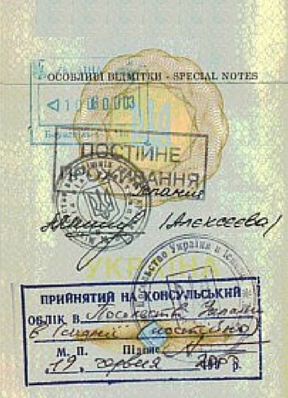

Tax Residency in Ukraine

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

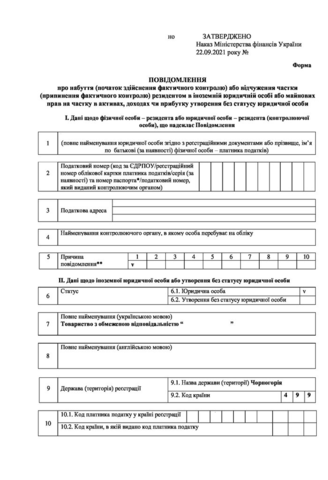

Today, businesses often operate across borders, making the issue of tax residency in Ukraine particularly relevant for many. Tax residency determines in which country you are required to pay taxes and can significantly impact your financial situation. Correctly determining tax residency is crucial for both individuals who travel or live abroad permanently and for businesses operating in multiple countries.

We don't just offer information – we provide practical assistance supported by experience. Our company has a network of practicing accounting and legal professionals in both Ukraine and abroad, dedicated to ensuring tax optimization. Our solutions aren't just theoretical; they're practical, efficient, and secure. We prioritize the future of your business, tailoring individualized approaches for each client. And whether your operations span Ukraine and beyond, we assure you of high-quality service, regardless of your location.

Dear visitor, the full text of this article is available only in Ukrainian and Russian versions.

If You are interested in this issue and You want to get a paid consultation on the topic - contact us via the forms of communication, by phone or through any other convenient way.

With all respects,

Team of "Pravova dopomoga" law company.

Our clients