How to Declare Cash When Traveling Across Multiple Countries

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Carrying cash across several borders is increasingly common among international travellers, expatriates, and business professionals. Entrepreneurs often transport funds for investments or contract payments, private individuals may bring cash for property purchases or tuition fees abroad, while others keep it as an emergency reserve during extended trips. Although digital banking and electronic payments have simplified international transfers, in many cases cash remains the most practical option.

Each country, however, has its own rules on the movement of currency and other monetary assets. The reason is straightforward: authorities seek to prevent money laundering, terrorist financing, and other illicit financial activities. Even well-intentioned travellers can face serious consequences if they fail to declare cash correctly or cannot provide proof of its lawful origin.

This article explains how to plan your journey with customs requirements in mind, what declaration limits apply in different jurisdictions, which supporting documents you should carry, and how to reduce risks when travelling with cash across multiple borders.

You might also like: Carrying Cash Across the Ukrainian Border: Common Issues and How to Avoid Them

Limits and Rules for Carrying Cash Across Borders

Every country sets its own rules for transporting cash across borders. The general principle is the same almost everywhere: amounts exceeding the equivalent of 10,000 euros or US dollars must be declared. However, there are important nuances that vary by jurisdiction.

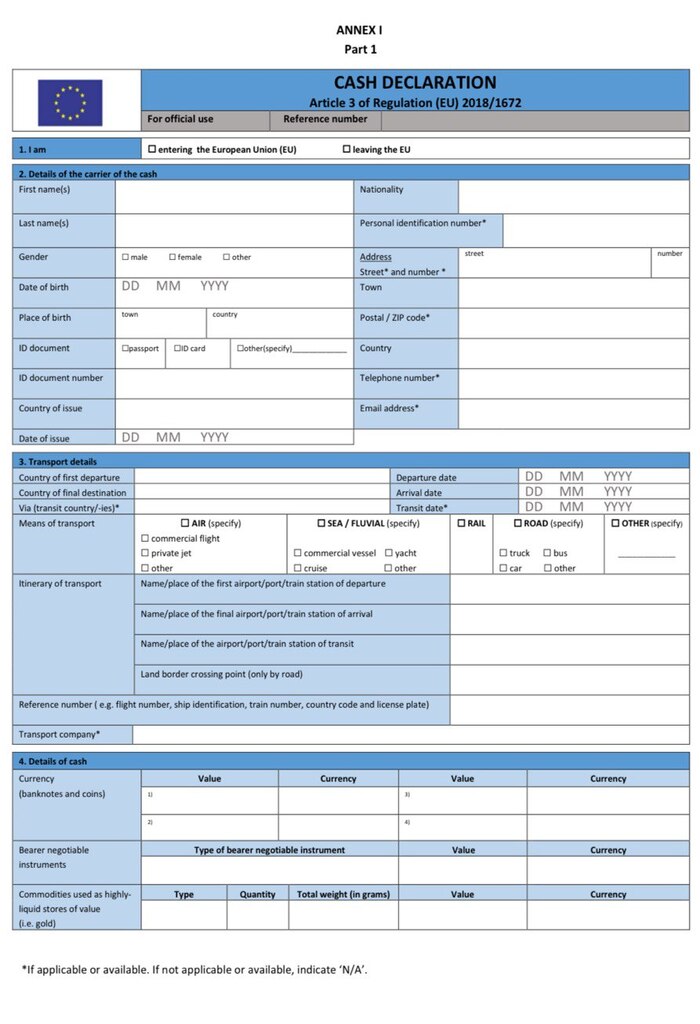

- When crossing EU borders with third countries (non-EU members), any amount over €10,000 must be declared in writing. For example, if you are flying from Ukraine to Spain with a transit stop in Poland and carrying €15,000, you are required to declare the amount upon entering Poland.

- U.S. customs regulations are among the strictest. If you are bringing in or taking out more than ,000 USD or equivalent, you must file the special FinCEN Form 105.

