What should a foreigner do with an LLC in Ukraine that does not operate?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

One of the most common grounds for obtaining a residence permit in Ukraine is setting up a company by a foreigner and obtaining a work permit. This gives the right to apply for a temporary residence permit. Thus, a foreigner can reside in Ukraine, each time extending the work permit and residence permit respectively.

Usually, companies that are created by foreigners solely for the purpose of obtaining a residence permit, do not operate, do not pay wages and taxes, and in most cases do not even submit reports to the tax authorities. This situation has existed for a long time, but recently the legislation of Ukraine has changed somewhat.

In this article, our lawyers will tell about the main legislative changes in this direction, and what to do to foreigners with such "zero" LLCs.

You may also like: Extension of Temporary or Permanent Residence Permit in Ukraine During the War

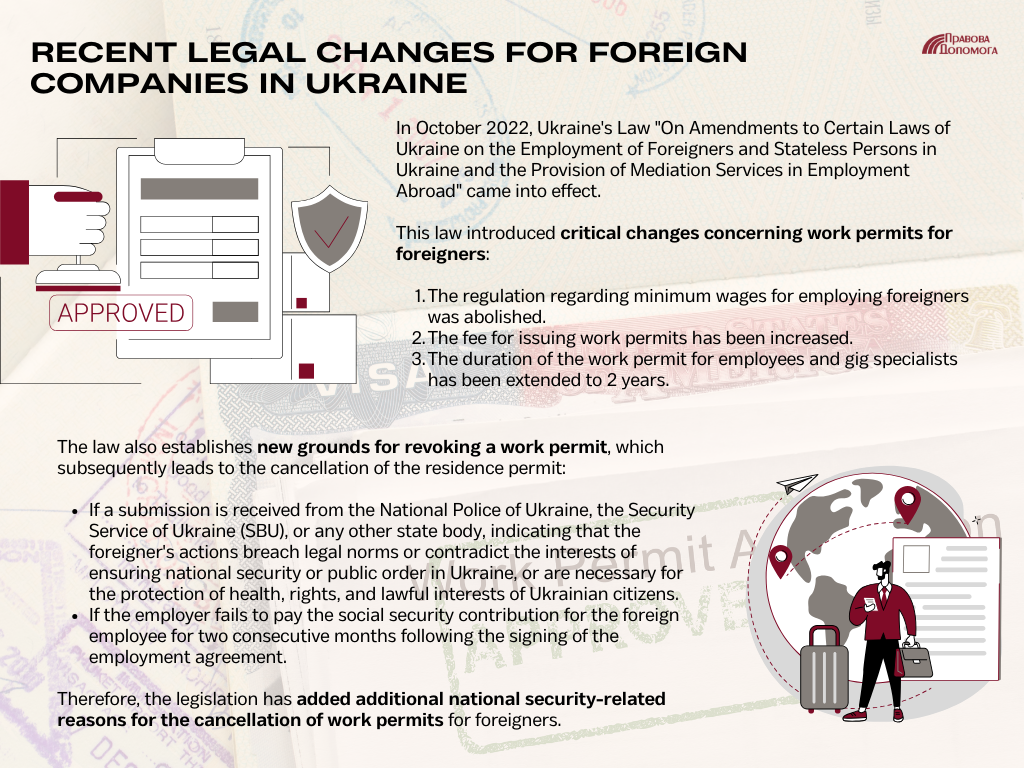

Innovations in the law concerning foreign companies in Ukraine

In October 2022 the Law of Ukraine "On Amendments to Certain Laws of Ukraine Regarding Employment of Foreigners and Stateless Persons in Ukraine" (hereinafter - the Law) came into force.

The Law provides for important changes related to work permits for foreigners, namely:

- The provision on the requirement to set a minimum wage for the employment of foreigners is no longer valid. In other words, it is not necessary to set 10 minimum wages (UAH 67,000) to employ a foreigner in a company. Accordingly, the labor law regulations, including those on wages (part-time workweek/month, etc.) may be applied to foreigners.

- The fee for the issuance of a work permit has increased.

- The period of validity of the work permit for workers and gig-specialists is 2 years.

At the same time, the law has provided some new grounds for revoking a work permit, which in turn leads to the revocation of the temporary residence permit:

- A petition from the National Police of Ukraine, National Security Service or other state body, if the foreigner's actions violate the norms of law or contradict the interests of national security of Ukraine, protection of public order or, if necessary for public health, protection of rights and legitimate interests of citizens of Ukraine.

- In case of employer's failure to pay the unified social tax for a foreigner within two months from the date of conclusion of the employment agreement.

That is, the legislator has provided additional reasons for revoking the work permit for foreigners, coming from reasons of national security. This is logical enough under martial law.

However, along with this, the legislator apparently decided to reduce the number of non-working companies of foreigners, which did not pay taxes and were used to formally obtain a work permit and a temporary residence permit.

You may also like: What to Do If the Grounds on Which You Obtained a Temporary or Permanent Permit or Permit to Work in Ukraine Have Changed?

