On the legitimacy of refusing inclusion in the Register of non-profit organizations

There is an obvious lack of regal regulation for procedure of inclusion into Ukrainian non-profit organizations registry (non-governmental organizations, charitable foundations, cooperatives and other organizations). And this lack causes numerous abuses of power by tax bodies.

One of the most wide-spread reasons for not inclusion into non-profit registry is non-compliance of income with requirements of provisions provided by the article 157 of the Tax code of Ukraine (hereinafter – the Code). The point is that mentioned in charters sources of income are different from ones described in the article.

Tax bodies mostly reckon the position that non-profit organization has right for income only from the sources provided by corresponding paragraph of the 157 article. So the position is that the charter provisions should quote word by word the Code list for possible income sources.

The described understanding of the norms is wrongful.

P. 157.12 of the Code defines that when non-profit organization receives income from sources other than the defined in paragraphs 157.2 - 157.9 of the Code, such an organization is obliged to pay income tax, that is calculated as a sum of income from such sources, reduced by sum of expenses, that are related to obtaining of such income, but not exceeding the amount of such income.

Thus, an organization that is included into the Registry of non-profit organizations is not deprived of the right to perform other activities and obtain an income.

The chances for successful appeal of such decisions are pretty high.

But the most effective way is to re-apply for inclusion in the Register while qualified legal support.

You may find interesting our next article:

Exclusion from the Register of nonprofit organizations.

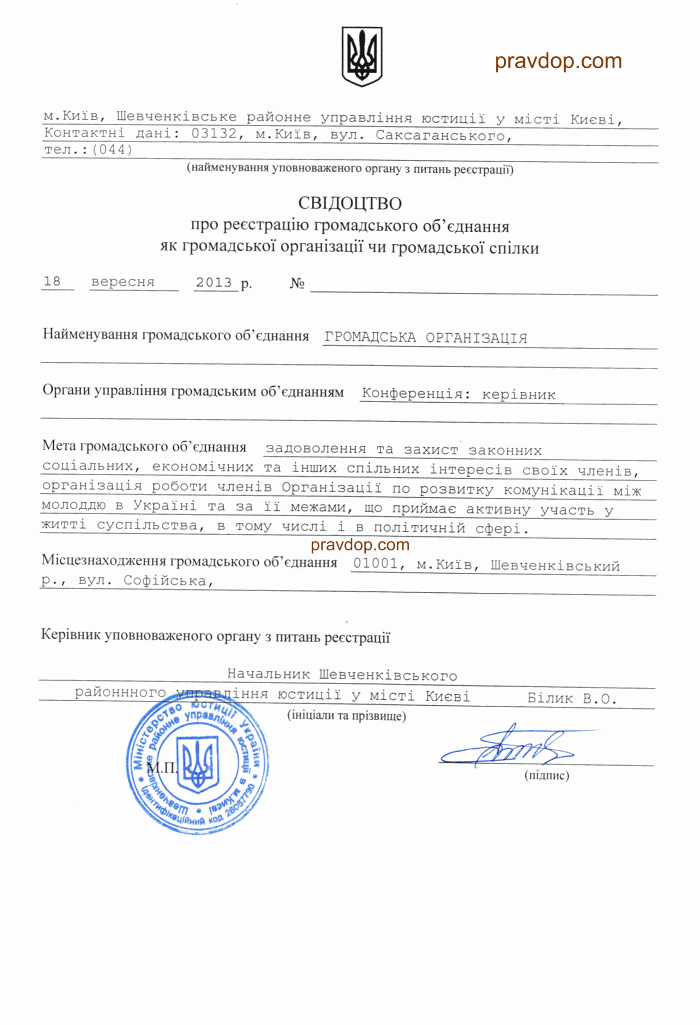

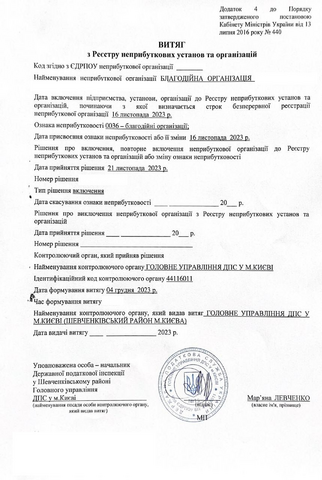

Legal services of funds and NGOs registration.

Our clients