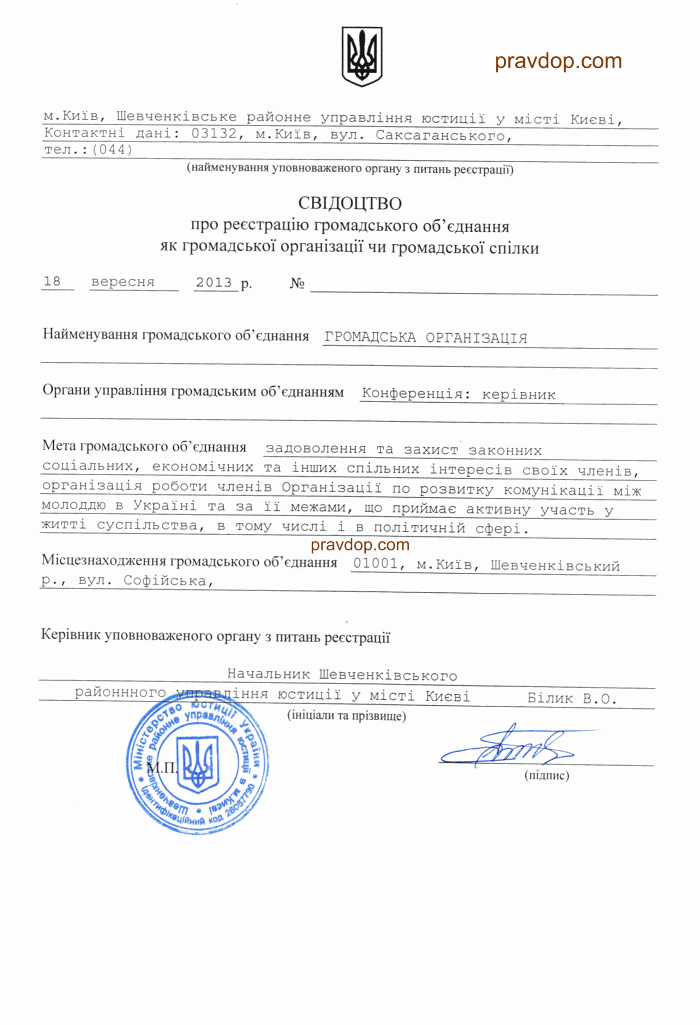

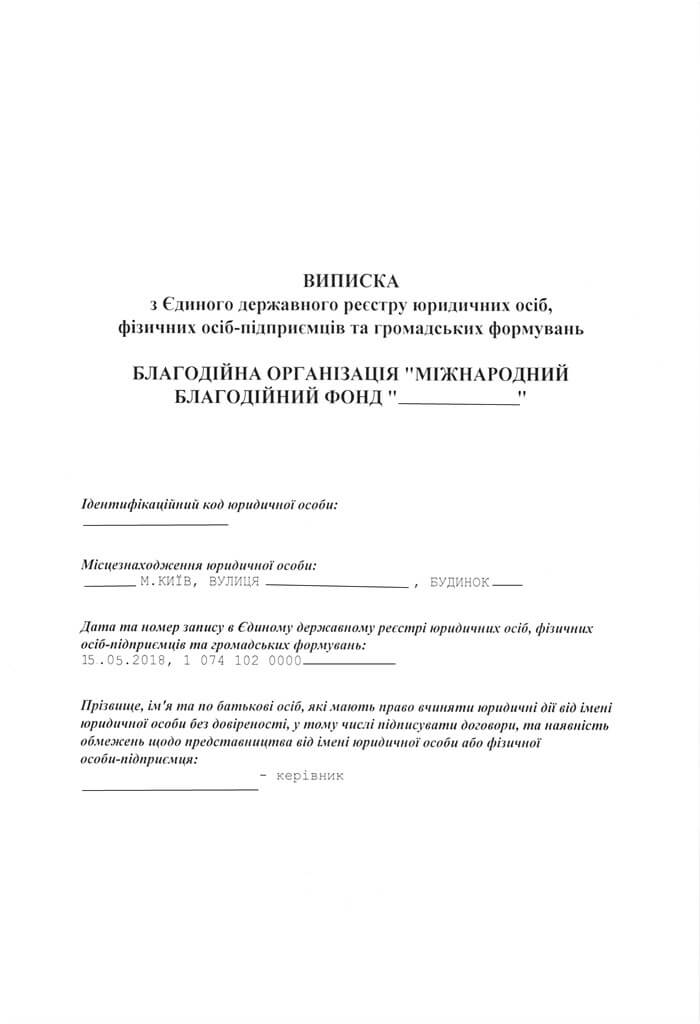

A non-governmental organization or public association is a legal entity, and consequently, it can possess distinct assets, and acquire rights and responsibilities, including those pertaining to its owned property. As a result, a non-governmental organization can acquire property, and property rights, and utilize them, provided that such acquisition and utilization are not prohibited by the current legislation of Ukraine and the organization's charter.

We highlight the charter's significance, as it precisely governs the activities of the non-governmental organization and the mechanisms for coordination, acquisition, and disposal of various types of property. Therefore, if the charter lacks essential provisions, it is advisable to update it, with the assistance of our company's legal experts.

Today, we will elaborate on what may be held in ownership by non-governmental organizations in Ukraine, how to acquire such property, and how to manage it without introducing risks to the organization.

