Registration features of charity organisations and founds

Cost of services:

Reviews of our Clients

Today, charitable organizations occupy a special place among other legal entities. This is due to the specifics of their activities, legal regulation, as well as tax benefits and preferences offered by the state.

According to the current legislation, a Charitable Organization is a legal entity of private law, whose constituent documents define charity as the primary objective of its activity (in one or more areas).

This means that a charitable organization can only be a legal entity with the following primary objective of activity:

- assistance to promote the interests of its beneficiaries in the area of charitable activities;

- support and development of these areas for the public good.

Charitable organization may be founded by any capable individuals or legal entities, except for local government bodies, public authorities and other legal entities of public law (state/municipal enterprises).

At the same time, subjects of charitable activity may hold charitable programmes, carry out joint charitable activities and other types of such activity together with foreigner citizens and foreign organizations.

Charitable organizations may set up separate subdivisions, act as a founder and a member of other charitable organizations (as well as associations, unions, voluntary associations) or conduct joint charitable activities.

A charitable organization can be established in the form of:

- Charitable Society, a charitable organization that has two or more founders and operates on the basis of its charter;

- Charitable Institution, a charitable organization whose constituent act defines assets that one or several founders transfer to achieve the goals of charitable activity from such assets (or income from such assets). The constituent act of the charitable institution may be contained in the last will and testament. The founder or founders of a charitable institution do not participate in the management of the institution, it operates on the basis of the constituent act.

- Charitable Foundation, a charitable organization that operates on the basis of its charter, has participants or members and is managed by them. The participants or members are not obliged to transfer any assets to such organization in order to achieve the goals of charitable activity. A charitable foundation may be created by one or several founders. In turn, the assets of a charitable foundation may be formed by the participants and/or other benefactors.

Charitable organizations acquire the rights and obligations of a legal entity from the moment of the state registration, which is conducted by the state registrar at the location of the legal entity.

To register a legal entity, the founder or an authorized person shall submit the following documents to the state registrar:

- An Application for the State Registration of a Legal Entity (Form No. 1);

- A power of attorney for a person authorized to represent the legal entity at the state registrar (if the documents are submitted by the representative of founders);

- An original copy (notarized copy) of the founders’ decision or of the relevant authority decision on establishing of a legal entity;

- Copy of the legal entity’s constituent document. In case of a charitable society and charitable foundation, the constituent document is the charter. In case of a charitable institution, such document is the constituent act. These documents shall be approved and signed by the founder (founders) of the charitable organization or persons authorized by them.

The constituent documents of the charitable organization must contain the following information:

- the name of the charitable organization;

- areas and purposes of the charitable activity;

- information on the governing bodies of the charitable organization, their composition, operating procedures, competence and decision-making procedure;

- procedure for election, appointment or approval of the members of the charitable organization’s governing bodies (except for the highest governing body of the charitable society and the charitable foundation), their replacement, suspension and complete termination of their powers);

- procedure for making amendments to the constituent documents of the charitable organization;

- sources of assets (income), auditing and reporting procedure of the charitable organization;

- the grounds and procedure for termination of the charitable organization’s activity, as well as the procedure for distribution of assets.

The state registrar checks whether the submitted documents meet the established requirements and conducts the state registration of the legal entity.

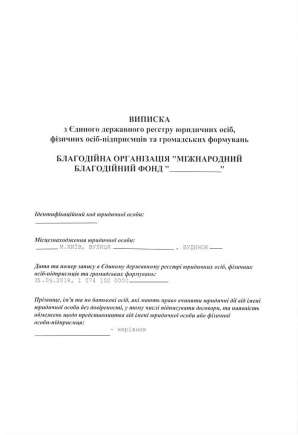

Based on the results of registration, the state registrar provides the applicant with:

- The list of documents provided to the state registrar for the state registration of a legal entity;

- An extract from the Unified State Register of Legal Entities, Individual Entrepreneurs and Public Organizations.

It should be noted that a legal entity that has not been assigned the status of a volunteer organization in accordance with the established procedure is prohibited to use the phrase “volunteer organization” in its name and activities. Such status is granted by the Ministry of Social Policy of Ukraine on the basis of the relevant application.

Following the state registration of the legal entity in the Unified State Register of Legal Entities, Individual Entrepreneurs and Public Organizations, the charitable organization shall be registered in the Register of Non-Profit Institutions and Organizations. This registration is required to become tax-exempt, e.i. not to pay income tax.

There are two ways to register a legal entity as non-profit organization:

- The first way is to submit a registration application using the form No. 1-PH and the documents for the state registration of establishment of a legal entity to the state registrar;

- The second way is to submit a registration application using the form No. 1-PH, as well as a copy of constituent documents and a power of attorney for representatives to the local office of the State Fiscal Service of Ukraine (at the place of location of the organization).

The territorial office of the State Fiscal Service makes a decision on granting the non-profit status within 14 calendar days after receipt of the registration application under the Form No. 1-PH and then enters the relevant information into the Register of Non-Profit Organizations of the State Fiscal Service of Ukraine. A copy of the original decision can be obtained at the territorial office of the State Fiscal Service.

Do you want to register a Charitable Organization or a Charitable Foundation? Сall us!

Our clients