How a foreigner can register business in Ukraine?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Over the past 10 years, Ukraine has welcomed many foreign entrepreneurs who have chosen this country to start and develop their businesses.

Ukraine has also become a favorite destination for representatives of such a rapidly developing industry as IT. Many IT specialists from Belarus, India, Egypt, and Great Britain move to Ukraine and start their startups here or register a business to be able to serve foreign Clients while staying in Ukraine.

Of course, the following question arises: How to register a business?

The thing is that many of our Clients are scared of the word combination “company registration”, in fact, a company is something complicated, it’s a legal entity, which involves many issues, including taxes, and therefore it is easier and simpler to register a sole proprietorship.

Our task is to assess what will be more advantageous and convenient in your case, and then - to clarify the situation both in case of starting a sole proprietorship, and registering the LLC. Starting a business in Ukraine will become simple and clear, and most importantly - it will meet your needs. Obtaining a residence permit with us is:

- All services in one place, both for obtaining a residence permit (visa, insurance, consultation, booking a visit to the consulate), and for any other legal issues in Ukraine (acquisition of real estate, payment of taxes, marriage, inheritance, starting a business, etc.);

- Solving your problem despite any force majeure circumstances;

- Choosing the best option for obtaining a residence permit just for you, based on our experience of more than 15 years;

- Security: we will help to avoid refusal, we will be in touch even when crossing the border, we will provide escort after obtaining a residence permit.

You may also like: How Can a Foreigner Start an Online Business in Ukraine?

Registration of a business in Ukraine through sole proprietorship and LLC: What to choose?

There can be many reasons to start a business in Ukraine:

-

Excellent geographical location, which makes it convenient to supply goods from and to many countries in Europe and Asia;

-

Many things, including even the cost of living, are many times cheaper than in America or Europe;

-

Ease of business registration - a company in Ukraine can be registered in 1 day;

-

Lower tax rates as well as state support in some business areas;

-

Starting a business by an individual also provides an opportunity to get further a temporary residence permit in Ukraine on the basis of the work permit, etc.

For IT-specialists Ukraine has created a favorable tax background, as we have already written here, and in 2021 the quotas for obtaining permanent residency in Ukraine were expanded.

All that remains is to understand how to register a business in Ukraine for a foreigner and what pitfalls to expect in the process.

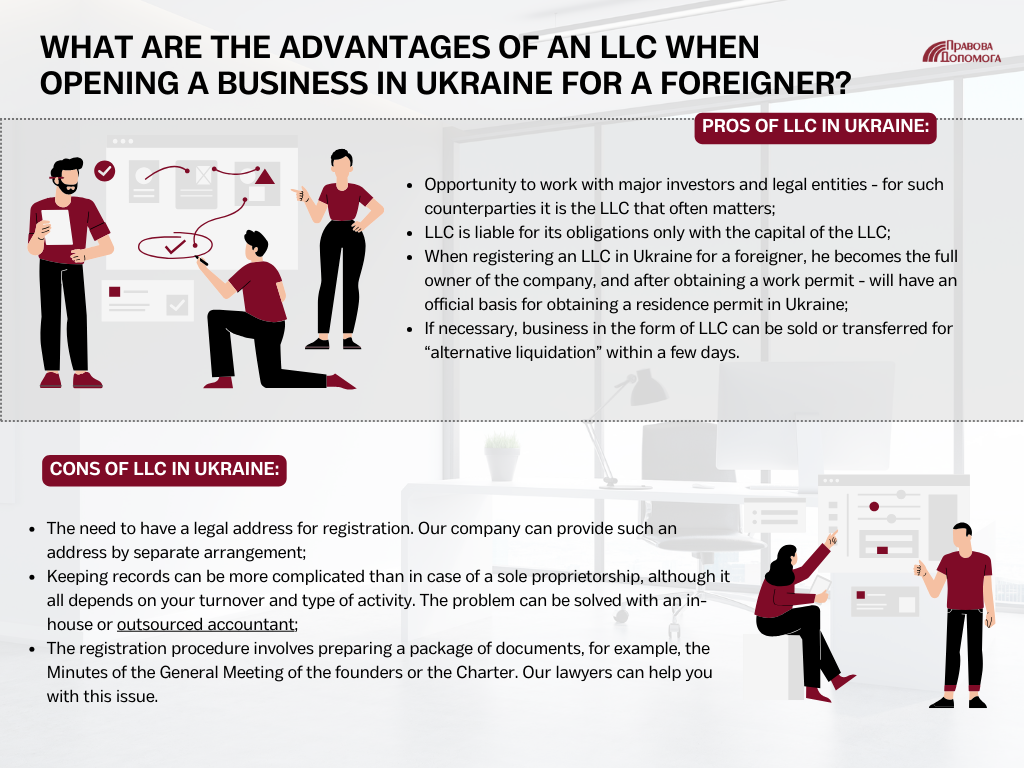

What are the advantages of an LLC when opening a business in Ukraine for a foreigner?