What are the options for operating an LLC that does not conduct business?

Given the legislative changes, a foreigner who already has a company, a work permit, and a temporary residence permit is faced with a rather difficult decision: to organize the company and pay taxes, or to leave everything "as it is" and hope that their company will not be affected by the changes.

The second option is a bad idea, and negligence can lead to negative consequences and additional costs, since the work permit will be revoked. The foreigner will again have to go through the procedure for obtaining a work permit, a temporary residence permit, and the costs could be higher.

In addition, according to Cl. 5 part 1 of Article 42-9 of the Law of Ukraine "On Employment of Population" in case of cancellation of the work permit due to non-payment of the unified social tax within 2 months from the date of the employment agreement, the documents for work permit can be re-submitted only after one year.

Accordingly, in the event of non-payment of the Unified Social Contribution (USC), a foreigner risks losing their work permit and residency permit for an entire year. Therefore, our legal experts advise maintaining the company's operations by paying the salaries to the foreigner and the USC associated with payroll accruals.

In such a scenario, it is crucial not only to fulfill the USC payment obligation but also to do so correctly.

Recently, a Ukrainian company sought consultation from us. They had hired a foreign specialist who obtained a work permit and, based on this, a temporary residence permit in Ukraine. The company diligently fulfilled its obligations and paid taxes for the foreign employee.

However, when it was time to renew the work permit, they received a letter from the Employment Center informing them that the permit was being revoked due to non-payment of the USC. As a result, they couldn't extend the work permit for their foreign employee because it was canceled. Additionally, they couldn't obtain a new one because there is a one-year ban on reapplication. The foreigner loses the basis for residency in Ukraine, jeopardizing their further employment with the company and their stay in the country.

To address the issue, we requested all necessary documents from the company's accountant, verified the payment receipts, and contacted the tax authorities and the Employment Center. We demonstrated that the USC was being paid monthly in a single payment for all employees. Consequently, the Pension Fund couldn't provide information to the Employment Center regarding whether the tax was paid for a specific foreign employee.

Following that, our efforts focused on informing the Employment Center about the company's consistent payment of USC throughout the entire duration of the work permit's validity. However, this needed to be substantiated with documentation. We provided tax reports submitted during this period, thereby confirming the absence of any USC payment arrears by the company. The Employment Center reviewed our explanatory letter along with the supporting documents and rescinded its previous decision. Consequently, the foreign employee was able to continue working in the company and extend their work permit and residence permit in Ukraine.

The employer can determine and calculate the salary at the minimum rate of 7,100 UAH (effective from January 1, 2024) and 8,000 UAH (effective from April 1, 2024), or at another rate specified in the employment agreement.In order for the employer to accrue wages, the company must have an open bank account and an open account of the foreigner in a Ukrainian bank. It is also possible for the foreigner to establish part-time work (day/week) and other work formats determined by the Labor Code of Ukraine.

In addition, the employer can use the norms of the Law of Ukraine “On the Organization of Labor Relations under Martial Law” and send the employee on unpaid leave.

You may also like: If a Foreigner Obtains a Temporary Residence Permit in Ukraine for Several Years in a Row, Can H/She Apply for Permanent Residence Permit or Citizenship?

Business support services for a foreign company in Ukraine

Since the Law came into force, we warned our clients about the changes in legislation and the need to pay the unified social tax. For clients interested in staying in Ukraine we helped to:

- Set up the operation of the company;

- Pay salaries and taxes;

- Submit accounting statements.

Thus, we try to ensure that our clients do not get their work permit revoked and help with legal and accounting support for the company.

We will help to:

- Set up the company so that wages and taxes are paid on time and the client does not have to worry about the cancellation of the work permit;

- Document vacations, business trips and other reasons for the foreigner's absence;

- Open a bank account for the company and for the foreigner;

- Create a payroll project (if necessary);

- Obtain an ID code, if you do not have one;

- Obtain signature keys for submitting reports.

On a monthly and quarterly basis, we provide the following services:

- Accounting support of the company and submission of necessary reports;

- Legal support of the company;

- Payroll (payment of wages and taxes).

If the company has not filed statements for previous reporting periods, our lawyers will also help you deal with this.

The cost of business support services is as follows:

If we are talking about a dormant company, and which you do not want to close, because it is your basis for obtaining a residence permit in Ukraine, the cost of service will be from 0 (if paid for the year).

If you pay quarterly or every six months, the service fee is 0 per month.

And in case of monthly payment (for example, the first month before the start of the activity) –0 per month).

Often such a company serves as an initial stage to move to Ukraine, to settle in and have time to really start a business and earn money from your favorite business, because now is a favorable time for this. In this case we can also help you when you decide to turn your company into a working business.

If today you have a company in Ukraine that is not operating, but you do not want to lose it, as well as lose your grounds for the permit in Ukraine, don't hesitate to contact us.

We offer comfortable service packages and assistance with any other legal issues that may arise in Ukraine.

You can find out the cost of services here or from our specialists.