- Ukrainian law sets a limit of €10,000 (or equivalent in another currency). If the amount exceeds this threshold, you must submit a written declaration and provide documents proving the source of the funds, such as cash withdrawal receipts, currency exchange slips (if applicable), or bank statements.

- In the United Kingdom, amounts exceeding £10,000 must be declared. An important detail is that this limit applies to the entire group of travelers. For example, if a family of four carries £3,000 each, the total of £12,000 must be declared.

In practice, even if the funds are legal, failure to comply with a country’s specific requirements carries a high risk of confiscation or fines.

Successful case: Transferring Funds from Ukraine to the USA and Their Legalization

Planning to Transport Cash: What You Need to Have With You

Transporting cash across several countries is not just about calculating the total amount. It’s a process that requires careful planning at every stage to avoid unnecessary risks and problems at customs.

1. Before your trip, carefully check which countries you will be passing through or flying over. Pay attention even to short layovers: customs officers may require a declaration even if you are only changing planes in a transit zone.

Example: A passenger is traveling from Kyiv to Canada via Poland. Route: Ukraine – Poland – Canada. Polish customs officers will require a declaration upon entry into Poland if you are carrying more than €10,000, and Canadian customs officers will require the same upon entry into Canada.

2. Customs authorities may request not only a declaration but also proof of the origin of funds. The most common supporting documents include:

- a bank statement confirming the cash withdrawal or receipts;

- a contract (for example, a real estate or car sale, or a gift agreement);

- an income certificate or tax declaration;

- other official evidence of a legitimate source of funds.

3. Before traveling, count your cash and convert it into a single currency to make it easier to calculate the limit. Use the official exchange rate of the country you are passing through. This helps avoid misunderstandings with customs officers.

4. The limits apply not only to cash in currency. Checks, promissory notes, bonds, or even gold bars may also be subject to declaration requirements. Check in advance what exactly is included in the term “monetary valuables” in your destination country.

5. In some cases, it may be advisable to distribute the amount among several travelers. However, keep in mind that in the United Kingdom and several other countries, the total amount carried by a group or family is counted together, so this method does not always work.

In conclusion, always transport cash with a clear plan and proper documentation—this minimizes risks and ensures peace of mind during your trip.

You might also like: Declaring Funds at the Border: How to Prepare and File the Documents Correctly

Risks of Transporting Cash Across Multiple Countries

Carrying cash across borders always involves certain risks — even when the funds are of completely legal origin. Based on practical experience, several major dangers commonly affect travelers.

The most frequent risk is cash confiscation due to incorrect or late declaration. If you exceed the allowed limit and fail to declare your funds, customs authorities have the right to seize the money.

Example: In the United Kingdom, if you fail to declare an amount that requires declaration, a border officer has the authority to seize all the cash you are carrying. To recover it, you may need to pay a fine of up to £5,000, which can be immediately deducted from the confiscated funds.

In many countries, financial penalties also apply. These can be either a fixed amount or a percentage of the undeclared cash.

It’s also important to note that customs inspections can take hours, leading to missed flights or disrupted connections.

Legal Assistance for Transporting Cash and Monetary Assets Across Borders

Transferring monetary assets abroad, including carrying cash through several countries, is always a high-risk area, even for experienced travelers. Even when funds have a legitimate origin, an error in completing a declaration or a lack of knowledge about local regulations can result in significant time losses or even fines.

With our help, transporting cash across borders becomes simple, fast, and safe. Relying on years of practical experience in customs support, we know exactly how to avoid bureaucratic delays and financial losses. Our legal firm offers comprehensive assistance, including:

- Consultations on currency control and customs regulations: we analyze your route, assess potential risks, and provide clear instructions on what and where to declare.

- Document preparation: we help properly complete declarations and gather proof of funds’ origin that may be required by customs authorities.

With us, your funds are protected and your journey remains stress free. Submit your request today and get support from experienced lawyers with guaranteed results.

Our clients