Legal support for charitable organizations in Kiev

Cost of services

Reviews of our Clients

What we offer

-

choosing the form of a charitable organization that best suits the founders' interest (in Ukraine, they can be registered as a charitable company, a charitable foundation or a charitable institution);

-

elaboration of the charitable organization's constituent documents, allowing the founder/founders to be confident in their control over the organization and its activity;

-

advising on the taxation of benefactors and beneficiaries;

-

obtaining the non-profit status;

-

inclusion into the register of volunteer organizations;

-

personnel and accounting services for charitable organizations

-

immigration consultations and obtaining documents (work permits, residence permits)

-

legal support for fundraising mechanisms;

-

drafting agreements, providing written and oral consultations on the application of Ukrainian legislation.

We are the best because:

- We are a team of experts with experience in creating and supporting charitable foundations in Ukraine, including complex cases: foreign organizations, accreditation, etc.

- We take care of all the needs of organizing work in Ukraine: accounting, legal and personnel support, all types of reporting, hiring, procedures for working with volunteers and migration services.

- It’s convenient and understandable with us. Completeness of information both at the start of working with us and every minute in the process.

- Foreign funds will receive a full understanding of the structure of work and reporting with the parent organization.

Documents required

What benefits will you get from charity support services?

Planning to start work in Ukraine, non-profit foreign and Ukrainian organizations may face the following challenges:

- there are often needs that the foundation itself does not know how to implement - for example, to bring a car to Ukraine, to pay for mobile communications of subordinates, to rent an office, to conduct tenders, etc;

- the diverse nature of the assistance received (and today it can be in any form, even cryptocurrencies) is confusing, requires certain designed mechanisms of accounting.

In case of foreign charities, organizations that operate in Ukraine through representative offices or new foundations, their situation is even more complicated:

- they have an understanding of how it works in another country, but no knowledge of how to set up all the processes in Ukraine;

- a frequent problem is the complete dependence on the regulations of the parent organization, for example, the need to hold a tender for services every time, work only through a representative office and not through other forms, a certain format of relations and subordination, etc. And all these aspects shall be specified in the rules of work in Ukraine.

Support services relieve charities of all these problems. Such concerns fall on the shoulders of a professional accountant and lawyer.

What do our company's support services support?

Comprehensive support services consist of several parts, which complement each other. The standard package of services includes:

- Legal services - providing consultations, working with contracts, corporate matters and other legal issues that may occur in the work;

- Accounting service - submitting reports, paying salaries, etc.;

- Personnel services - we will help with personnel documents, hiring and firing employees;

- Work with the accounts of the charitable foundation.

Additionally, if necessary, we provide assistance in obtaining documents for the work of foreign citizens - residence permit, work permit, ID code, etc. We help to organize work with volunteers in Ukraine, get the opportunity to attract foreign volunteers to the activity.

Service packages offers

Provision of document templates for fund work:

- orders for employees, draft labor agreements (contracts), employee statements, time sheets, staff lists, etc.

- regulations on confidentiality and protection of personal data, statements and orders related to work with personal data and confidential information

- an agreement on the provision of charitable donation, an act and a request for receiving charitable donation

- agreement on involvement of volunteersagreement on the provision of services, performance of works, purchase and sale

*The package is offered for new charitable foundations at the start of work

*At the request of the Client, document templates can be adapted to the needs of the Client's fund upon separate agreement

Submission of reports on the activities of the fund

Consulting: 5 hours of work by a lawyer per month on issues related to the activities of the Fund, including, but not limited to:

- providing legal advice (written and oral) regarding the work of the organization

- preparation of contracts, acts, requests, answers, letters and any other documents upon request

- participation in negotiations with counterparties

- providing explanations and answers to the requests of state authorities, local self-government, legal entities and individuals

- preparation of personnel documents (orders, orders, employment contracts)

- providing advice on taxation and non-profit compliancere

- presentation of the organization's interests in state authorities, notaries, banking institutions, etc.

- other legal services (except support of inspections by state bodies, litigation and claims work, corporate issues)

-

Analyzing organizational and supporting documents for humanitarian aid

-

Obtaining a Qualified Electronic Signature (QES) if required

-

Registering in the Automated Humanitarian Aid Registration System

-

Obtaining a recipient number for humanitarian aid

-

Completing electronic forms and registering the cargo in the system

-

Acquiring a Unique Humanitarian Aid Code.

-

Filling out a declaration for goods recognized as humanitarian aid according to customs regulations

-

Inputting data into the inventory description when necessary

Main challenges that charities and foundations face in Ukraine

Here are the most common situations for charities in Ukraine:

- The transfer of charitable assistance must be documented. Otherwise, you might face the risk of penalties from the Tax Service. These may be Acceptance Acts, individual contracts, and more, depending on the situation. Our company can develop a number of templates that the organization can use in their work. The second option is hiring a lawyer on staff, who will supervise the execution of the transfer of assistance.

- You need to follow the 80/20 rule. A charitable organization may charge no more than 20 percent of its income to administrative costs. However, good cost planning can lower administrative costs. This planning can be done both at the start of an activity and as it progresses. We offer a working combination of accountant and lawyer for such an audit.

