Obtainment of non-profit status by non-profit organizations in Ukraine

Cost of services

Reviews of our Clients

What we offer

- we look into the charter of the Client for the possibility of obtaining the status of non-profitability for their organization;

- we prepare and submit a package of documents to the State Fiscal Service body;

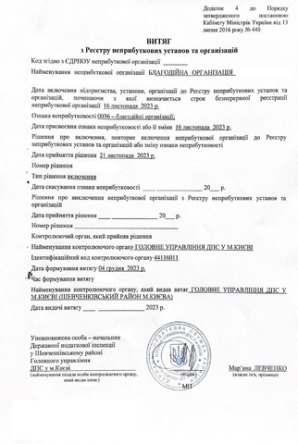

- we get a decision to include non-profit institutions and organizations in the register;

- in case of inconsistency of the provisions of the charter with the current legislation - we develop a new revision of the charter and register with the relevant authorities (by separate agreement with the Client).

Documents

If the service for obtaining the status of non-profitability is not provided within the framework of the organization’s registration, but separately - we recommend ordering a preliminary consultation (evaluation of the charter) for the possibility of obtaining the status of non-profitability in accordance with the charter of the organization. We cannot be sure that its provisions comply with the current legislation of Ukraine in the case when the charter was not prepared by our lawyers. The cost of the consultation will be free for you (it will be included in the cost of services for obtaining the status of non-profitability) if, according to the results of the evaluation, the charter is suitable for inclusion of the organization in the register of non-profit institutions and organizations.

State payments and fees for inclusion in the register of non-profit institutions and organizations are not provided for.

Why us

Our successful projects

Answers to frequently asked questions

Is there a need to notify the tax office about a change in the composition of participants or members of a non-profit organization?

There is no need to inform the tax about the change in the membership of a public organization. But it is necessary to change the composition of the participants in a charitable organization, since the participants sign the charter of the organization. When changing the membership of a charitable organization, you need to submit a copy of the charter to the local authority of the SFS, even if no provision has changed. But when registering a new edition of the charter, changes in legislation should be taken into account. The SFS authority, in turn, provides a decision on the re-inclusion of the organization in the register of non-profit institutions and organizations.

How long is the decision (certificate) on inclusion in the register of nonprofit institutions and organizations valid for and is it necessary to get it confirmed and updated?

The decision to include non-profit institutions and organizations in the register is issued for an unlimited period of time. In case of amendments to the charter documents of the organization, the SFS body considers a new edition of these charter documents. If their provisions do not contradict the current legislation of Ukraine, a decision is made on re-inclusion in the aforementioned register. There is no need to periodically confirm the status of non-profitability or update the decision (certificate).

Nonprofit Organization: Requirements for the charter when obtaining a status

One of the key factors determining whether the nonprofit status of a particular organization will be granted is the content of its charter. Along with quite typical mistakes that can often be found in the statutory documents of a non-profit organization, a misunderstanding by the tax inspector of the norms of current legislation can also get in the way of obtaining a certificate of non-profitability. In practice, one has to deal with such situations, and these are exactly the cases when it is quite difficult to obtain a non-profit status without the help of a qualified lawyer. You can read more about recommendations to the charter of a nonprofit organization in the comments of our lawyers.The specialists of our company carry out a preliminary audit of the charter of the Client before preparing an application and a package of documents. This is necessary so that a certificate of non-profitability is certainly issued on time.

Registration of a charitable foundation, public associations and garage cooperatives is an established standard service that our company provies, so we can guarantee that we will carry out the entire procedure within two weeks.

What does the law tell us?

The reporting procedure for nonprofit organizations, as well as the benefits provided by obtaining the indicated status, are described in the Tax Code of Ukraine. So, one of the important aspects is that registering a charity fund or registering a public organization, receiving a certificate of non-profitability, does not exempt such an organization from submitting profit reports. The register of court decisions has had many precedents when the court sided with the tax authorities in this matter.The legislation does not establish the time limits for consideration by the tax authorities of applications for obtaining the above status. In practice, it all depends on the area of ??registration and the workload of the inspector.

Our company has been providing such services for many years, so we know the whole procedure inside out. Not just how to make sure that all documents are properly executed, but how to make the whole process as quick and efficient as possible.

We also hope to become your partner in any legal matters, which means we are willing to resolve any of your legal issues in various areas of law.

If you need to obtain a non-profit-making status - contact us! Entrust the paperwork to professionals!