How to Legally Transfer Money Abroad: What You Need to Know

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Since February 24, 2022, many Ukrainians have relocated to foreign countries, leaving behind real estate, assets, land, and more in Ukraine. As time passes, more citizens are adjusting to life abroad and are increasingly tying their futures to these countries, resulting in the sale of property that remains in Ukraine. Today, this process can be easily facilitated, even remotely, without the need to physically return to Ukraine. However, several crucial questions arise:

- What are the legal methods for sending acquired funds abroad?

- What are the limits for transporting cash across borders, and how much money can be transferred abroad?

- How can the legality of the funds you plan to transfer or take abroad be substantiated?

- What are the risks if the legitimacy of the funds taken abroad is not adequately proven?

It is essential to note that today, the ability to freely and smoothly move financial assets across different parts of the world is vital. However, many countries, including Ukraine, have regulations and guidelines governing the export of substantial sums of money abroad. For instance, Ukrainian legislation imposes restrictions on physically exporting funds exceeding 10,000 euros without proper declaration. Such limitations may pose challenges for individuals seeking to legitimize funds acquired abroad. How, then, can one legally transfer funds abroad when the amount exceeds the established limit?

In this article, we will cover potential avenues for legally exporting large sums abroad, while adhering to all legislative requirements and regulations. If you're seeking more than just information and require a reliable partner to facilitate money transfers to another country, entrust us with the task. We specialize in developing personalized strategies for our clients to export funds from Ukraine, tailored to their unique circumstances. With our expertise in the legal nuances of various countries' legislation, including regulations regarding the import of financial assets, the process becomes straightforward. Furthermore, we guarantee the confidentiality and security of all transactions.

You may also like: How to Ensure Compliance in EU Banks for Opening a Corporate Account?

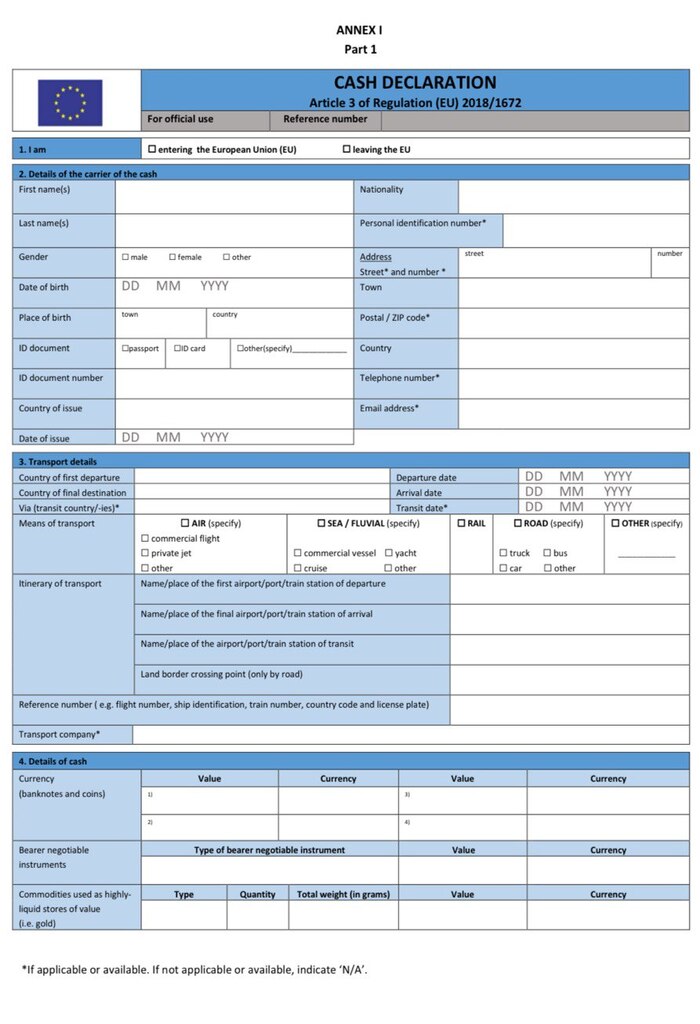

Exporting Cash Abroad: Declaring More Than €10,000 at Customs

To send money abroad, Ukraine offers various financial services that cater to both personal and business needs. When sending cash abroad exceeding €10,000, it is mandatory to declare this amount during customs control. This involves accurately completing a customs declaration, providing all necessary details about the cash being taken out. Alternatively, many prefer a safer and more convenient method by arranging a money transfer from Ukraine, which allows for secure and traceable transactions without the need to carry large amounts of cash. This process occurs directly at the border, where individuals must declare their intention to declare currency and fill out a customs declaration—a form known as the Declaration of Cross-Border Movement of Individuals' Currency Values. It is advisable to complete this declaration in advance, ensuring careful attention to all its sections. In such cases, seeking assistance from a qualified lawyer is recommended.