- A charitable organization may operate only within the scope of activities set by the Law of Ukraine "On Charitable Activities and Charitable Organizations". We will help you to choose and indicate the spheres of activity in the charter correctly.

Charitable organization and taxes

The vast majority of charities are non-profit organizations and do not pay income tax. Therefore, the non-profit criteria must be met. However, in the case of hiring employees, charities are required to pay taxes for individuals, just like other legal entities.

Therefore, non-profit organizations must keep accounting records, pay taxes for employees, and have all the necessary documents to avoid the risk of penalties from the controlling agencies.

In addition, charitable organizations have some limitations, for example, only 20% of the money the organization receives can be spent on administrative costs, such as office rent, payroll, purchasing office supplies, etc. The other 80% must be spent on the organization's operations.

Violating this rule can lead to a loss of a nonprofit status and penalties. But sound legal and accounting planning allows for a more efficient allocation of the organization's funds and ensures that the 80/20 rule is not violated.

If such scheme of work will not suit your organization, we will suggest other options for doing business in Ukraine.

What do charity support services include?

Charity support is a complex of legal, accounting and personnel services, which are provided by employees of our company. This includes any legal and accounting assistance to a charitable organization, starting from the registration of a charity organization and ending with the support of the implementation of any projects.

When working with charitable organizations, we first determine the list of services that they may need, depending on the plan for their activities in Ukraine. It all depends on whether such an organization plans to hire employees, work with volunteers, the amount of charitable donations, etc.

Why us

Our clients

Our successful projects

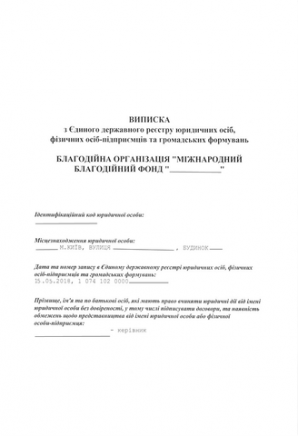

What documents must a charitable foundation have?

- Statutory documents;

- Agreements and acts on the transfer and receipt of charitable assistance;

- Personnel documents;

- Extract from the register of non-profit organizations;

- NDA agreements and documents on handling personal data.

This is a standard set of documents, which can be adjusted depending on the charity's organization, its goals, and other factors.

Involvement of volunteers in the work of the charitable foundation

If the charity is planning to involve volunteers in its work, it is necessary to obtain registration in the volunteer registry. Also, it is necessary to conclude an agreement with the volunteer and (we strongly recommend) to get insurance for the volunteer. We can help you with all of these issues.

Organizing the fund flow at a charitable foundation

A charitable organization may initiate a public collection, receiving help from legal entities and individuals. The help should be documented, and we will be pleased to help you with that.

However, the most important issue is usually the way the organization uses the money it has received. This requires correct accounting and legal support of each project of the organization.

Answers to frequently asked questions

What documents can confirm the transfer of donations to the charity?

Contracts, certificates and photo-video fixation (just in case)

Is there criminal liability for misuse of charitable aid?

Yes. Art. 201-1 of the Criminal Code of Ukraine provides for liability for the sale of goods (items) of humanitarian aid or the use of charitable donations, gratuitous aid or other transactions for the disposal of such property for profit, committed in a significant amount.

Can foreigners work in a charitable organization in Ukraine?

Yes. There are two options - employment through obtaining a work permit and volunteering. Both options have their own specific features.

Can a charitable organization conduct business activities?

The law provides for the possibility of conducting business activities, but without the purpose of making a profit.

The advantages of legal support for charitable organizations by our company

- We support a number of organizations from the first day of their registration, which allows our lawyers to deeply understand the internal processes of organizations;

- Specialists of the Tax Practice Group offer optimal tax solutions for all parties of the relationship (benefactors and beneficiaries);

- We constantly follow the developments in the regulation of charity and respective court practice in Ukraine;

- We have experience in supporting charitable foundations founded by foreign citizens, foreign organizations and employing foreigners;

- We assist in organizing the work structure of an organization. For example, to create a supervisory board, to limit the powers of the head of the organization and develop effective control mechanisms. If the organization is large, we help to open branches all over Ukraine, where possible;

- If the format of the work through a charitable organization is not suitable, we will suggest other options, for example, accreditation of the organization's representative office in Ukraine, public organization etc.;

- We will help with changes in the charitable organization, if required.

Consultation of a lawyer on support of charitable organizations in Ukraine

If you want to understand how charitable organizations are registered and provided with legal support, contact us for an introductory consultation. A lawyer will tell you:

- What is included in the legal support of a charitable foundation in Ukraine;

- What issues will be covered by legal support in your case;

- How we can develop a personal package for legal support for you.

Since 2009 our company has started to provide legal assistance for charitable organizations in Kyiv, most of them have passed the initial state registration with our help.

Apart from the charitable organizations initially registered in Ukraine, we also support activities of foreign charitable organizations' branches in Ukraine.

If you are interested in more detailed information about legal support for charitable organizations in Kyiv and Ukraine, don't hesitate to contact us.