Is an alternative liquidation of a public organization possible in Ukraine? Stages of termination of NGO

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

A non-governmental organization (NGO), like any legal entity (if it was created with legal entity status, of course), may logically approach the conclusion of its activities and its complete termination. Where to start, what steps to take when considering terminating the activities of an NGO?

Stages of liquidation (termination) of an NGO

Avoiding mistakes and terminating the activities of an NGO is a task that requires attention. The process of stopping the functioning of an NGO consists of several important steps, each of which requires a careful approach. Below, we will examine this process in more detail and highlight key aspects of concluding the activities of an NGO.

Step 1: Decision of the General Assembly of Members

The very first and one of the most crucial steps, the correct execution of which determines much in the future. At the general meeting, when the decision to terminate the activities of the NGO is made, a liquidator or liquidation commission is immediately appointed. The functions of the liquidator can also be assigned to the acting manager. Since the organization most likely has non-profit status, like most NGOs, the general assembly must decide where to transfer the assets remaining on its balance sheet. This should be either a similar non-profit organization or the income of the state.

Step 2: Submission of Documents to the Justice Department

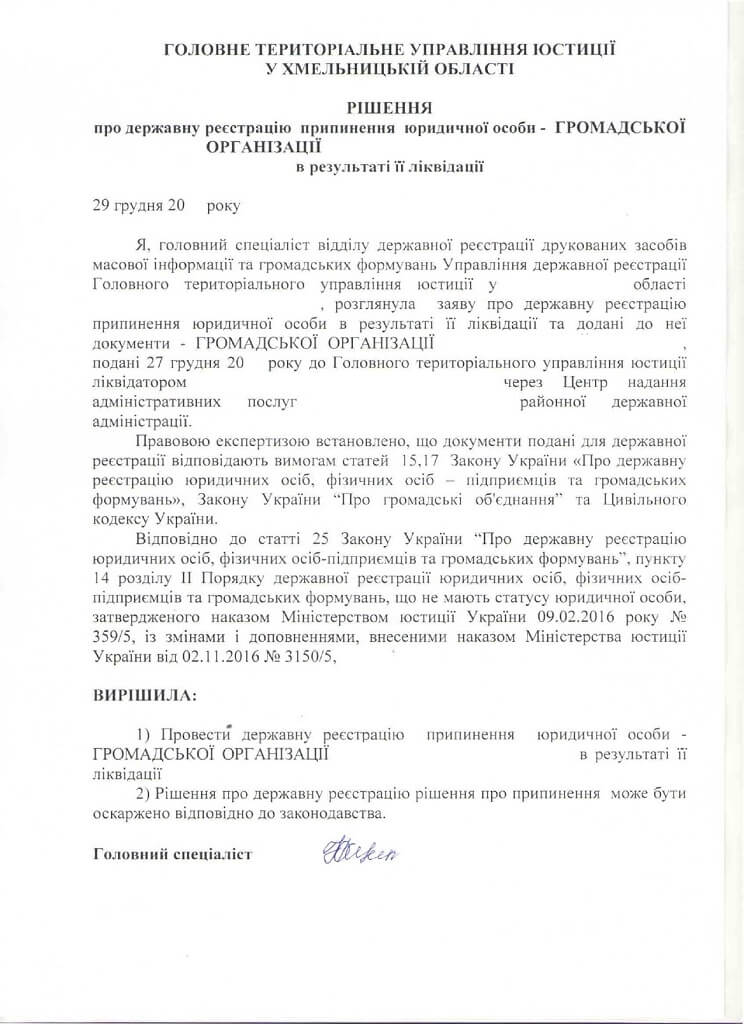

Submit the relevant application and one copy of the minutes of the general meeting or a notarized copy (prepare multiple copies from the start) to the justice department. Subsequently, the state registrar updates the Unified State Register with information that the organization is in the process of termination. In essence, this marks the beginning of the journey through all bureaucratic procedures.

Step 3: Inspection by Government Agencies, Tax Inspection

Many have heard about the queues for inspections. They were not scheduled during several lockdowns and the ongoing war, at least until July 2023. So, waiting for the inspection to be scheduled takes a considerable amount of time. Going through a tax inspection can be challenging if the organization had financial transactions, salary accruals, or vice versa, a lack of accruals, etc. The State Tax Service, in addition to the tax clearance certificate, also examines social security contributions for pension insurance. It issues a certificate of absence of arrears in the payment of the single social contribution (SSC).

If needed, our lawyers can assist you in completing this inspection in the shortest possible time, thanks to their competence and extensive experience. Entrusting this process to us will relieve you of worries about navigating inspections. Of course, we cannot prevent fines if there are actual arrears. However, we will protect you from unfair scrutiny by inspectors and unjustified delays in processing. The ultimate goal of the inspection is to obtain certificates of absence of arrears and removal from the register as a taxpayer and SSC payer.

Step 4: Submission of Documents to the Archive and Final Termination

All primary documentation and certificates from the State Tax Service regarding the inspection must be submitted to the state archive for storage. On the surface, this step might seem straightforward – submitting documents to the archive. However, even here, the process is not always simple. We have had clients who navigated through various inspections themselves but stumbled at the archive stage. This is because conscientious archive staff, often of the "old school," have a deep understanding of how documents should appear, the correct composition (sequence), and how they should be bound.

After successfully completing the archiving process, you will receive a document confirming the submission of documents to the archive. This document allows you to approach the state registrar, who updates the register with the information that the legal entity has been terminated.

Alternative Dissolution of a Non-Governmental Organization in Ukraine

The concept of alternative dissolution often sparks interest, especially when it comes to getting rid of an obsolete non-governmental organization (NGO). In essence, alternative dissolution does not imply a complete cessation but rather involves a series of procedures through which corporate rights and management are transferred to others, and the old participants or leadership are no longer connected to the organization.

In the case of an NGO, the situation is more complex as currently only a change in leadership is possible. Founders remain on the list of founders in the Unified State Register indefinitely until a procedure for changing founders is approved, although relevant bills are already in progress. It's crucial to understand that if a change in leadership is made without an approved procedure for changing founders, it may lead to subsequent complications.

Is there a threat to founders? In reality, no, since it is assumed that founders merely established the organization and have no further obligations. They become regular members of the organization, just like those who join later. Nevertheless, many are concerned about the presence of their names on the list of founders and seek to remove their information from this list.

Note: This statement aligns with the law but lacks procedural approval. Currently, it's not possible to remove or replace one of the participants. However, there are procedures to indicate in the corresponding section not surnames but simply the phrase "founders - individuals."

It's crucial to understand that responsibility for managing the affairs of the NGO always falls under leadership and accounting, sometimes the supervisory board if present. Members of the organization cannot be held responsible for signed contracts, unfulfilled obligations, or the submission/non-submission of reports. All these aspects fall under the leadership's responsibility. Therefore, when choosing a method to terminate the organization's activities, this should guide the decision.

If you need to cease your non-governmental organization's (NGO) activities, and the bureaucratic process and time involved seem overwhelming, feel free to reach out to us. Our team is ready to take on the challenge, saving your time and efficiently addressing the issues related to dissolving the organization.

The cost of liquidating an NGO in Ukraine can be found here.

Also, you may find the following services interesting:

Registration of Changes in a Non-Governmental Organization.

Legal Support for Public Associations (Organizations and Unions).

Our clients