SUPPORT OF TAX AUDITS IN UKRAINE

Cost of services

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

What we offer

-

Reviewing requests for explanations and document submission;

-

Analyzing the schedule for scheduled tax audits;

-

Drafting responses to requests for explanations and document copies;

-

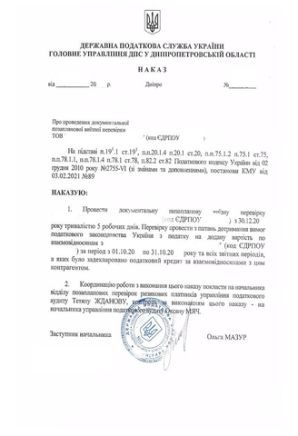

Assessing the Order regarding the tax audit;

-

Examining primary documentation prior to the audit to identify potential risks related to penalty sanctions and additional tax liabilities;

-

Conducting employee training on behavior during the audit;

-

Providing consultations during the tax audit;

-

Supplying responses and clarifications during the audit;

-

Analyzing the tax audit report;

-

Preparing objections to the audit report.

Required documents

Types of Tax Audits

- Documentary audits: scheduled and unscheduled, with the possibility of unscheduled audits being off-site audits.

- Factual audits.

- Desk audits (which are off-site audits focused on taxpayer reporting)

Consequences of a Tax Audit

Following a tax audit, the supervisory authority issues an act or certificate in case no violations are found. Based on the audit findings outlined in the Audit Report, the supervisory authority issues a tax notification-decision. This decision may include penalties or tax assessments, the amounts of which depend on the violations identified in the audit report.

How We Assist

Our team provides comprehensive support to clients during unplanned audits, planned audits, factual audits, and desk audits. Even before the audit begins, we identify potential risks related to penalty sanctions and tax assessments.

Why Choose Us?

- Expertise and Preparation: Success in tax matters begins with thorough preparation. Our team conducts a comprehensive analysis of your tax situation and formulates strategies proactively, ensuring readiness even before a tax audit commences.

- Security and Risk Minimization: Your security is our primary concern. If tax risks cannot be avoided, we will devise a strategy to minimize them effectively. We handle all complex processes, ensuring that your involvement, even during legal proceedings, is kept to a minimum.

- Comprehensive Support: From the initial preparation to the final appeal, our team of seasoned accountants and lawyers will support you every step of the way. We have extensive experience with various business structures and have consistently managed successful audits for many years.

- Prompt Response: In the event of an unexpected audit, timing is critical. Our team responds swiftly, providing you with the necessary time to make informed decisions and prepare adequately.

- Proven Track Record: Our firm is proud of its achievements, including successful appeals involving sums exceeding 50,000,000 UAH and assisting over 100 clients with their tax challenges in recent years.

By choosing us, you gain not only our expertise and experience but also comprehensive support and a guarantee of successful resolution of your tax issues.

Service packages offers

This package is the first and mandatory step in supporting any inspection process.

Legal assistance includes:

-

Analysis of primary documentation to identify potential risks of fines and tax liabilities

-

Review of the inspection order (notification-decision)

-

Legal opinion on the chosen strategy for protecting your interests and defining the legal scope of work required for supporting a tax audit

* Final cost may vary depending on the volume of primary documents and complexity of the case.

This package is provided after the Audit (Package 1).

Legal support includes:

-

Review of requests to assess the validity of the requested documents and the appropriateness of providing them in the volumes indicated

-

Preparation of responses to requests within the scope of the tax audit

-

Analysis of the Client’s counterparties involved in the audited business transactions to verify due diligence in their selection (we review all available registries and exchange incorporation documents with the counterparties)

-

Preparation and delivery of key recommendations to staff on how to behave during the inspection

-

Legal representation during the inspection, including preparation of objections to the audit report

* The package cost for scheduled audits will be higher and will depend on the audit period and the volume of initial documentation.

