How to open a network of pawnshops of one owner in Ukraine?

Successful participants of the financial services market, in particular, pawnshop owners, often want to expand their business and create separate subdivisions for carrying on business and extending their network.

To start a pawnshop business and ensure legal activities of its separate subdivisions, it is required to take some actions related to registration, inclusion in the State Register of Financial Institutions and licensing.

Let's look at the practical steps to be taken.

Actions required to open the pawnshop network

1. Setting up a business entity, i.e. a pawnshop.

The law of Ukraine provides for a number of requirements to this kind of business:

- It shall be set up as a general partnership;

- Its authorized capital shall exceed UAH 500,000 (if there are no other separate subdivisions);

- It shall own premises to provide financial services.

As for certain requirements for pawnshops with separate subdivisions, it should be noted that according to the law of Ukraine, the authorized capital of the parent company shall exceed UAH 1 million.

If you already have an operating pawnshop, you can proceed to the second step controlling for the abovementioned requirements.

Our service: Registration of a pawnshop in Ukraine

2. Inclusion of the general partnership and its subdivisions into the State Register of Financial Institutions.

Currently, there are several options to get separate subdivisions included in the Register of Financial Institutions:

а) while registering a parent company.

In this case, in order to register the parent company and its separate subdivisions in the State Register of Financial Institutions, the following documents shall be prepared and submitted to the State Commission for Regulation of Financial Services Markets:

- Certificate of State Registration of the legal entity, including the information on its subdivisions;

- Copies of constituent documents;

- Audit documentation confirming the submission of the report and formation of the authorized capital;

- Documents that prove ownership of the premises, accounting system and software;

- Copies of internal documents that regulate the financial services activities;

- Documents confirming the competence of the chief accountant and director;

- Standard service agreements.

б) after the parent company registration.

If a separate subdivision is included in the company, which is already registered in the State Register of Financial Institutions, it is necessary to take the following actions within 15 days after its registration:

- Submit a registration certificate on a separate subdivision;

- Add information on the subdivision to the website (name, location, list of services, date of establishment, EDRPOU code and data about the director).

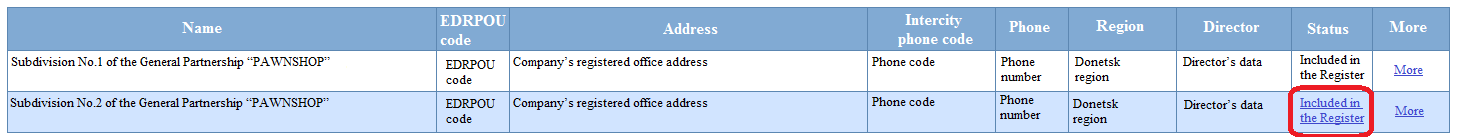

Note! You can check the information about the inclusion of your pawnshop subdivisions into the Register in the Complex Information System of the State Commission for Regulation of Financial Services Markets by clicking the Separate Subdivisions section.

It brings the list of all subdivisions of the financial institutions with their registration status: “Included in the Register”

Related article: Inclusion into the State Register of Financial Institutions in Ukraine: Our practical experience

3. Submitting a set of documents and obtaining a license to carry out activities related to lending money, including on financial credit terms.

The required set of documents includes:

- Financial reports confirmed by an audit firm;

- Documents (auditor's report or bank certificate) confirming that the authorized capital is appropriately formed;

- Copies of constituent documents certified by a notary;

- Documents confirming the professional qualifications of the director and chief accountant (employment record books, diplomas, certificates);

- Information on the premises used for the storage of collateral and means of security (burglar alarm/security guard);

- Information about special technical equipment and software to be used in pawnshop;

- Copies of internal regulations and agreements required for providing financial services;

- Pawnshop structure diagram.

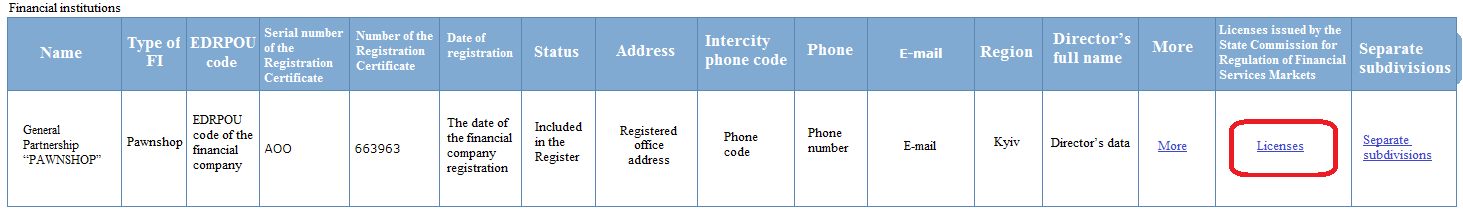

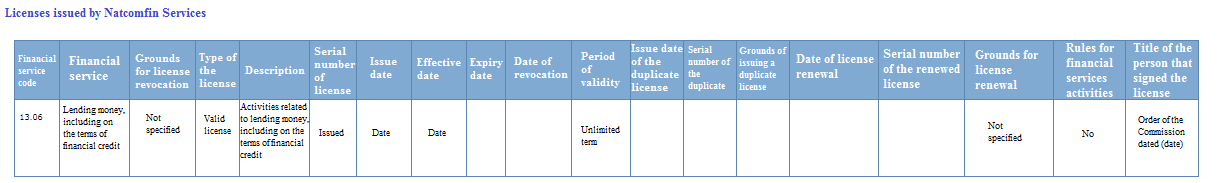

The information on the license can be found in the Complex Information System of the State Commission for Regulation of Financial Services Markets in the Licenses section of the previously selected legal entity.

The confirmation of the licence status will be displayed in the information on the types of financial services to be provided by the legal entity.

Important information on the types of pawnshop activities

It should be noted that before the adoption of new license requirements in 2016, pawnshops could carry out two types of activities, namely:

- Offering financial loans with raising funds, which required obtaining a license and compliance with relevant requirements;

- Offering financial loans using their own funds; for doing this a pawnshop had to be included in the Register without having to obtain a relevant license.

Some of these types of activities can still be found in the Register. This is due to the fact that, in practice, there are a large number of pawnshops that were registered under the old license requirements, but did not bring their activities in line with the legislation.

Today, when new license requirements have been adopted, there is only one business activities of a pawnshop - lending money, including on the terms of financial credit, which requires the applicant to pass through all three stages mentioned above. Thus, if necessary, our lawyers can provide legal assistance at any stage or support the entire registration procedure.

Our clients