What to Do If You Receive an Act After a Desk Audit?

Cost of services:

Reviews of our Clients

Desk audits are a method by which regulatory authorities analyze taxpayers' tax reporting. These audits are conducted in the offices of tax authorities and do not require the taxpayer's participation. The main sources of information for desk audits include tax declarations, the electronic value-added tax administration system, and other electronic registers.

Throughout our years of practice in tax law, we have found that many of our clients have faced instances of incorrect actions by tax authorities, which perceive violations where there are none. We understand that this can pose a serious challenge to your business, and dealing with such a situation without practical knowledge is nearly impossible. Even for an in-house accountant, this is not always feasible. Therefore, our team of lawyers is ready to take on this task. We will not only help you defend your lawful rights and interests, providing reliable protection, but also help you prepare for a tax audit to act proactively.

In this article, we will share useful information and discuss:

- How a desk audit is conducted?

- What the State Tax Service (STS) can check during a desk audit?

- How to appeal the Tax Audit Act?

We will consider appealing the Tax Audit Act using a real case example where a client's company faced a penalty totaling 2 million UAH. This will provide a better understanding of the process and help you learn how to effectively act and protect your interests in the tax sphere. Our goal is not only to provide you with quality legal support during a tax audit but also to help you become more knowledgeable in this area, ensuring full support at all stages.

You may also like: Appealing Penalties for Late Registration of Tax Invoices

The Procedure for Conducting a Desk Audit

Regarding the process of conducting an audit, it's important to note that desk audits typically occur within 30 calendar days following the deadline for submitting tax returns. If tax documents are provided after this deadline, the audit period is adjusted accordingly. During the audit, all aspects of the taxpayer's tax reporting are scrutinized, with particular attention to:

- Timeliness of report submissions.

- Fulfillment of specific tax obligations.

- Prompt registration of tax invoices.

These are commonly queried areas investigated by the regulatory authority during desk audits. It's worth mentioning that desk audits are conducted directly at the State Tax Service (STS) office, distinguishing them from field audits. In essence, the audit takes place without tax officials visiting the taxpayer's premises. Following the desk audit, a report detailing the findings is compiled. If no violations are discovered, a certificate confirming the accuracy of the company's tax records is issued. However, if violations are uncovered during the audit, an official report (Act) is prepared, documenting the identified issues. It's essential to recognize that the audit report can have significant implications for the business.

Receiving an Act During a Desk Audit: What to Do?

If violations are detected during a desk audit, an Audit Act is prepared, which is signed by the authorized officials of the tax authority. Taxpayers have the right to raise objections to the Audit Act. Following the review of your objections, the tax authority will send you a letter detailing the results of the objections, either informing you of the cancellation of the conclusions of the Audit Act or confirming the conclusions of the Audit Act without changes. The next step is for the tax authority to issue a tax notification-decision. Based on the corresponding tax notification-decision, penalties are typically applied to the taxpayer.

It's worth noting that such tax notification-decisions are subject to two types of appeals:

- Administrative appeal.

- Judicial appeal.

The deadlines for appealing tax notification-decisions resulting from a desk audit, both administratively and judicially, are the same as those for appealing tax notification-decisions made as a result of an unscheduled or scheduled inspection – 10 days.

How to Protect Your Interests After Receiving a Tax Audit Report?

Taxpayers are advised to meticulously review and analyze the Audit Report, which is compiled based on the findings of the actual audit, and to promptly respond to it. We recommend leveraging the right granted to taxpayers by the Tax Code of Ukraine to raise objections to the identified violations. To draft objections to the Audit Report, we suggest turning to our team of qualified lawyers for effective protection of your business and time-saving.

Furthermore, in cases involving complex issues or situations related to desk audits, taxpayers are always encouraged to seek advice from qualified lawyers or tax consultants. We will provide you with professional assistance in resolving legal issues, protecting your rights, and preventing possible negative consequences.

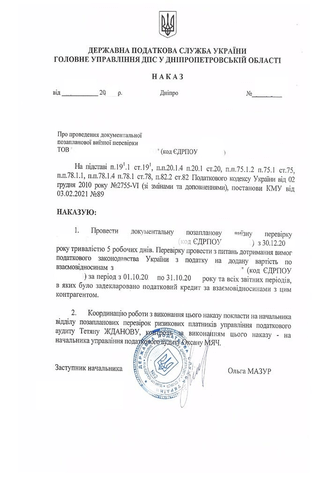

For example, a client primarily engaged in wholesale trade of construction materials approached us with an issue: they received tax notification-decisions following a desk audit sent to their postal address. After analyzing the tax notification-decisions, it was discovered that our client was fined over 2 million UAH for late registration of tax invoices.

After providing detailed consultation to the client regarding further actions, a joint decision was made to appeal the received tax notification-decisions in court, bypassing the administrative procedure to save time. Following the court proceedings, the tax notification-decisions imposing penalty sanctions totaling over 2 million hryvnias were overturned. Thus, by timely seeking assistance from our company and obtaining support from our tax law specialists, the client was able to appeal the Tax Audit Report and avoid a significant fine.

You may also like: Appealing Tax Audit Reports in Ukraine: Legal Assistance

Tax Audit Assistance from Our Legal Firm

In summary, desk audits are a crucial component of the tax system aimed at ensuring compliance with tax laws and identifying any violations. It's vital for taxpayers to:

- Understand their rights and obligations.

- Prepare adequately for audits.

- Respond promptly to any actions or decisions by tax authorities.

We advise our clients to avoid delays in submitting tax returns and related clarifications, ensure timely payment of tax obligations, and promptly register tax invoices and make any necessary adjustments to avoid adverse consequences and penalties from tax authorities. Additionally, we offer the following services:

- Comprehensive legal support during tax audits, including audit preparation, engagement with tax authorities, and defense in drafting audit reports.

- Consultations and guidance on tax law matters to help clients understand their rights and obligations as taxpayers.

- Recommendations to prevent violations of tax laws and mitigate risks associated with tax audits.

- Preparation and timely submission of accurate tax returns to prevent fines and sanctions.

- Development of strategies for effective tax management and optimization.

- Appeals against tax notification-decisions in cases of violations and imposition of penalty sanctions.

Do not hesitate to reach out to us for any issues that arise during a desk audit. Timely action can help mitigate further problems and avoid significant financial losses. Take advantage of our service for appealing tax decisions and drafting objections to desk audit reports.

Contact us today, and rest assured of professional support and successful resolution of any adverse tax situations!

Our clients