Legal support for appealing the audit report starts from 28,000 UAH (700 USD):

-

Analysis of the audit report and its annexes

-

Preparation and drafting of objections to the audit report

-

Lawyer’s participation in the review process of the objections to the audit report conclusions (if necessary)

Judicial appeal in the first instance starts from 60,000 UAH (1,500 USD):

-

Analysis of the audit report and annexes, as well as initial documentation

-

Collection of evidence, preparation of all required procedural documents (claim, response to counterclaims, etc.)

-

Lawyer’s participation in the court hearing, including document preparation

Legal support for appeal proceedings starts from 32,000 UAH (750 USD):

-

Analysis of the audit report, court decision, and initial documentation

-

Collection of evidence, preparation of all necessary procedural documents (appeal, response to counterclaims, other required documents, participation in hearings)

-

Participation of a lawyer in court hearings, document preparation

* Final cost depends on the complexity of the case and the amount of the claim.

Handling Actual Tax Audits

Actual tax audits are carried out at the taxpayer's place of business activity and the locations of the taxpayer's economic or other property rights.

These audits are conducted without prior notification to the taxpayer and aim to ensure the taxpayer's compliance with legal regulations pertaining to:

- The possession of licenses and certificates, including those related to the production and circulation of excisable goods.

- The procedures followed by taxpayers in conducting financial transactions.

- The management of cash transactions.

- The regulation of cash flow.

- Employers' adherence to labor contract legislation and the proper documentation of employment relationships with employees (hired individuals).

In contrast to documentary and desk audits, actual tax audits are conducted in cases and according to procedures established not only by the Tax Code of Ukraine but also by other laws, for which regulatory authorities are responsible for enforcement.

Within the framework of conducting an actual tax audit, the regulatory authority has the right, among other things, to employ specific procedures:

- Conducting a control calculation operation (prior to the commencement of the audit).

- Timing economic transactions (during the audit).

It can be challenging to prepare for such audits as they are carried out without prior notice. Engaging an attorney during the audit is advantageous, as a lawyer can:

- Assist in preparing and providing qualified responses to the auditors' inquiries.

- Ensure that the audit procedures are adhered to.

- In case a report is generated as a result of the audit, provide timely and well-founded objections in accordance with the deadlines specified by the Tax Code of Ukraine regarding such findings.

Supporting Documentary Audits

There are two types of documentary audits:

- Unscheduled (on-site and off-site) audits.

- Scheduled audits.

These audits are appropriately named "documentary" because the regulatory authority examines the documents (primary documentation) related to the taxpayer's activities during the corresponding audit period. Therefore, meticulous attention must be given to the primary documentation before the audit commences, as substantial penalties and tax liabilities can be imposed based on the audit outcomes.

Furthermore, the audit results can lead to alterations in the tax system. For instance, a violation of the conditions for remaining on the simplified tax system may result in a shift to the general tax system. In such cases, the regulatory authority not only transitions the taxpayer to the general tax system but may also impose additional tax liabilities for the entire period, starting from when, according to the regulatory authority, the conditions for the preferential system were breached.

Moreover, based on the audit results and the tax notifications and decisions issued as a result, a taxpayer may face criminal charges for tax evasion.

Handling primary documentation can be done either before or during the audit, depending on the client's situation and at which stage a lawyer is engaged.

Unscheduled audits are typically more predictable because they are often preceded by a request for written explanations and the submission of primary documentation. This allows for preparation ahead of the impending audit and organizing the primary documentation for the relevant audit period.

Scheduled documentary audits are the most comprehensive among all types of audits as they encompass all tax matters for the audited period.

Supporting Desk Audits

A desk audit is an examination conducted solely within the premises of the regulatory authority and is based exclusively on:

- Data provided in the taxpayer's tax declarations (returns).

- Data from the electronic administration system for value-added tax (VAT), which includes information from the central authority responsible for implementing the government's treasury policy regarding taxpayers' accounts in the electronic VAT administration system, data from the Unified Registry of Tax Invoices, and data from customs declarations.