You may also like: Legislation Governing the Activities of Non-Governmental Organizations

Objects that can be held in ownership by a Non-Governmental Organization (NGO) and the procedure for formalizing property rights

An NGO can acquire the following types of property:

1. Real estate. An NGO has the right to acquire ownership of real estate and dispose of such property in accordance with the law. The grounds for acquiring property can vary, ranging from complex privatization procedures to a purchase or donation agreement.

The acquisition of real estate involves the re-registration of property rights in the registry of real rights. It is crucial to properly prepare the documents and coordinate all actions with the registrar or notary. For instance, we recently provided consultation to a client regarding the sale of real estate owned by an NGO. However, to avoid the loss of non-profit status, we had to amend the charter and incorporate relevant provisions regarding the sale of property. The procedure for selling property in such a case would be as follows: prepare documents, coordinate with the notary, and oversee the buying and selling process.

2. Movable property – vehicles. Non-Governmental Organizations have the right to acquire vehicles as their property. The grounds for acquisition are also diverse – it can be through purchase, donation, or another form of transfer in favor of the NGO. It is important to note that vehicles entail the obligation of registration with the traffic authorities and for military purposes. Therefore, if an NGO purchases a vehicle, it will be necessary to undergo re-registration with the Ministry of Internal Affairs and enlistment for military purposes.

3. Corporate rights. NGOs can be participants in other legal entities and own a portion of the charter capital of such legal entities. For instance, we assisted in the sale of a 30% stake in the charter capital of an LLC owned by an NGO. From the NGO, we obtained the General Meeting Protocol of the NGO members, the charter, and the personal presence of the NGO director for signing the purchase and sale agreement and the transfer of rights document.

4. Trademarks and intellectual property. Non-Governmental Organizations (NGOs) not only have the right to use their own symbols but also can register or acquire trademarks, obtaining corresponding protection for their distinctive marks. In our practice, there are numerous examples of this, particularly for organizations engaged in activities related to the arts and other creative endeavors. Recently, we registered a trademark for one of the NGOs involved in organizing dance events and promoting specific dance styles. Concerning other forms of intellectual property, NGOs may hold property rights to such objects.

5. Other objects and property rights. A non-governmental organization may possess various other items, including funds, assets, property rights, and so forth.

You may also like: How to Secure an International Grant for a Ukrainian Non-Governmental Organization?

Alienation of property rights of a non-governmental organization

Disposition of Property Rights of an NGO involves considering the following factors:

1. Legally defined procedures for property alienation, the order, and the process. For example, when alienating real estate, it is necessary to carry out the re-registration of property rights in the real estate registry, formalize the corresponding transaction with a notary, and undertake other required actions. On the other hand, acquiring goods for the NGO's office will be done through a written contract. Therefore, the specificity of the alienated object needs to be taken into account.

2. The NGO's charter should define the necessary provisions. For instance, when conducting the sale or purchase of real estate, we highly recommend specifying the procedure and the possibility of executing such a transaction in the charter. Additionally, we recommend reflecting on the sources of income for the NGO in the charter. These provisions in the charter will help avoid the possibility of challenging transactions or losing non-profit status, as well as tax audits.

3. Authority. To sell property, an individual must have the appropriate authority. Typically, the organization's chairperson receives such authority from the general assembly of members. Executing a transaction without the proper authority can be grounds for declaring the transaction invalid, with corresponding consequences.

Therefore, if your non-governmental organization needs to dispose of specific assets, it is advisable to seek the assistance of legal professionals. Our team of lawyers is ready to help you and provide the following services:

- Analysis, consultation, and recommendations regarding asset disposal.

- Document preparation.

- Facilitation of the signing and execution of the sales procedure with a notary.

- Re-registration of real estate.

- Other necessary actions that need to be undertaken.

You may also like: Reporting by Non-Governmental Organizations in Ukraine: How to Receive Funding?

Transfer of Assets in the Event of Non-Governmental Organization Liquidation

Non-profit organizations, such as NGOs and public acossiations, typically include provisions in their charters regarding the transfer of assets in the event of the liquidation of one or several non-profit organizations or the allocation of such assets to the budget. Generally, before the liquidation process, NGOs address asset-related matters.

However, if there is still property remaining after the liquidation, it is necessary to transfer it to the entities mentioned above during the liquidation process. Typically, the transfer of such assets is accompanied by corresponding acts concluded between the recipient of the assets and the NGO, represented by the liquidator or liquidation commission.

In the event that it is necessary to liquidate an NGO, our experienced lawyers are ready to provide comprehensive support and advice on all aspects of this process. This includes handling the necessary documentation, liaising with relevant authorities, and ensuring the procedure is carried out in accordance with applicable legislation.

For over a decade, we have been collaborating with non-profit organizations in Ukraine, offering a range of services:

- Assisting in identifying the optimal path for initiating activities in Ukraine, including registration, accreditation, and related processes.

- Providing support in structuring NGOs in Ukraine.

- Offering legal assistance during the commencement of operations in Ukraine.

- Delivering accounting and legal support services in Ukraine tailored for NGOs.

- Assisting in resolving operational intricacies such as volunteer management, obtaining non-profit status, legal documentation for NGO funding, and more.

Learn more about our support for non-profit organizations here.

Discover the cost of registering changes in a Non-Governmental Organization here.