The seemingly complicated procedure of company registration in Ukraine is actually a simple algorithm of actions, which our lawyers know thoroughly and can carry out for you. The procedure is not what you need to fear. The main thing is to correctly understand what will be the best option for the start of your business and its development.

Pros of LLC in Ukraine:

-

Opportunity to work with major investors and legal entities - for such counterparties it is the LLC that often matters;

-

LLC is liable for its obligations only with the capital of the LLC (by the way, for the registration of LLC in Ukraine there are no requirements for minimum amount of the authorized share capital, usually it is UAH 1,000);

-

When registering an LLC in Ukraine for a foreigner, he becomes the full owner of the company, and after obtaining a work permit - will have an official basis for obtaining a residence permit in Ukraine;

-

If necessary, business in the form of LLC can be sold or transferred for “alternative liquidation” within a few days.

Cons of LLC in Ukraine:

-

The need to have a legal address for registration. Our company can provide such an address by separate arrangement;

-

Keeping records can be more complicated than in case of a sole proprietorship, although it all depends on your turnover and type of activity. The problem can be solved with an in-house or outsourced accountant;

-

The registration procedure involves preparing a package of documents, for example, the Minutes of the General Meeting of the founders or the Charter. Our lawyers can help you with this issue.

If you plan to actively develop your business in Ukraine, to cooperate with counterparties - legal entities or VAT payers, a company can be the best option for you.

Registration of a business through LLC in Ukraine is an opportunity both to start a business and to get a basis for legal stay in the country. Moreover, running a company in Ukraine is not difficult, and we will tell you about all the nuances that you need for its functioning at the consultation.

Our company can also provide accounting services to your firm for the period required and provide a legal address for its registration.

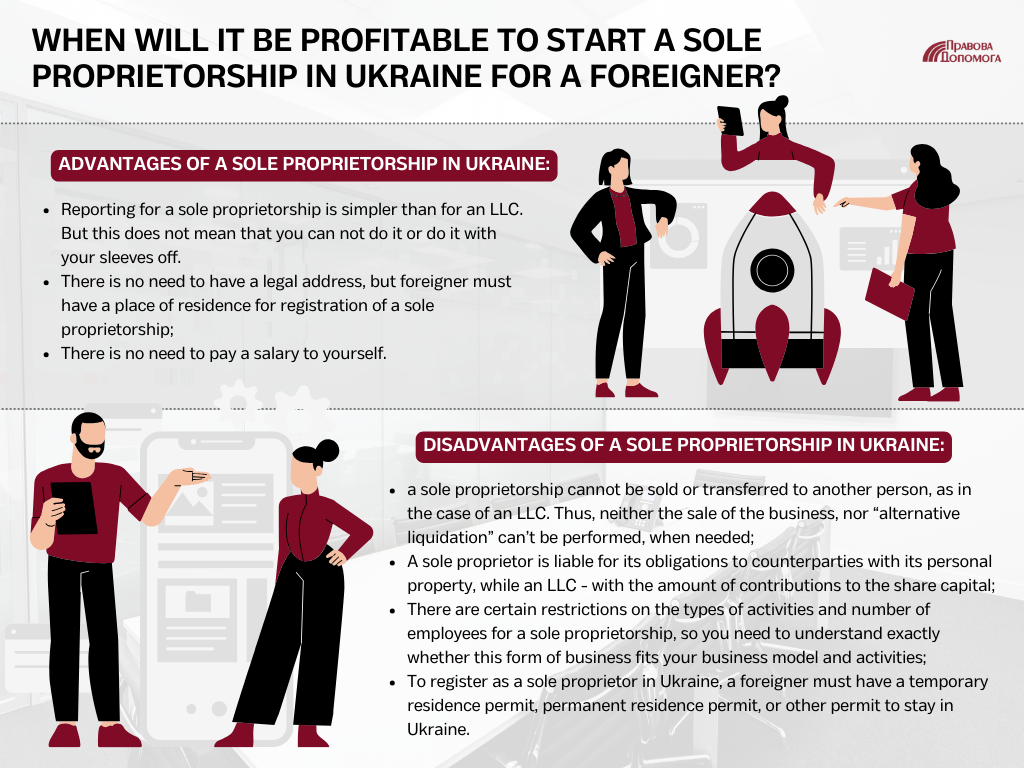

When will it be profitable to start a sole proprietorship in Ukraine for a foreigner?

If the registration of an LLC gives you the opportunity to get a temporary residence permit or a permanent residence permit in Ukraine, the registration of a sole proprietorship requires that you already have it. That is, in order to register a sole proprietorship in Ukraine, a foreigner will need proof of legal stay in Ukraine. This requires grounds, such as marriage to a resident or a work permit.