- Data from the Unified Registry of Excise Invoices.

- Data from the electronic administration system for the sale of fuel and ethyl alcohol.

The subject of a desk audit is the taxpayer's tax reporting.

The common basis for conducting a desk audit is the submission of a tax declaration (return) by the taxpayer, which is subsequently accepted by the regulatory authority.

A notable feature of desk audits is that they are carried out by officials of the regulatory authority without the need for any specific decision from the head (or their deputy or authorized representative) of such an authority or department. The taxpayer's consent to the audit and their presence during the desk audit are not mandatory.

When accompanying a desk audit, the actions of a tax attorney are primarily focused on preparing objections to the desk audit report. This is because during such an audit, deadlines may not be observed or tax code provisions may be incorrectly applied by the auditor.

Why us

Our clients

Our successful projects

Can you refuse access to the auditors?

Yes, it's possible to deny access to auditors. However, in such cases, the supervisory authority may impose administrative measures, such as seizing assets. A lawyer will assess the situation and the potential risks specific to your case.

What's the duration of a tax audit?

- Unscheduled audits typically shouldn't exceed 10 working days.

- Scheduled audits can last up to 20 working days.

- Factual audits cannot exceed 10 days.

In what situations can a tax audit be suspended?

A tax audit can be suspended when there are objective reasons, such as:

- The need to obtain an expert opinion.

- The taxpayer's recovery of lost documents.

- Obtaining information from foreign government authorities about the taxpayer's activities, and so on.

What documents need to be provided during an audit?

During an audit, you're required to provide documents only for the period specified in the audit request or order. Typically, this includes:

- Primary documents that reveal the content and essence of the business transaction.

- Financial reporting documents.

- Tax reporting documents.

Answers to frequently asked questions

What are the consequences of a taxpayer not providing documents during an audit?

Refusing to provide documents during an audit can have serious consequences. The supervisory authority may proceed to assess tax liabilities for those transactions in full.

Does receiving a request for explanations and document copies precede a tax audit?

Yes, typically, even after providing a comprehensive response to a tax request, the tax authority may still initiate an audit, often citing the alleged absence of requested documents or insufficient explanations for the questions posed in the request.

How to prepare for a tax audit?

To effectively prepare for an upcoming tax audit, you should thoroughly analyze the primary documentation, financial records, and tax reports of your business for the expected audit period. This is the most effective way to minimize the risks associated with potential penalty sanctions and tax liabilities.

Grounds for conducting unscheduled tax audits

The reasons for conducting unscheduled tax audits are outlined in section 78.1 of the Tax Code of Ukraine. The Tax Code of Ukraine enumerates 27 specific grounds for initiating tax audits. However, some of the most common reasons include:

- Failure by the taxpayer to provide requested copies of documents to the supervisory authority.

- Discrepancies or inconsistencies in the submitted tax reports.

- When a taxpayer submits a declaration claiming a refund from the budget, specifically related to value-added tax (VAT), based on grounds specified in the Tax Code of Ukraine, and/or when there is a negative VAT amount exceeding UAH 100,000.

How to verify the credentials of a tax inspector?

Before commencing the audit, tax inspectors are required to present an audit order, an official direction, and an employee identification card issued by the supervisory authority. In the absence of proper identification, the taxpayer has the right to deny access to the inspectors for the purpose of the audit.

Roles and responsibilities of a tax attorney during an audit

During an audit, a tax attorney:

- Verifies the legality of the grounds for conducting the audit, including analyzing the audit order and directions.

- Provides consultations to the client regarding the decision to grant or deny access to auditors before the tax audit begins.

- Analyzes and responds to requests received during the audit process.

- Participates in preparing written explanations in response to the auditors' requests and assists in providing the necessary documents during the audit.

If you are looking to prepare for a tax audit or require assistance during an ongoing audit, please do not hesitate to reach out to us!