Audit report of a financial company: requirements

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

The non-bank financial institutions sector is changing more and more every day. Not so long ago we have already written about the new rules of the financial services market, which entrepreneurs will be able to notice in the near future.

Resolution of the Cabinet of Ministers on the License Terms for conducting business activities in the sphere of financial services has also been amended.

Today we will elaborate on these innovations and how they will affect the procedure for obtaining an auditor’s opinion and its content.

How do these changes relate to the auditor’s opinion of a financial company?

In order to understand how these changes relate to the auditor’s opinion, we decided to compare p. 18 of the License Terms in the older and new versions.

Older Version: It is stated that in addition to the application, the applicant must submit financial statements, the reliability and completeness of which is confirmed by the audit firm. Such a firm had to be registered in the Register of Audit Firms and Auditors eligible to carry out audit of financial institutions.

New Version: It is stated that the applicants shall submit financial statements, the reliability and completeness of which is confirmed by an auditor or audit firm (which complies with legal requirements) in the unmodified opinion or modified opinion with a reservation in the audit report.

Related article: The Difference Between Financial Licenses: How To Choose A License For Your Business?

How will these changes affect the process of obtaining an auditor’s opinion?

From now on, the company that will audit the statements of a financial institution is not required to be included in a special Register of Audit Firms eligible to carry out audit of financial institutions.

In addition, the regulations governing the maintenance of the Register of Audit Firms eligible to carry out audit of financial companies are no longer in force.

This means that any audit company registered in a separate Register of Auditors can now issue an auditor’s opinion.

However, not all auditors have enough competence and not all of them know and understand exactly what kind of an auditor’s opinion should be submitted to the National Commission for State Regulation of Financial Services Markets in order to obtain a license.

In order not to waste money on the auditor’s opinion and not to fall into the trap, it is better to seek support and assistance of qualified lawyers, who are not auditors, but know all the whims of the licensing authority and can always suggest the best solution.

