Cash Declaration at the Border: How to Prepare and Submit the Right Documents

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Did you know that your hard-earned money intended for investments, business development, or starting a new life abroad can be detained right at the border? This isn’t a myth, but a very real risk for entrepreneurs, investors, individuals conducting large financial transactions, and even ordinary citizens planning to buy property overseas or move abroad permanently.

Every day, thousands of people cross borders with capital. Yet only a few fully understand how to properly prove the legal origin of their funds and avoid unpleasant situations, such as delays or, worse, financial losses. What’s more, in most cases, these issues could have been anticipated and prevented.

We, the team at Pravova Dopomoga, have extensive experience in providing legal support for international financial transactions and situations involving crossing borders with cash. Drawing on real-world practice, we’ll explain how to prepare the correct set of documents to prove the legal origin of your funds so your financial plans don’t come to a halt at customs control.

You might also like: How We Helped Transport Cash from Ukraine to Germany: Overcoming Challenges in Cash Declaration

Declaring Funds at the Border: An Obligation That Protects Your Capital

The requirements for declaring cash when crossing a border are not just bureaucratic red tape. They are a vital part of the global system to combat money laundering (AML) and the financing of terrorism (CTF), actively implemented by countries around the world, including Ukraine. The Financial Action Task Force (FATF) sets the standards that countries follow to ensure financial transparency.

In Ukraine, the rules for transporting currency valuables abroad are established by a number of regulatory acts. Specifically, the Law of Ukraine “On Currency and Currency Operations” and corresponding resolutions of the National Bank of Ukraine (NBU) clearly regulate the procedure for moving currency across the customs border. The Customs Code of Ukraine, in turn, defines the procedures for customs control and declaration. Therefore, declaring funds is not a suggestion but a legal obligation that ensures your financial safety.

You might also like: How Much Cash Can You Take Abroad?

Limit on Cash That Can Be Carried Without Declaration

Many are familiar with the “€10,000 rule,” but is it truly universal? Under current Ukrainian law, individuals are allowed to bring in or take out cash and banking metals totaling no more than €10,000 (or the equivalent in another currency) without written declaration. If the amount is €10,000 or more, it must be declared in writing at the border.

However, it’s important to understand that regulations vary from country to country. While the €10,000 threshold is commonly accepted across most European Union nations, other countries may have their own, often stricter, limits or additional requirements.

For example, in the United States, when importing or exporting cash or equivalents (such as checks or securities) totaling 10,000$ or more, you are required to complete FinCEN Form 105 (Report of International Transportation of Currency or Monetary Instruments). This applies to both U.S. dollars and the equivalent amount in any other currency.

In the United Arab Emirates, the threshold for mandatory cash declaration upon entry or exit is generally 60,000 AED (approximately ,300 USD), or the equivalent in another currency. However, proof of the source of funds may be requested even for smaller amounts, especially when large transactions are involved.

Many countries in Asia, Africa, and Latin America also have their own, often lower, limits or require the declaration of any amount exceeding a specific threshold. Some countries may even require declaration of smaller sums if the circumstances raise suspicion.

This is precisely why, before traveling with a large amount of cash, it is critically important to check the current regulations of both the country of departure (Ukraine) and the destination and transit countries.

You might also like: Transferring Funds from Ukraine to the U.S. and Their Legalization