At the border, it is crucial to present documents confirming the legal origin of the funds and pay an export duty, calculated based on the border exchange rate on the day of crossing. Our legal team can assist you in preparing the necessary documents to confirm the funds' legal origin for their export abroad. Additionally, under Ukrainian law, individuals leaving for permanent residency abroad with the corresponding stamp in their passport from the State Migration Service are exempt from the obligation to provide a written declaration for goods exceeding a total invoice value of €10,000. They are also exempt from paying an export duty.

And what happens if customs officers find undeclared or incorrectly declared currency exceeding €10,000? This could lead to serious consequences. Of course, customs officials are not authorized to confiscate all the money. However, the fine could be significant. Currently, the fine is set at 20% of the amount exceeding the legal limit for undeclared currency. This means that if you plan to physically send €50,000 in cash across the border and fail to declare this amount according to customs rules, you will have to pay a fine of €8,000. And this does not include the export duty. According to official data from the State Customs Service regarding cases of illegal currency export, in 2023 alone, 73 million UAH were seized in customs violation cases!

You may also like: Opening a Personal Account for Ukrainian Citizens Abroad

Depositing Funds into a Bank Account with Subsequent Withdrawal Abroad

When you send money abroad, Ukraine’s banking system ensures secure and reliable transactions for international transfers. One crucial consideration here is the National Bank of Ukraine's stipulated procedures for banks when crediting cash funds exceeding 400,000 UAH to individuals' accounts. These requirements necessitate providing documents regarding the source of the funds, raising questions about income legalization. Several issues arise, particularly concerning undergoing thorough banking financial monitoring:

- The documents provided must align with the activities you engage in.

- The documents must be properly executed, certified, and authenticated to meet the bank's requirements.

Our team of professionals understands the specifics of bank operations and has experience resolving such situations. We are prepared to assist you in preparing and providing documents confirming your funds' origin. Compliance may take time as the bank approves the deposit, but our lawyers can explore various options for transferring money abroad.

Transferring funds to a bank account with subsequent withdrawal abroad enables the use of foreign currency, including withdrawing money from ATMs, even if the account holds hryvnias. It's crucial to note the established cash withdrawal limits from the card. If none of the described options suit you, our company has encountered other methods that our lawyers can tailor to your situation and share with you during consultations.

You may also like: How to Open a Bank Account in Poland for Ukrainians: Documents to Prepare and Choosing a Polish Bank

Confirmation of the Legality of Fund Acquisition Abroad

An issue that may arise abroad is how to convince a foreign bank that the funds you have taken abroad were acquired legally. Even a purchase agreement for real estate or inheritance in Ukraine does not resolve this issue. Therefore, it is necessary to prepare documents to convince the foreign bank of their legality so that you can use the money abroad. Our lawyers will assist you not only in properly transferring money from Ukraine abroad but also in depositing assets into a foreign bank account in a way that the bank has no claims to these funds, namely:

- Making it impossible to return the funds.

- Avoiding account blocking or closure.

Banks in foreign countries care about their reputation and conduct thorough checks on the legality of your funds to prevent money laundering obtained through criminal means, such as arms or drug trafficking. This is why assistance from qualified lawyers is crucial in such cases. They will meticulously and correctly prepare a package of documents that is clear and substantive for banking scrutiny.

If you need to transfer money abroad or take cash with you, don't hesitate to contact us. Using a reliable service for a money transfer from Ukraine can help avoid potential issues at customs and ensures that funds reach their destination efficiently. Our legal firm offers consultations and guidance on the required documents for this process. Additionally, our legal experts will not only explain how to transfer money abroad legally but also recommend the best way of fund withdrawal based on your specific circumstances. We will:

- Provide insights into the pros and cons of different options.

- Specify which method of transferring money abroad best suits your needs.

- Mitigate all potential risks and ensure the safety of your funds.

Feel free to call our toll-free hotline at 0 800 201 809 or click the "Request a Call" button for immediate assistance. Our legal experts are ready to address all your inquiries and provide the necessary support for the best transferring money abroad.

Our clients

Service packages offers

-

Analysis of the client's situation and consultation on transferring funds abroad.

-

Developing alternative methods and procedures for sending funds from Ukraine, tailored to each case.

-

Assessing risks, such as taxation, in compliance with Ukrainian and foreign legislation.

-

Assisting in gathering necessary documentation to verify the source of funds.

-

Completing required customs declarations for international fund transfers. Official inquiries to the State Border Guard Service for clarification on required documentation for transferring specific amounts of funds abroad (if necessary).

-

Calculation of taxes applicable to fund transfers.