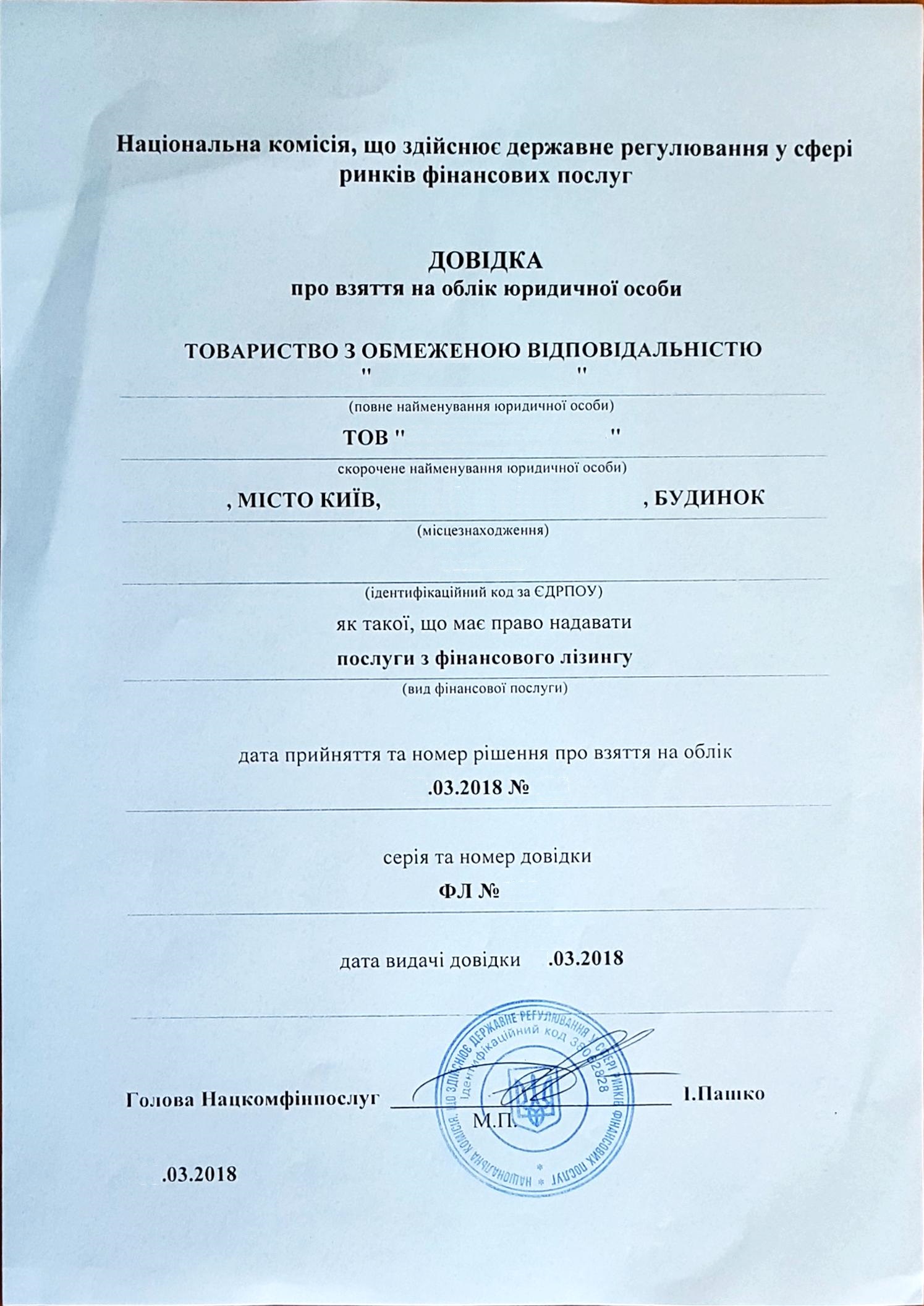

Related article: Registered A Financial Company With The Obtainment Of Leasing License

Requirements for the auditor’s opinion

Over the lifetime of the financial services market, lawmakers have developed a large number of laws and regulations governing this area. There are also a number of documents that set out the requirements for auditor’s opinion of financial companies.

We have real practical experience of working with financial companies, and we can tell the reader how an auditor’s opinion should really look. And what information it should contain.

The documents to be provided by the auditor may be conveniently divided into 6 parts.

1. Independent auditor’s report on the review of interim financial statements. It is actually the main report.

It defines the scope of work that the auditors normally perform and the limits of responsibility of the company’s management and independent auditors.

It shall also specify the basic information about the company (its name, location, activities, etc.).

The main part of the report contains the information on the volumes of different types of the company’s turnover, funds, liabilities and other assets and liabilities of the company.

The most important thing to pay attention to is the information about the sources and amount of the share capital. This information shall comply with the license requirements and the requirements for registration in the Register of Financial Institutions for a financial company, so that the financial company can be properly established and function.

2. Balance Sheet or Company Financial Statements. It shall contain detailed information on the company’s assets, including exact figures for the relevant period and the amount of expenses.

3. Statement of owner’s equity: It shows the share of the property financed by the owners of the company and reflects all changes in the company’s capital.

5. Auditor’s notes, which usually specify the basis for the preparation of the financial statements, accounting policies and other information confirming the financial statements.

4. Cash flow statement: It contains expense items and balances for various company’s activities.

5. Profit and Loss Statement, which shall contain information on consolidated income and expenses of the legal entity for certain periods.

Each of the documents has its own specific features and may differ from the standard documents of audit firms. That is why, we usually additionally check the documents provided by audit firms.

However, you must bear in mind that the auditor is an independent profession, so you shouldn’t bring pressure to bear upon them or provide them with any advices. Over the years we have worked with various companies. We have also established relations with reliable partners, gained relevant experience, and developed effective communicative skills.

If you want to learn more about the procedure for obtaining the auditor’s opinion of a financial company or would like to order the appropriate service - call us!