What is an offshore company? Company registration in offshore jurisdiction

Offshore is a method of tax planning, thanks to which a legal entity de facto operates inside the territory of one country, but is registered in another jurisdiction, which provides the best tax opportunities.

Many companies have to move their own business to offshore jurisdictions due to the difficult predictability of the political and economic situation in the countries where they operate.

What are the advantages of offshore zones?

There are more than fifty offshore zones in the world. Their absolute advantages over jurisdictions with traditional conditions are as follows:

- A simplified company incorporation procedure;

- Possibility of non-disclosure of data on legal entity controllers and final beneficiaries;

- Minimization of taxes, as well as the time allocated to fulfill obligations under them.

The list of offshore jurisdictions include mainly developed economies and developing countries, and in some cases parts of their territories.

This fiscal policy model is more advantageous and convenient for many states, as well as contributes to increased production, employment, gross product, technological progress, etc.

Related article: Legal Support Of Business: Is It So important?

How are offshore zones classified?

Offshore areas are usually classified into the following categories:

- High-status territories. They include offshore centres located in European countries.

The cost of their maintenance is the highest - from 10,000 dollars per year. These countries offer tax remissions for a certain types of economic activity.

Actually, financial activity in such jurisdiction is strictly regulated, because it is subject to regular audit inspections, and the requirements for keeping accounting records are also strict there. Data on controllers may be disclosed according to the usual procedure.

- Separate administrative-territorial units within countries with special fiscal conditions.

- Island offshore zones. Here we have a quite different picture: taxes as such are replaced by relatively small fixed contributions, there are low requirements for keeping accounting records, and the owners of companies maintain the highest level of anonymity.

How and where to set up an offshore company?

In order to register your business in an offshore zone, you must:

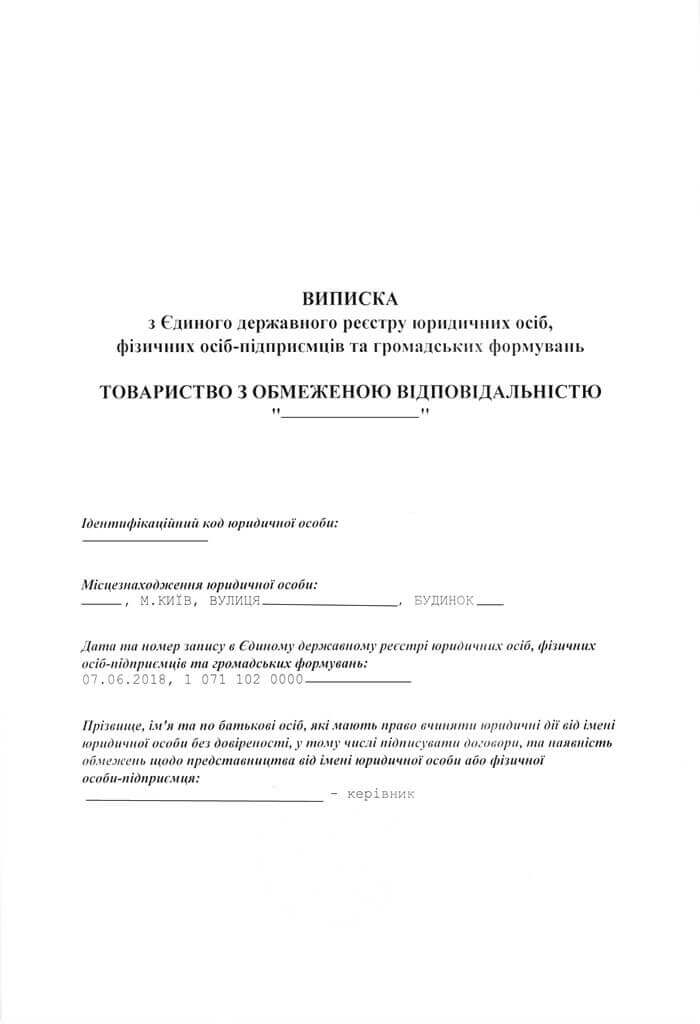

- have documents properly executed - the Memorandum of Association and the Charter. The documents shall be drawn up taking into account local laws and regulations;

- pay the registration fee, the amount of which is stipulated by law.

The cost of the offshore company incorporation may depend directly on the amount of the authorized capital and the geographical location of the offshore zone. The contribution is paid in the form of the annuity payment.

So, the answer to the question “How much does it cost to set up an offshore company?” will vary depending on many factors.

Related article: Why Is It Important For A Business To Have Not Only A Legal Address, But Also An Established Postal Service?

Additional requirements for setting up an offshore company

Most offshore areas do not have strict requirements for keeping accounting records (form and frequency of reporting). Annual reporting is a whim of only a few countries.

But a legal address of the company is a must. It is necessary to store documentation and to receive official requests from fiscal authorities.

If you want to know more about the consequences and possibility of registering an offshore company - call us! The lawyers of our company will provide you with a detailed consultation.

Our clients