Assistance with Opening Bank Accounts for Non-Residents and Companies

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

As international business operations become increasingly common, opening bank accounts in Ukrainian banks for non-residents and their companies is gaining importance. This strategic step not only facilitates business expansion into new markets but also provides opportunities for efficient financial management and the execution of international transactions.

In this article, we will discuss the process of opening a bank account for non-residents and their companies in Ukraine, offering practical tips and recommendations. We will particularly focus on the possibility of opening an account remotely with the support of our expert. We are always ready to help those seeking reliable and convenient solutions for managing their financial operations and business activities in Ukraine.

You may also like: How to Open a Bank Account for a Foreign Legal Entity in Ukraine?

Opening a Bank Account in a Ukrainian Bank for Non-Residents and Their Companies: Why It Is Important

Opening a bank account in a Ukrainian bank for non-residents and their companies is a key step in establishing the optimal conditions for successful business operations in Ukraine. Having a bank account in Ukraine is particularly relevant for businesses with Ukrainian clients and those that sell their goods and services within the country. Let's explore some of the main reasons why opening a bank account in a Ukrainian bank is essential for non-residents and their companies:

1. Conducting Financial Transactions in Hryvnia and Other Currencies: Opening a bank account in a Ukrainian bank provides a convenient opportunity to conduct financial transactions in the national currency (hryvnia) or other major global currencies, which is necessary for conducting business and carrying out various operations in Ukraine.

2. Ensuring Legality and Transparency of Financial Operations: Opening an account in a Ukrainian bank allows non-residents and their companies to verify the legality and transparency of their financial operations in Ukraine.

3. Access to Loans and Other Financial Services: Opening a bank account expands access to various financial services, including loans, investments, insurance, and more. This can be a crucial factor in the development and expansion of non-resident businesses within Ukraine.

4. Optimizing Financial Processes and Reducing Administrative Costs: Opening a bank account in a Ukrainian bank enables the optimization of financial processes and the reduction of administrative expenses associated with conducting business in Ukraine.

Thus, opening a bank account in a Ukrainian bank is a relevant service for non-residents and their companies seeking to conduct their activities successfully in Ukraine.

You may also like: How to Use Your Corporate Account in Ukraine?

Guidelines for Choosing a Bank and Preparing Documentation for Successful Account Opening

Initiating the process of opening a bank account for a legal entity marks the first stage, where making the right choice of bank and preparing the necessary documentation is crucial. In collaboration with our clients, before selecting a bank, we conduct market research on banking services, assessing the bank's reputation, its experience with legal entities, as well as the available services and service conditions. We also compare the conditions for opening and servicing the account, including:

- Requirements for the minimum account balance

- Commission fees

- Account maintenance costs

- Access to online banking

- The complexity of compliance procedures

- Other important parameters

When selecting a bank for opening a company account, it's important to consider all these aspects. This will ensure efficient and secure business operations. In general, making the right choice of a bank can greatly facilitate financial transactions and contribute to the successful growth of your company.

Key Steps to Opening an Account in a Ukrainian Bank for a Legal Entity

Therefore, opening a corporate bank account is essential for convenient and efficient financial operations, contract negotiations, and settlements with partners and clients. At first glance, this procedure may seem straightforward and typical. However, in reality, to successfully open an account in a Ukrainian bank for a legal entity, it's necessary to consider many nuances. That's why we always recommend seeking assistance from specialists with years of practical experience. So, guided by our expertise, let's outline the key steps that need to be taken:

1. Bank Selection: The first step is to choose a bank that caters to legal entities and has experience dealing with non-residents. It's crucial to consider the bank's reputation, and financial stability, as well as its service conditions and fees.

2. Document Gathering: Our legal firm will assist in preparing the necessary documentation for opening the account. This may include the company's statutory documents, registration certificate, taxpayer identification code, passports of founders and directors, and other documents required according to the bank's internal policies.

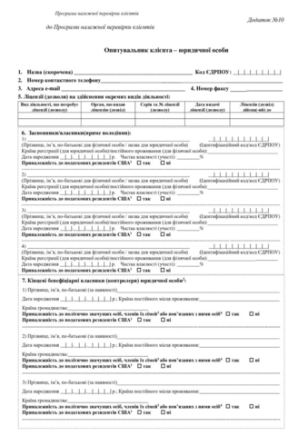

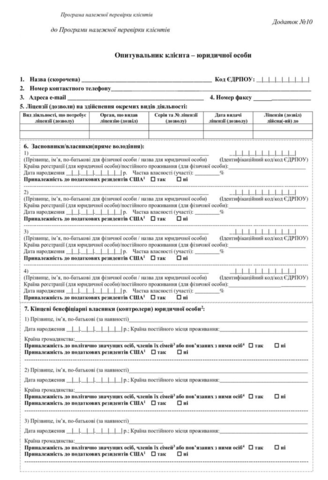

3. Form Completion: After selecting the bank and compiling the necessary documents, we will fill out the account opening forms and bank documents. These forms typically include basic information about the company and its directors, as well as the type of account the client wishes to open.

4. Compliance Process Assistance: Once all documents are submitted, the bank will commence the client's verification process. Bank managers may request additional documents and explanations. Professional legal assistance is crucial at this stage to minimize the risk of rejection. Our team can provide accurate and comprehensible responses to the bank's inquiries and prepare the necessary supporting documents.

5. Receipt of Account Details: Upon successful completion of the verification process, the bank will furnish you with your account details, enabling you to conduct financial transactions seamlessly.

It is important to remember that the procedure for opening a bank account can vary depending on the rules and requirements of each specific bank. Additionally, having legal assistance can be helpful in simplifying this process and ensuring compliance with all regulations and requirements.

Opening a Bank Account Remotely: A Case Study

Let's examine the case of our client, a foreign national who contacted our law firm for assistance in opening a personal account and a company account in Ukraine. Due to the ongoing conflict, he was unable to travel to Ukraine to visit the bank in person. However, this was not an issue for us, as we have experience in opening bank accounts remotely through a power of attorney, with minimal involvement from the client.

Upon taking on the case, our company first conducted a market analysis to identify the best bank that met all the client's needs and, crucially, offered the option to open accounts remotely, as not all banks provide this option. We then prepared the complete set of necessary documents, including a power of attorney for a representative from our law firm to open the accounts on the client's behalf.

Our specialists then ensured the documents were sent to the bank and managed the entire account opening process. Thanks to our thorough preparation, we successfully navigated all the bank's compliance stages and opened the accounts for the client in a short timeframe. The client was satisfied with our collaboration, as we facilitated a convenient process with minimal time investment required from him.

If you need assistance with opening a bank account in Ukraine, we are here to help. Our team is ready to provide a full range of services to support non-residents and their companies in opening bank accounts, ensuring a personalized approach and high-quality service. We offer:

- Consultations on all aspects of the procedure and requirements for opening an account in a Ukrainian bank.

- Collection of necessary documentation and assistance in preparing the document package.

- Obtaining additional documents required for foreigners to open an account in compliance with the specific bank's requirements.

- Accompaniment of clients during bank visits and interaction with bank representatives.

- Assistance in completing the required banking forms and questionnaires.

- Continuous monitoring of the account opening process and prompt resolution of any issues that arise during the procedure.

Don't waste time on formalities. Reach out to us today, and we will be happy to help you open a bank account in Ukraine without any stress. We provide top-notch service and support at every step of the process.

Our clients