As for taxation of a sole proprietorship, the group and the taxation system will depend on the type of activity you are going to be engaged in. A foreight sole proprietor can become a single taxpayer at the rate of 5% only.

Advantages of a sole proprietorship in Ukraine:

-

Reporting for a sole proprietorship is simpler than for an LLC. But this does not mean that you can not do it or do it with your sleeves off.

-

There is no need to have a legal address, but foreigner must have a place of residence for registration of a sole proprietorship;

-

There is no need to pay a salary to yourself.

Disadvantages of a sole proprietorship in Ukraine:

-

a sole proprietorship cannot be sold or transferred to another person, as in the case of an LLC. Thus, neither the sale of the business, nor “alternative liquidation” can’t be performed, when needed;

-

A sole proprietor is liable for its obligations to counterparties with its personal property, while an LLC - with the amount of contributions to the share capital;

-

There are certain restrictions on the types of activities and number of employees for a sole proprietorship, so you need to understand exactly whether this form of business fits your business model and activities;

-

To register as a sole proprietor in Ukraine, a foreigner must have a temporary residence permit, permanent residence permit, or other permit to stay in Ukraine.

A sole proprietorship is most often an advantageous option if you already have grounds for legal stay in Ukraine and you plan to work mainly with physical persons-counterparties.

Our lawyers will analyze your situation and advise the best option that will be beneficial to you. Whatever option you choose, we will help you with business registration in Ukraine and achieving other goals you set for yourself here.

You may also like: Registration of an IT-Business in Ukraine

Legal services for starting a business for foreigners in Ukraine

It is impossible to say unequivocally that an LLC is suitable for such situations and a sole proprietorship - for others. The choice depends on many factors: business model, type of activity, your vision of business development in Ukraine, the availability of a residence permit, etc.

After finding out the answers to these questions, a lawyer of our company will be able to say exactly how to act in your situation.

If you have decided to set up an LLC in Ukraine, our lawyers offer you:

-

Advising on registration of an LLC in Ukraine for a foreigner;

-

Preparation of the necessary package of documents for registration of an LLC in Kyiv for a foreigner;

-

Obtaining a TIN;

-

Services of a nominal director of an LLC, if in the future you want to take this position;

-

The legal address for the company;

-

If necessary - obtaining a work permit for a foreigner to be able to work in the created company;

-

If necessary - obtaining a permanent residence permit in Ukraine;

-

Consulting on running business in Ukraine and entrance to Ukrainian market;

-

If necessary - accounting outsourcing services for the period you need.

A basic package of services for LLC registration in Ukraine with obtaining TIN, submitting documents to the registrar, registering the place of residence and opening a bank account in Ukraine will cost about USD 900. The price may vary depending on the scope of services you need. For example, if you want to register an LLC and get a temporary residence permit, it can be done within one package at a cost of USD 2,500. You can find the details here.

The cost of a monthly package of legal support services depends on the amount of lawyer’s and accountant’s time you need. You can choose a package that meets your needs here.

If you have decided to start a sole proprietorship in Ukraine, our lawyers offer you:

-

Advising on registration of a sole proprietorship in Ukraine for a foreigner;

-

Preparation of the process of registration of a sole proprietorship in Kyiv for a foreigner;

-

Obtaining a TIN;

-

If necessary - obtaining a temporary residence permit in Ukraine (if there are other grounds);

-

Consulting on running a business in Ukraine and entrance to Ukrainian market;

-

If necessary - accounting outsourcing services for sole proprietorships for the period you need.

A basic package of services for sole proprietorship registration in Ukraine with obtaining a TIN, submitting documents to the registrar, registering the place of residence and opening a bank account in Ukraine will cost about USD 1,200. The price may vary depending on the amount of services you need. We can always begin with a consultation, which will be included into the service price, provided that you order it from us.

Important! In 2022, there were a number of changes regarding the registration of companies for non-residents. Among the changes is the obligation to pay Single tax within 2 months from the date of hiring a foreign director. This also applies to other employees, but we are talking about the director, because at the start of a business in Ukraine, this is the most common option. If you plan to immediately start hiring and operating your company, you are already ready to pay taxes. But if the company was planned by you to obtain a residence permit in Ukraine and you wanted it to "lay on the shelf" a little, now you need to take into account the payment of tax. Otherwise, you risk losing your work permit, and hence your residence permit.

Our company offers a separate package of support services for such companies. You can read in detail here or ask our experts.

Is your goal to have a working business in Ukraine? Don’t hesitate to contact us! We will help you find the best scheme for doing business in Ukraine, obtain the necessary permits and help eliminate any obstacles.

Didn’t find an answer to your question?

All about opening a foreign business in Ukraine is here.

Our services to foreigners in Ukraine.

Everything about doing business in Ukraine.

Everything about obtaining a Temporary Residence Permit in Ukraine.

Our clients