Document Package for Declaring Cash at the Border

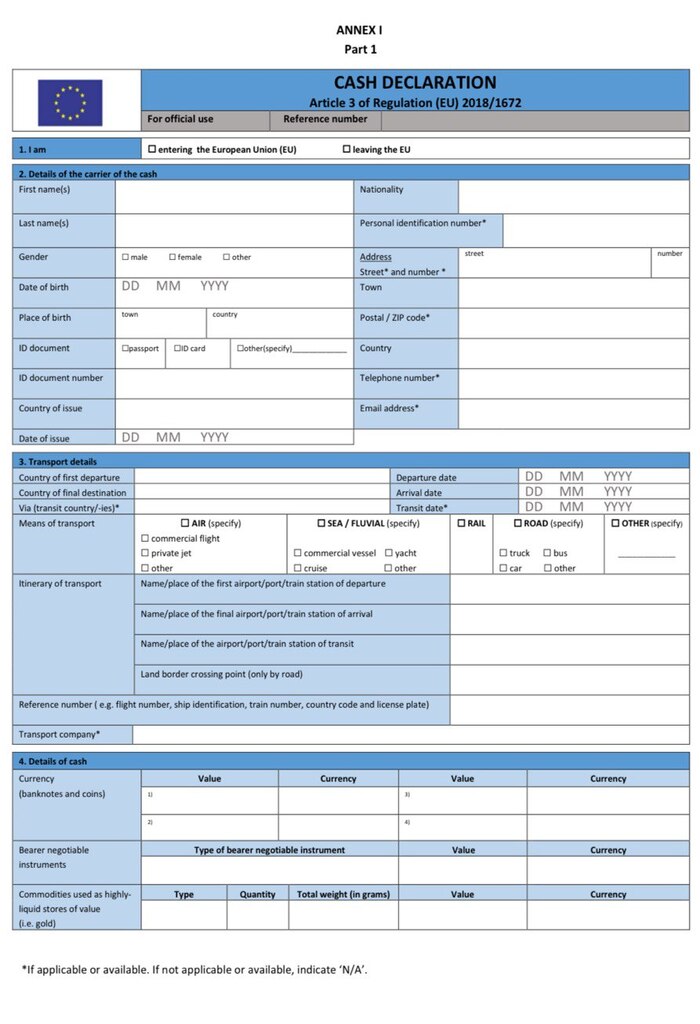

Accordingly, the core set of documents for declaring funds, aside from the customs declaration itself and a passport, must include documents confirming the source of the funds:

- Banking documents. This includes bank statements, withdrawal receipts, and documents verifying the origin of funds deposited into the bank account.

Each document must support the declared amount and clearly explain its origin. Any errors, inaccuracies, or incomplete information may serve as grounds for denying the transfer of funds.

Please note! If you have a non-standard situation, for example, the funds were stored in a safe or received in cash from a partner, a tailored approach is required when preparing your document package. In such cases, it is best to seek legal advice to avoid potential risks.

You might also like: Proving the Source of Funds: When Is It Required and How to Do It?

Potential Pitfalls When Carrying Cash Abroad and How to Avoid Them

Even with basic knowledge, you can still find yourself in an unpleasant situation. The most common trap is an incomplete document package. Customs is a highly specific authority and often requires additional proof of the source of funds. For example, a bank receipt for foreign currency withdrawal must be accompanied by a full account statement showing the movement of funds. If you cannot sufficiently prove that the full amount you’re transporting was indeed withdrawn from your account, you risk delays, denial of permission to export the cash, or even temporary seizure of the funds at the border for further inspection.

Our advice: Always aim to compile the most comprehensive set of documents possible. It’s better to include an extra certificate than to be missing a critical one.

The second pitfall is providing inaccurate information in the declaration. In reality, filling out a customs declaration is far more complex than it might initially seem. It demands attention to detail and precision. A single mistake, such as an incorrect passport number, can result in having to rewrite the entire form at customs, causing significant delays and unnecessary stress during your departure.

And that’s not even mentioning the documents themselves. Customs officers carefully scrutinize each one, so forged or falsified documents are quickly detected. In such cases, not only will you be prevented from taking the funds abroad, but you may also face criminal liability, which, to put it mildly, is an unpleasant outcome.

Even if you’ve prepared everything correctly and cleared Ukrainian customs, the next pitfall may be waiting for you beyond the border. Ignoring the rules of the destination/transit country is one of the most common mistakes people make. Always research the customs regulations of every country you’ll be traveling through with cash. This includes both declaration thresholds and any requirements for additional documents.

And if you’re uncertain about anything, consult a professional. It will save you time, stress, and money.

How to Safely Transport Money Across the Border

At Pravova Dopomoga Law Firm, we offer a proven solution for those planning to cross the border with funds. We’ve successfully handled dozens of cases, from entrepreneurs investing abroad to clients relocating for permanent residence. And in every case, our top priority has remained the same: ensuring the client’s complete safety during customs control.

We provide comprehensive legal support:

- Preparation of a complete document package: certificates, bank statements, and other materials verifying the legality of your assets.

- Customs declaration processing: guidance to ensure proper declaration in full compliance with currency and customs regulations.

- Risk analysis: we identify weak points, assess all potential risks in advance, and always provide honest warnings about possible complications, along with safe, practical solutions.

- Communication with customs and tax authorities in case of disputes: we represent your interests if delays or questions arise.

- Personalized consultations on relocation and investments based on the specifics of the departure country or the client’s financial plans.

We operate not only in Ukraine but also support clients in key jurisdictions across Europe, the U.S., the Middle East, and beyond, offering:

- Assistance with opening bank accounts abroad

- Support with registering a business overseas

- Legal guidance for residency legalization or obtaining resident status

Contact us today if you’re planning to invest, relocate abroad, or simply want to maintain full control over your finances, we’ll ensure a smooth and secure border crossing with your funds.

Our clients